Introduction

I meet a lot of founders in Welwyn Garden City and across Hertfordshire who feel busy but not fully in control of their business. Sales are good. The team is growing. Yet they are never sure how much cash it is really safe to spend.

That’s where a cash flow forecast comes in. It shows what money is expected to flow in and out of the business in the weeks and months ahead. With a forecast, you can see problems before they hit, plan for growth, and sleep better at night.

This guide explains what a cash flow forecast is, why it matters for UK small businesses, and how to create one. I’ll walk you through examples and best practices, so you can put the idea to work in your own business.

What Is a Cash Flow Forecast?

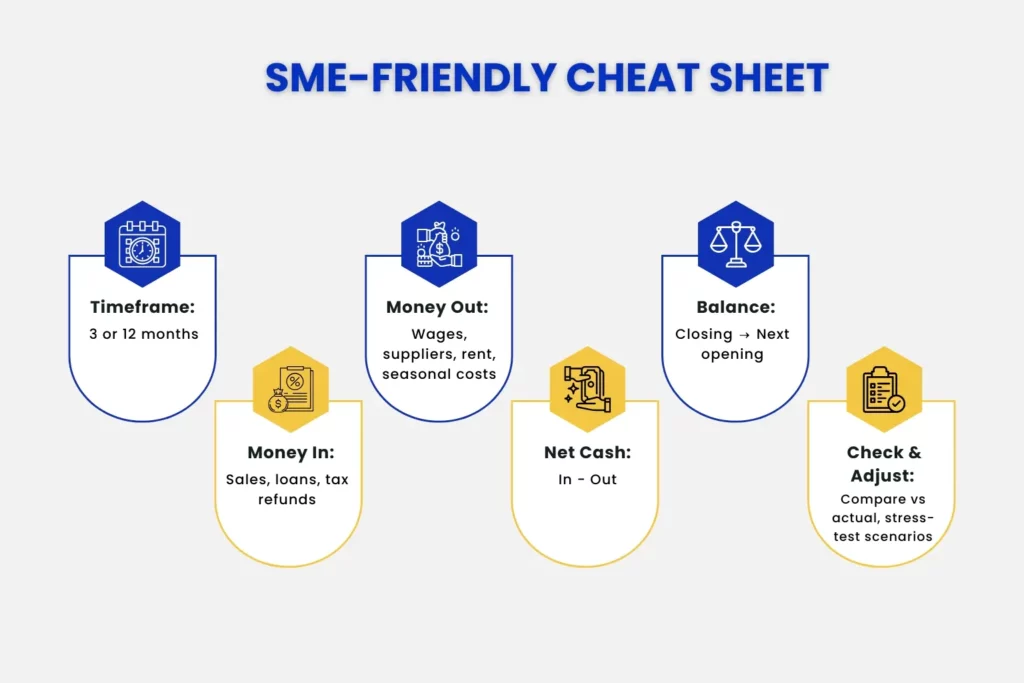

A cash flow forecast shows how money moves in and out of your business over a fixed time horizon. Some business owners choose a long time horizon, say 6 months, but other owners use a shorter three-month rolling forecast too.

The forecast summarises:

- Cash in: sales income, loan drawdowns, investment, VAT refunds.

- Cash out: supplier payments, wages, rent, tax, loan repayments.

At the end of each month or week, you see the balance left in the bank. This helps you check if you will have enough to cover your bills and still fund growth.

A forecast is different from a profit and loss account, which shows your business’s financial performance over a period. Profit may look healthy on paper, but cash tells the real story. It can sometimes take a while to convert your profit into cash in the bank because of customer payments terms, so a cashflow forecast helps unpick all of this.

Why Cash Flow Forecasting Matters for UK Small Businesses

Cash is the fuel that keeps your business running. You can be profitable, but cash-poor, and strangely enough this isn’t an uncommon situation in the business world today. That’s why a forecast matters. It gives you an early warning when things look tight and shows you when and what you can afford to invest in your business.

For a growth-focused founder, a cashflow forecasts helps you sleep at night. You’ll know if you can cover payroll, buy stock, or take on that new lease. It stops surprises and gives you space to plan.

Banks, investors, and suppliers all take confidence when they see you’re tracking cash. But more importantly, it’s about your confidence and peace of mind as the owner.

Step-by-Step Guide to Creating a Cash Flow Forecast

- Set your time frame: decide how far ahead you want to look. Many owners start with 12 months. For fast-moving businesses, a rolling three-month view is more useful.

- Estimate your cash inflows by listing all the money you expect to receive, including sales income from your customers, loan drawdowns, investments, tax refunds, or grants. Be realistic about timings. If a client usually pays 30 days late, build that in.

- Estimate your cash outflows by adding up all the payments you’ll need to make. Think wages, suppliers, rent, insurance, VAT, and loan repayments. Don’t forget seasonal extras like bonuses or Corporation Tax. To know how it matters in staying compliant with HMRC, check out our full guide on [Why Corporate Tax Planning Matters].

- Calculate net cash flow by subtracting outflows from inflows each period. This shows your net cashflow.

- Track your opening and closing balances. Start with your current bank balance, add inflows, subtract outflows and the number left is your closing balance for that period. This becomes the opening balance for the next.

- Review and update as a forecast is a living document. Don’t forget to compare it to your actual numbers. Adjust as you go. That’s where the real insight comes from.

Cash Flow Forecast Example

A good forecast doesn’t need to be complicated. It should show what money is coming in, what money is going out, and the balance left at the end. Many modern accounting systems, like Xero, will produce a clear breakdown for you.

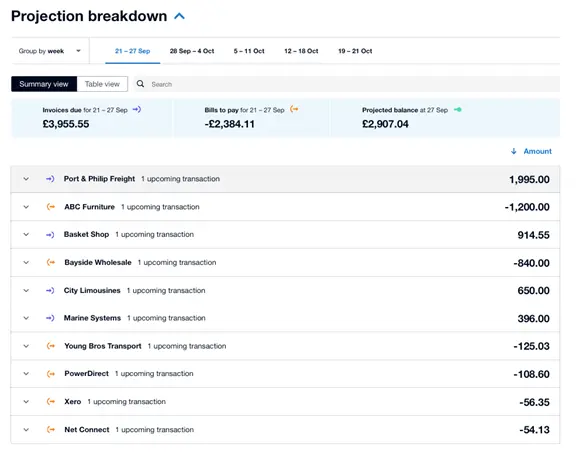

Take this example of a one-week projection:

This cashflow example inside Xero summarises the following information:

- Invoices due: £3,955.55

- Bills to pay: £2,384.11

- Projected bank balance at the end of the week: £2,907.04

You can also see the detail behind those numbers. For instance:

- A client, Port & Philip Freight, is due to pay £1,995.

- You need to pay suppliers like ABC Furniture (£1,200) and Bayside Wholesale (£840).

- Smaller transactions such as Xero fees and utilities are also included.

This style of forecast it’s ‘direct’. This means it links directly to your actual invoices and bills. You can see not only whether you’ll have enough cash in total, but exactly who needs to pay you and who you need to pay. This style of cashflow is much more useful than a ‘statutory’ style cashflow that you may see in a set of year end accounts that is often very confusing to non-accountants.

Best Practices for Cash Flow Forecasting

- Be realistic with your numbers – don’t assume every client will pay on time. If a customer usually pays late, factor that in.

- Keep it up to date, either monthly or weekly if cash is tight. Compare forecast to actual and adjust.

- Focus on what matters, grouping small items together and highlighting big payments. Don’t make it messy!

- Use visuals where you can eg graphs or dashboards. These are powerful for spotting trends quickly.

- Plan for scenarios and create a best case and worst case. What if sales dip or invoices are late? Run different scenarios – eg what happens if my sales drop 10%? This is called stress-testing your business model.

- Link it to decisions and use your forecast to answer real questions such as ‘Can I hire?’ or ‘Do I need to chase an invoice?’ and ‘Should I wait to buy equipment?’

Conclusion

Cash flow forecasting is not about predicting the future perfectly, it’s about being prepared. A forecast gives you a clear view of money in, money out, and what’s left in the bank.

For founders in Welwyn Garden City and across Hertfordshire, a cash flow forecast means fewer sleepless nights and more confident decisions. Our accountants in Hertfordshire can help you set up accurate forecasts and stay in control.

Don’t let cash flow be a mystery. Use a forecast to take charge of your numbers and your future.

People Also Ask:

How do I create a cash flow forecast for my small business?

You could start with just a simple spreadsheet or your accounting software. We see many simply but effective cashflows being run on a spreadsheet. List all expected income and expenses, then calculate your closing balance each month. Keep it simple at first and remember that the aim is clarity, not perfection.

How often should a UK small business update its cash flow forecast?

Monthly is a good rhythm for most SMEs. However, as we say above, if you’re growing fast or cash is tight, think about doing it weekly. The more you review and compare against actual results, the more useful the forecast becomes.

Can startups use the same forecasting methods as established businesses?

Yes, but startups may want to focus on shorter time frames. A three-month rolling forecast is often more realistic than a full year. Established businesses can usually project further ahead.

What are the key benefits of maintaining a cash flow forecast?

You see problems early, plan investments with confidence, and reduce stress. It also builds credibility with banks and investors who want to know you’re on top of your numbers.

How can accounting software help with cash flow forecasting?

Tools like Xero pull in real invoices and bills to create forecasts automatically. This saves time and makes forecasts more accurate. You can see not just totals but who owes you and who you need to pay. The example I have used above is a screenshot of a Xero demo cashflow.

If you want to develop your cashflow further, there are many add-on apps you can purchase, for example Futurli or Spotlight. These apps are dedicated cashflow planning add-on tools.

Why choose Julian Hobbs for cash flow forecasting support?

Because we combine local knowledge with practical expertise. We work with businesses across Hertfordshire, giving you clear, tailored forecasts that actually get used. We take the stress out of the process so you can focus on running your business.