The Chancellor, Rachel Reeves, delivered the Autumn Budget 2025 on 26 November 2025. It continues a clear government direction toward tightening tax thresholds, freezing allowances, and reforming reliefs in ways that will shape the UK business landscape for a while to come. This Budget reframes how many small businesses will interact with tax and planning decisions going forward.

Let’s unpick how it affects you, and what actions you should be thinking about.

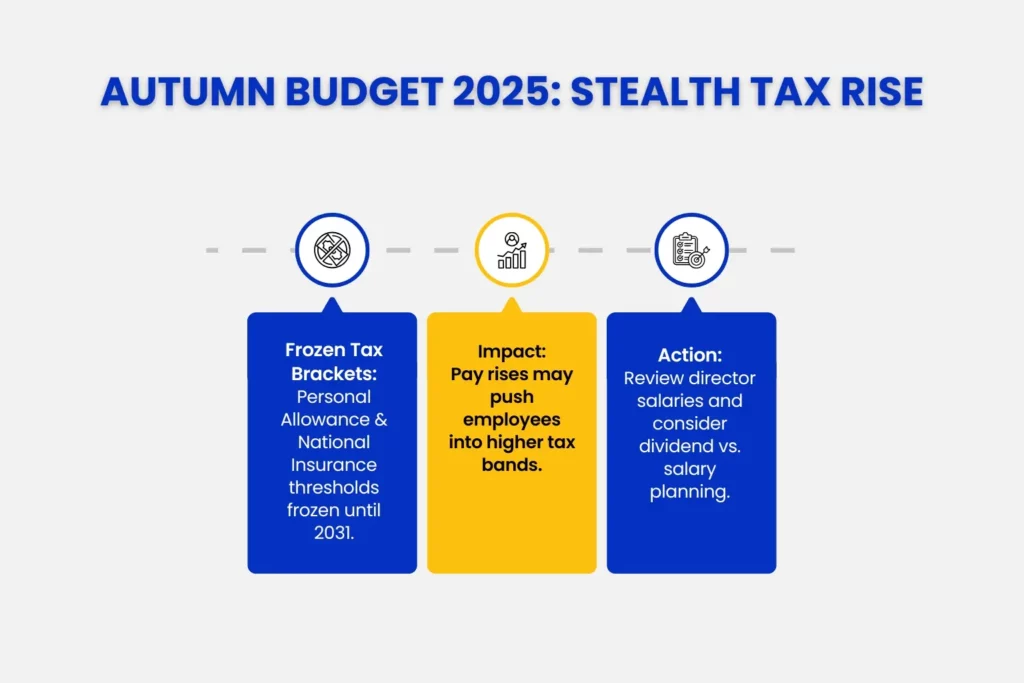

Personal tax and National Insurance Threshold Freezes

One of the biggest themes of the Autumn Budget was the extension of freezes on personal tax and National Insurance thresholds until April 2031.

What has changed

The amount of Personal Allowance (the income you can earn tax free) is frozen. The Higher and Additional Rate thresholds, where more tax is payable, are also frozen.

The Employer National Insurance threshold, below which employers pay no National Insurance, is also unchanged.

That means even if someone gets a pay rise, they could be pushed into a higher marginal rate of tax or National Insurance with no change in the tax thresholds themselves. Over time this is often referred to as a stealth tax rise because real terms tax payments increase without headline tax rates changing.

Impact on small businesses

- For company directors and employees, pay rises translate into higher tax drag as earnings move into taxed bands.

- Employer costs rise because of frozen National Insurance thresholds, which effectively increases the cost of growth.

- For clients approaching the higher or additional rates, this makes cash flow planning and tax efficient remuneration strategies more important.

What to do now

Review director and key employee remuneration packages. Also, consider dividend versus salary planning, particularly with dividend tax increases coming (see below).

Dividend, Savings and Rental Income Taxes

One of the most impactful changes for small business owners, landlords, and directors is the increase in tax on non-earned income (dividends, property income and bank interest)

Key adjustments

- Dividend tax rates increase by 2% from April 2026. This means higher tax bills for company directors extracting profits via dividends.

- Savings and rental income tax rates also increase by 2% from April 2027.

- The dividend allowance remains at just £500, meaning most dividend income will be taxed.

What this means

These changes affect income taken from companies, investment returns, and rental profits. All are common income streams for small business owners. With savings interest and property income also taxed more heavily, the impact is wider than just company directors.

Action points

- Directors should revisit dividend policies and assess whether the current balance between salary and dividends still works.

- Landlords may need updated cash flow forecasts to reflect higher tax on rental profits.

- Consider pensions or ISAs where appropriate to shelter income in a tax efficient way.

Corporation Tax and Capital Allowances

Corporation tax remains at 25%. However, the reliefs used to deduct capital investment costs are changing.

What is new

- The writing down allowance for plant and machinery reduces from 18% to 14% from April 2026.

- A new 40% First Year Allowance is introduced from 1/1/2026 for certain qualifying expenditure where full expensing does not apply.

- Full expensing continues for companies but does not apply to sole traders or partnerships.

What this means

Small companies investing in equipment, tools, or machinery will see relief applied differently depending on asset type and timing. Planning capital expenditure carefully could result in meaningful tax savings.

Practical tips

- Plan capital expenditure ahead of April 2026 where possible.

- Review asset classifications to ensure new allowances are fully utilised.

- Unincorporated businesses may wish to consider whether incorporation or leasing strategies could improve tax efficiency.

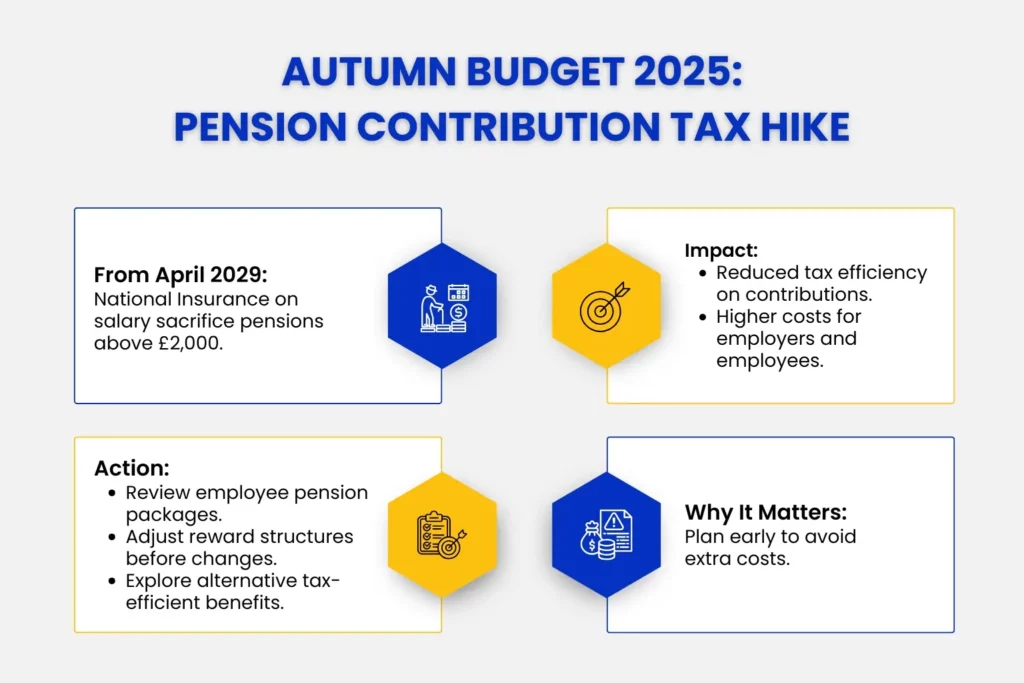

Salary Sacrifice and Pension Changes

From April 2029 onwards, salary sacrifice pension contributions above £2,000 will be subject to National Insurance. This reduces the long-term tax efficiency of some employee benefit structures.

What to consider

Review workforce reward structures sooner rather than later. Consider whether benefit strategies should be adjusted before these changes take effect.

Business Rates Reform

The Budget included a significant package of business rates changes which may have major implications for businesses occupying property.

Key points

- Permanent business rates reductions for certain retail, hospitality, and leisure properties.

- A planned move to a five-tier rate multiplier system in future years.

- Extension of film and studio business rates relief for ten years.

Sector impact

Some retail and hospitality businesses could see reduced property tax bills. However, revaluations may still result in increases where rateable values rise sharply.

Action steps

- Review current business rates liabilities.

- Check eligibility for new reliefs.

- Challenge rateable values where they appear incorrect or excessive.

Landlords and Property Investors

Many small business owners also hold property, either personally or through companies.

Key changes

- Higher tax rates on rental income from April 2027.

- A new council tax surcharge for residential properties valued above £2 million from April 2028.

These changes may reduce net rental returns and should be factored into long term property and cash flow planning.

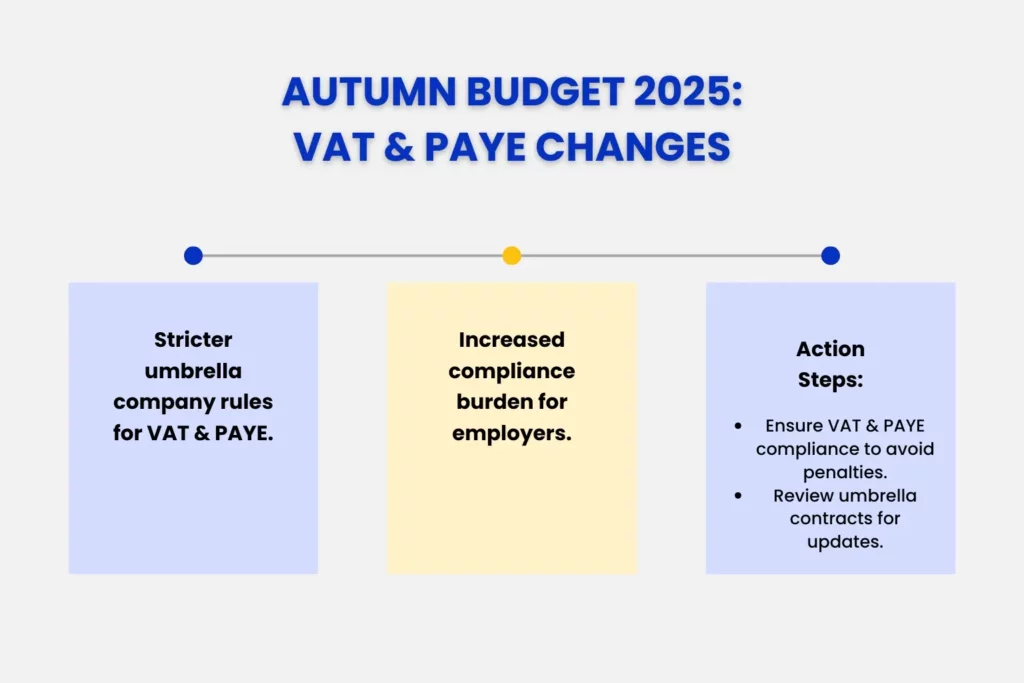

VAT, CIS and Payroll Updates

Alongside headline measures, the Budget included technical compliance changes:

- Umbrella company VAT and PAYE responsibilities have tightened, increasing obligations for employers and agencies.

- Tax free reimbursements for certain employer provided costs have been expanded, including items such as homeworking equipment and health related benefits.

These changes are operational rather than headline grabbing, but errors can be costly.

What this means in plain English

Cash flow will matter more than ever. Frozen thresholds combined with rising taxes on non-earned income mean many business owners will pay more tax without feeling any richer.

Company directors should review how profits are extracted. Without careful planning, tax leakage will increase year on year.

Property owners should reassess rental yields after tax, particularly as rates on rental income rise.

While headline tax rates have not jumped dramatically, the structure of the system has shifted in a way that makes proactive planning essential.

Next Steps After the Autumn Budget 2025: What SMEs Need to Do

- Review director salaries and dividend strategies.

- Build future tax changes into budgets and forecasts.

- Time capital expenditure carefully.

- Check business rates liabilities.

- Review employee benefits and salary sacrifice arrangements.

- Update projections for rental income where relevant.

Final thoughts

The Autumn Budget 2025 was not designed to grab headlines. Instead, it quietly reshapes the tax landscape through frozen thresholds, reduced allowances, and higher taxes on investment income. For small businesses, the impact will be gradual but persistent.

Those who plan early will be far better placed than those who react later.

If you would like help understanding how these changes affect your business specifically, or want support building a tax efficient plan for the years ahead, get in touch.