Introduction

I often meet small business owners in Welwyn Garden City and across Hertfordshire who are frustrated. Sales are solid. Customers are happy, but the numbers still feel like a fog. Many ask me what are management accounts and how they can help their business. Their accounts are filed once a year, but that’s almost ancient history by the time the accounts are reviewed, signed and filed. You need something more focused and more current to steer the business in the day to day. That’s where management accounts come in.

Management Accounts Explained – How UK Businesses Use Them

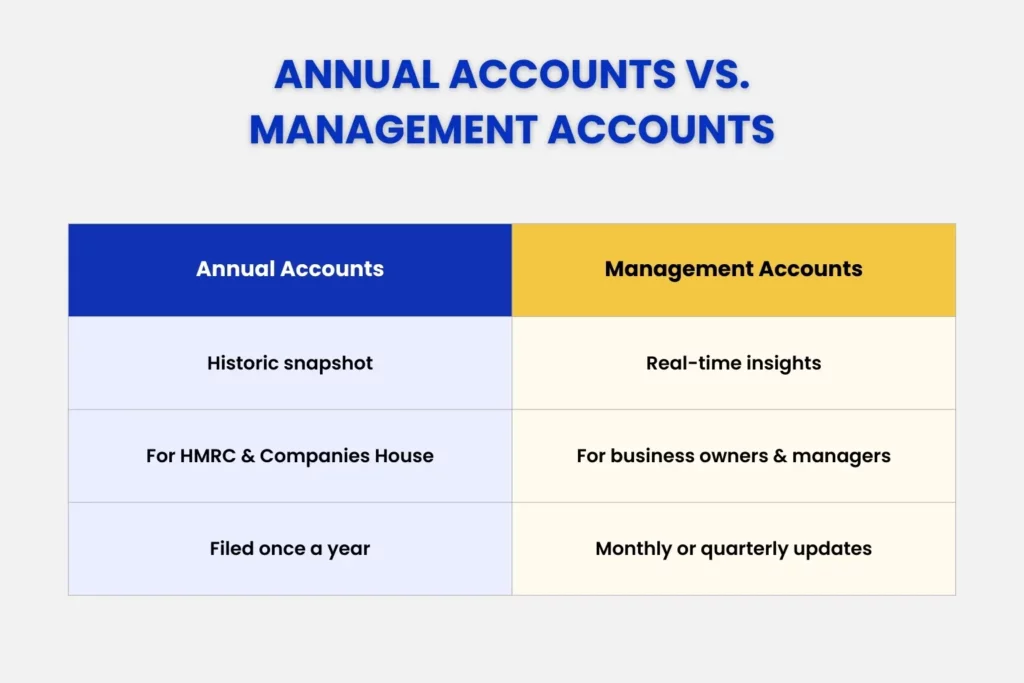

Management accounts are financial reports prepared regularly, usually monthly or quarterly. Unlike annual accounts, they’re not for Companies House or HMRC. They’re for you. They help you understand how the business is performing right now.

These reports cover:

- Your profit and loss,

- Your cash flow,

- Your Key Performance Indicators;

- Your balance sheet.

The point is to give you the insight to make decisions today, not six months after the year end. They’re not just for big corporates. They’re for every owner who wants more control. I would go as far as to say that good regular management accounts become the key document for running your business.

Benefits of Management Accounting for Your Business

With professionally prepared management accounts, you will achieve all of the following:

- Spot problems early, before they become crises.

- See trends in sales, costs, and cash flow as they are just beginning.

- You’ll make better decisions over pricing, staffing, and investment.

- You’ll make sure your business is on track to deliver on your forecasted performance.

I have worked with many seasoned business owners, and its not uncommon for them to feel stuck. For many business owners, their businesses simply meander along because most businesses have a tendency to meander unless the founder or CEO push it in new directions. Monthly management accounts are the big way to get out this ‘pottering along’ pattern. With management accounts a better business plan emerges, and with it better performance.

How Monthly Management Accounts Keep Your Business on Track

Good quality management accounts are a health check-up for your business. You wouldn’t wait a year to see your doctor if something felt wrong (despite the Doctor’s Receptionist suggesting this might be your best plan!). Why then wait a year until your next set of annual statutory accounts to check in see how your business is doing?

Monthly accounts give you a steady rhythm. You know what’s coming in, what’s going out, and how much cash is left in the tank. That regular review keeps surprises to a minimum and gives you confidence to plan for the future.

What a Set of High-Quality Management Accounts Looks Like

A good set of management accounts should be clear, simple, and useful. They should present the key information in different formats: pictorial, graphical, tabular and plain old narrative. A good set of management accounts should have something for everybody. Here’s what we include:

- A one-page summary of the big numbers: sales, profit, cash flow.

- An Executive Summary really highlighting the key take-aways you need to know.

- Visuals like charts and graphs so you can spot trends at a glance. One go-to essential we always include is a gross profit margin tracker graph

- Key Performance Indicator Tracker page. This is your ‘dashboard’ of essential business metrics;

- Detailed financials later in the pack. This way, you can dip into the detail having already digested the main headlines. You don’t need to wade through the detail in order to get the main messages!

- Comparisons to past months, previous years and budgets so you see progress over time. This is built into the sections above.

Also, every set of management accounts we prepare is customised for the individual business’s needs. KPIs are different for all businesses and sectors, and your management accounts document needs to reflect these variations.

The best management accounts therefore include a huge variety of information and styles of presentation.

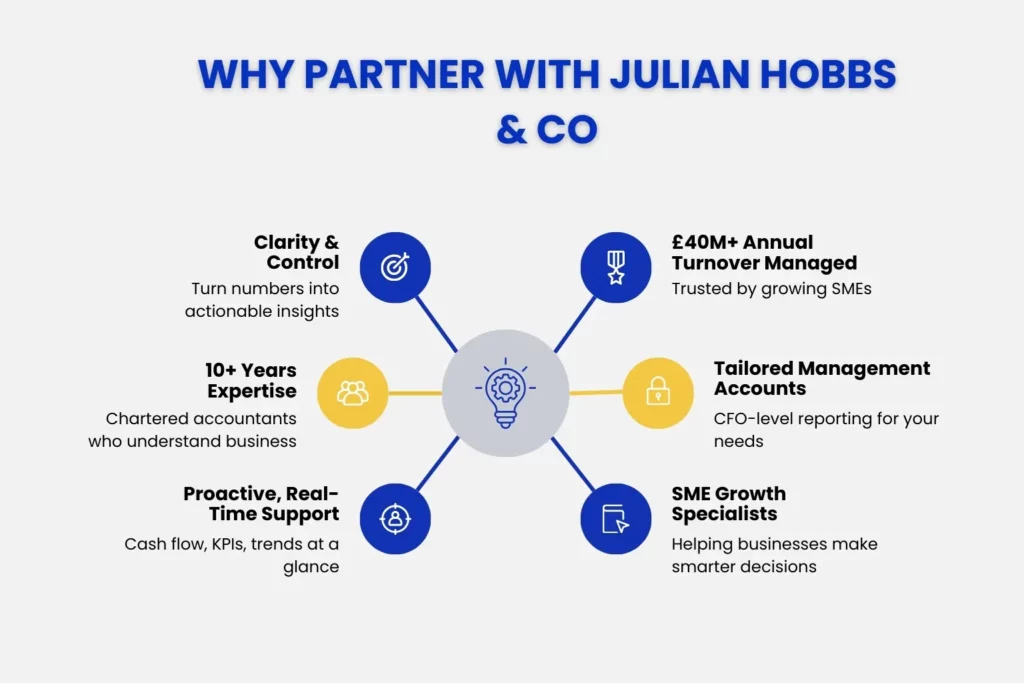

How We Help UK SMEs Outsource Management Accounting

Many business owners I meet in Hertfordshire know they should be doing management accounts but never find the time. Or worse, they find an advisor who just doesn’t appreciate the value of management accounts and deliver the service. That’s where we step in.

We prepare accurate and timely reports each month. We keep things simple and focus on what matters to you. We work remotely, providing quality service to businesses’ needing local accountants in Welwyn Garden City and Hertfordshire. Behind the scenes, our wider bookkeeping team ensures the numbers are always reliable.

Common Mistakes Businesses Make with Management Accounts

Here are the pitfalls I see most often:

- Not reviewing the accounts regularly

- Not following up the management accounts with a proper conversation where questions can be posed;

- Including too much detail and making them hard to read and understand.

- Treating them as a tick-box exercise instead of a decision-making tool.

Keep it simple and regular.

Conclusion: Take Control of Your Business with Accurate Management Accounts

Management accounts aren’t a luxury. They’re a necessity that keeps you in control of your business. They give you clarity, confidence, and information on which to plan ahead.

If you’d like to see how management accounts could work for your business in Welwyn Garden City or across Hertfordshire, our expert accountants in Hertfordshire can help. We’ll make sense of your numbers and put you back in control.

People Also Ask:

What are management accounts and who uses them?

Management accounts are regular financial reports that show how your business is performing now. They’re used by owners and managers who want to make smarter, quicker decisions. You don’t have to be a large company. Even small businesses benefit.

How often should management accounts be prepared for UK SMEs?

Monthly is best. It keeps you on top of cash flow and performance without letting problems build up. Quarterly can work for some, but the longer the gap, the less useful the insights.

What is the difference between management accounts and annual accounts?

Annual accounts are for compliance; they’re a snapshot for Companies House and HMRC. Management accounts are for control and real time monitoring. They’re designed to help you make decisions during the year.

How much do monthly management accounts cost?

Costs vary depending on your setup and what’s included. Instead of seeing it as an expense, think of it as an investment. Good management accounts give you the information to save money, grow faster, and avoid costly mistakes.

Can SMEs outsource management accounts to Julian Hobbs?

Yes of course. We work with SMEs across Hertfordshire and beyond. We prepare reports that are clear, timely, and tailored to your business. That way, you get the benefits of management accounts without the hassle of preparing them yourself.