Introduction

VAT registration can feel like one of those admin jobs you’ll get to later. But knowing when and how to register is important. If you trade in the UK, you need to keep an eye on your turnover and know when it crosses the VAT registration threshold.

This guide explains what the threshold means, how to calculate it, and what to do if you go over it. We’ll also cover the benefits of VAT Registration as well as common mistakes businesses make.

What Is The VAT Registration Threshold? What Tests must you apply?

The VAT registration threshold is the amount of taxable turnover a business can earn before it must register for VAT with HMRC. For the 2025/26 tax year, the threshold is £90,000.

There are 2 tests you must apply when deciding if you need to register for VAT. The first test is called the Rolling 12 Month Lookback test. That means that you compare your turnover over the last 12 months against the VAT Registration Threshold of £90,000. Once your rolling 12-month turnover reaches this figure, registration becomes mandatory. If on reading, you are beyond the 2025/26 tax year, please check with us and will update you as the current threshold.

There’s also a second test if you know your taxable sales will exceed the limit in the next 30 days alone. This is called the 30-Day ‘Look-Forward Test’. For example, if you win a large new contract that will deliver in excess of £90,000 in the next 30 days you must register straight away. HMRC expects you to apply as soon as you realise this, not after it happens. It’s designed to stop businesses from delaying registration once a big increase in sales is clearly on the way. This is a simple test to administer as if you know your turnover will be over £90,000 in the next 30 days, registration is mandatory.

How to Test if You Have Breached the Threshold over the last 12 months

The threshold mostly works on a rolling 12-month basis, not the financial year. Each month, you look back over the last 12 months to see if your total taxable sales exceed £90,000.

Example:

If your business turnover from July 2024 to June 2025 adds up to £91,500, you’ve gone over the limit and must register. You should apply for registration within 30 days of the end of the month end where you crossed the line.

If your sales fall below the threshold again later, you can ask HMRC later to cancel your registration, but only if you expect your turnover to stay under the limit. You can only stop charging VAT once HMRC have approved your formal VAT deregistration.

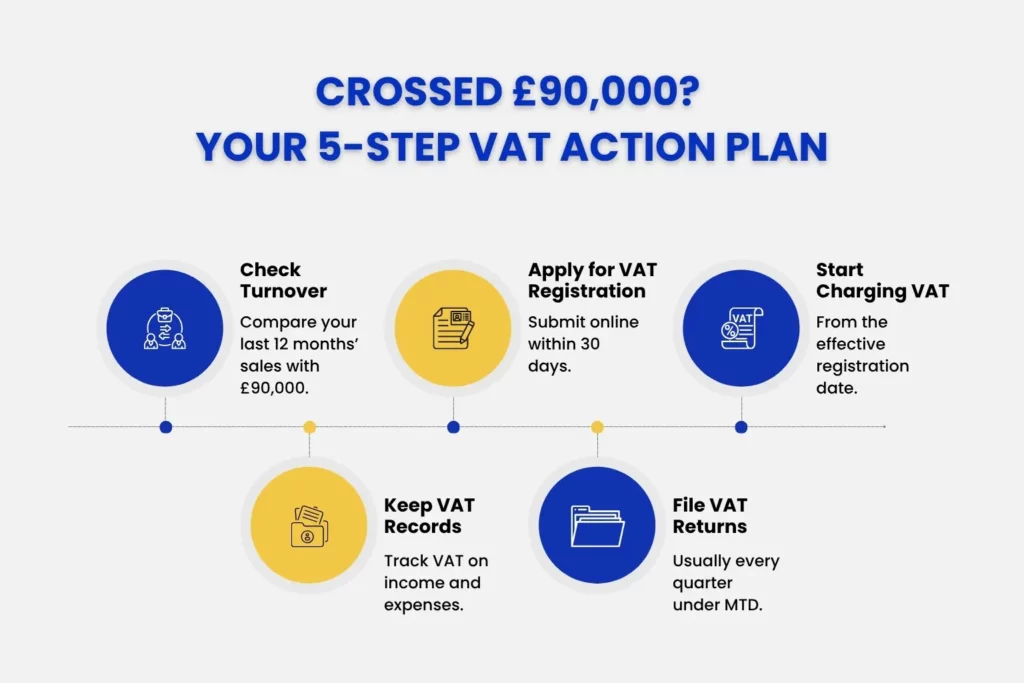

What Are The Practical Steps If I’m At or Over The Threshold?

If you realise you’ve gone over the VAT threshold here’s what you need to do:

1. Check your figures carefully and confirm you’ve crossed the £90,000 limit on a rolling 12 month basis.

2. Apply for VAT registration on the HMRC website within 30 days.

3. Once registered, start charging VAT on sales from your registration date.

4. Keep accurate records of VAT charged to your customers and VAT you pay on business purchases.

5. File your VAT returns, usually every quarter.

If you delay registration, HMRC can charge penalties and interest on VAT you should have collected earlier. Acting quickly helps you avoid unnecessary stress and costs.

What Bookkeeping Controls Should I Put In Place?

Staying on top of your numbers makes VAT easier to manage. Good bookkeeping means you’ll spot when your turnover is close to the threshold and avoid surprises. Once you start approaching the VAT registration threshold, you should do the rolling 12 month look back test every month

Here are a few practical controls:

– Use accounting software like Xero or QuickBooks to track turnover automatically.

– Reconcile your bank and sales records at least monthly.

– Set up alerts in your accounting system when your total taxable sales approach £85,000.

These small habits save time and give you confidence that you’re always compliant.

Benefits Of VAT Registration. When Voluntary Makes Sense

Sometimes it makes sense to register before you have to. Voluntary registration can offer advantages.

If your clients are mostly VAT-registered businesses, they can reclaim the VAT you charge meaning that registering early won’t make you less competitive. You’ll also be able to reclaim VAT on your own business purchases. In this case, a voluntary VAT registration can work to your advantage.

Voluntary registration can make your business look more established and professional. It’s often a good idea for growing service-based businesses or contractors who expect to exceed the threshold soon.

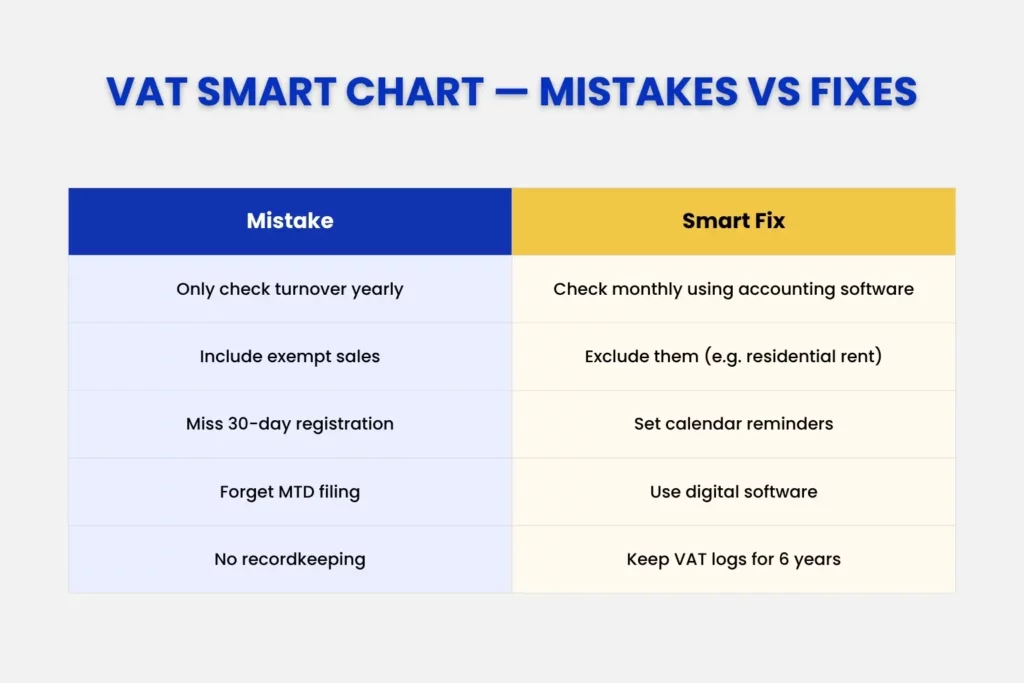

Common Mistakes SMEs Make With The Threshold

VAT rules can be tricky, and many small businesses make the same errors. Here are some of the most common ones:

– Only checking turnover against the registration threshold at year end instead of monthly.

– Forgetting that the threshold applies to a rolling 12-month period.

– Including VAT-exempt sales when calculating turnover. For example, residential property rental income is Exempt rated for VAT purposes and so VAT isn’t applied. There are many other similar examples.

– Missing the 30-day deadline to register.

– Not keeping proper records of taxable and exempt income.

Avoiding these mistakes keeps HMRC off your back and saves money on penalties.

Checklist & Tools To Utilise

Here’s a simple checklist to help you stay compliant:

– Review turnover monthly.

– Track VAT-exempt sales separately. Remember any zero-rated sales count towards the Registration threshold.

– Register promptly once you hit the £90,000 threshold.

– Keep VAT records for at least six years.

– Use digital accounting software to file VAT returns through Making Tax Digital (MTD).

How Can A Local Chartered Accountant Help?

A local accountant can make sure your turnover is tracked correctly and that you register at exactly the right time.

At Julian Hobbs & Co, we help small businesses across multiple locations like Hertfordshire, Barnet, Welwyn and more; understand their VAT obligations and manage the process from start to finish. We handle registration, set up software, and make sure your records meet HMRC standards.

You’ll have peace of mind knowing your VAT is under control and that you remain fully compliant.

If you’re unsure about VAT registration or need help getting set up, contact us. We’ll explain everything clearly and help you make the right choice for your business.

People Also Ask:

Where can I find the current VAT registration threshold?

HMRC publishes the current threshold on its website. As of 2025/26, it’s £90,000.

Does the threshold include VAT-exempt sales?

No. The threshold only applies to taxable turnover.

Can HMRC backdate VAT registration?

Yes. If you should have registered earlier, HMRC can backdate it and charge interest on unpaid VAT.

Can I register voluntarily before I hit the threshold?

Yes, and it can be beneficial if you deal mainly with VAT-registered clients.

How often should I check my rolling total?

Every month. The threshold applies to any rolling 12-month period, not the financial year. Utilising monthly management accounts can prove to be a gamechanger. Read our guide here.

Do I have to be VAT registered?

Only once your taxable turnover passes £90,000, unless you choose to register voluntarily.

How long does HMRC take to process registration?

Usually between two and four weeks.

Why choose Julian Hobbs & Co for VAT help?

We specialise in helping small UK businesses manage VAT simply and effectively. We’ll guide you through registration and make sure your bookkeeping supports your VAT returns and is fully compliant. Connect with us today.