Introduction

In the UK, if you hear about tax free savings account, your mind probably jumps straight to ISAs. While it is a part of tax-free savings, it is not the only option.

With Banks heavily advertising them, comparison sites leading with them, and every other person vouching for them, most people assume ISAs to be the only tax free savings option, when in reality, it’s not.

The truth is more nuanced.

While ISAs (Individual Savings Accounts) are brilliant, so are the other options. The choice depends on the individual’s needs & goals. In fact, millions of UK citizens are already earning tax-free savings interest without holding an ISA at all.

This blog will help you explore other tax-free savings account options, where you can earn interest without paying any tax. We will also look into what tax-free savings actually mean under UK tax rules, different tax-free savings beyond an ISA, and how ordinary UK citizens can keep more of their savings return, legally.

No jargon – just clear explanations.

What is a Tax Free Savings Account?

As the name literally suggests, zero tax on your interests from savings/investments. You get to keep your savings alongside interest, without being subjected to any capital or income tax from HMRC.

There are restrictions to it, such as annual contribution limits and account-specific rules; however, in totality, such accounts can make a real difference over time.

Let us now look into the reasons why some savings might be tax-free:

- The product itself is exempt from tax (e.g., Premium Bonds)

- The savings sit inside a tax free wrapper (e.g., those of ISAs)

- Income is low enough to avoid tax (Personal Savings Allowance: £1,000 basic, £500 higher, £0 additional)

Don’t worry, we’ll break it all down. We’ll help you catch on to categories 1 & 3 that many people miss out on.

Why Choose Tax Free Savings Accounts in the UK?

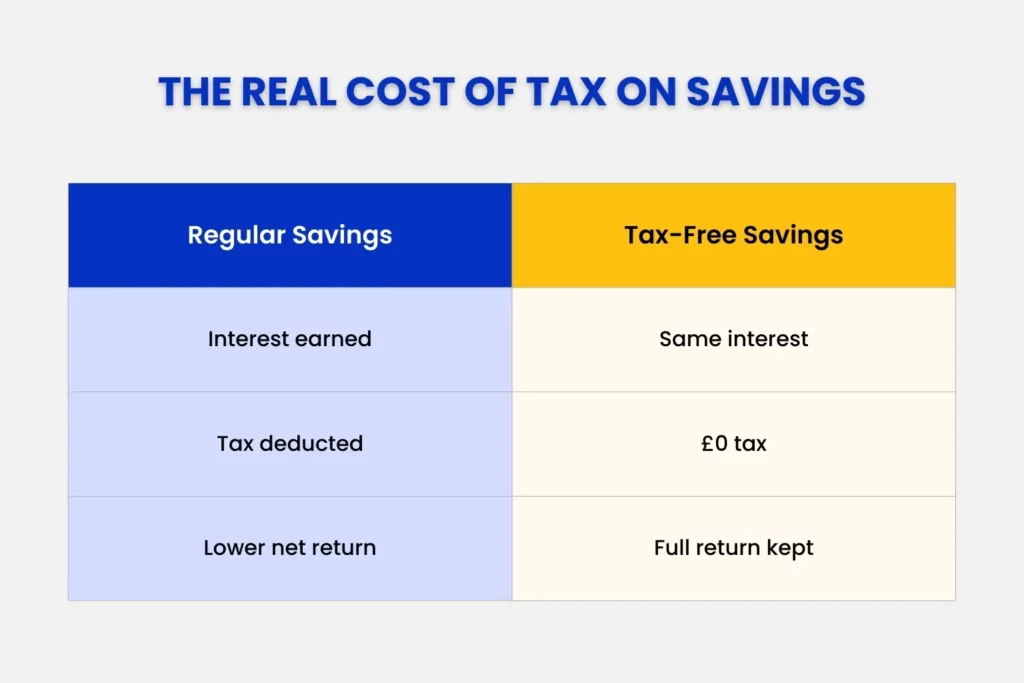

Gone are the days when interest rates were rock bottom, and paying tax didn’t matter much. But now, with higher rates, the tax you’d normally pay can quickly add up. The solution? Tax free savings account, which lets you grow your savings without incurring taxes.

Let’s understand with an example –

Say you’re a basic-rate taxpayer with £30,000 in a regular savings account, earning 4.5% interest. That’s £1,350 in interest per year. After PSA (£1,350 − £1,000), you lose £70 to tax (£350 × 20%). Now, assume you’re a higher-rate taxpayer, you could then lose £340 to tax.

With a tax-free savings account, all of this interest/ returns is yours to keep. The same £30,000 when invested into an ISA or premium bonds, or other tax-free savings account options, lets you pocket the full £1,350 of interest with you. No tax deducted.

Beyond this obvious benefit, you also get peace of mind. You don’t have to worry about complicated calculations or surprise bills from HMRC. You can let your savings incur interests without worrying about tax. This ultimately makes a real difference over time, letting you gather emergency funds or maybe even buy a house.

The Different Types of Tax Free Savings Accounts

Below are the different types of tax free savings accounts available for the 2025/26 tax year:

#1 Premium Bonds (NS&I)

This is a government-backed, unique approach to tax-free savings, where a person can invest from £25 to £50,000 in Premium Bonds. Rather than earning interest like your typical ISAs, your investment is converted into bonds and entered into a monthly prize draw.

What follows is a ‘luck-intuitive’ gamble, where the ERNIE picks a winning number, and the prize is provided, which is entirely tax-free. As of 2025/26, the prize fund rate is 3.60%.

Now, why invest in premium bonds when there’s a good chance that you wouldn’t be winning for months or sometimes years?

Answer – Because premium bonds are completely safe, backed by HM Treasury. Your money is still there even if you don’t win anything. At any point in time, you can fully withdraw it, and once processed by NS&I, the money is back into your bank account. Another big advantage is that it can be used alongside ISAs – that’s £70,000 per person earning tax-free returns.

Speak to your financial advisor. They’ll help you weigh your options (both pros & cons) and choose the best option.

#2 Child Trust Funds (CTFs)

Just like an ISA, a CTF lets you accumulate interest on savings- tax-free. You don’t have to pay any income or capital gain tax on the interest, dividends, or investment growth. The difference? This account is specifically for children under 18.

Although it’s no longer available to children born on or after 2011, existing accounts remain tax-free, which can then be converted into a Junior ISA as the investment grows.

One important point to note is the £100 parental gift rule. If money gifted by a parent generates more than £100 a year in interest/dividends, the excess is taxed on the parent. However, if the same money is gifted by a grandparent or other relative, the £100 rule does not apply, and the entire income remains tax-free.

#3 National Savings & Investments (NS&I) Products

This is another government-backed scheme, where your investment is fully tax-free. Like the premium bond, this product ( Index-Linked Savings Certificate) is also by NS&I, and is backed by HM Treasury.

Here, the capital grows in line with inflation (RPI), so your money keeps its value over time. Say you’ve invested £10,000 in an NS&I Index-Linked Certificate, and there’s been a 5%inflation. Your certificate would grow by 5%, and your earnings would be £500 – all tax-free.

While new issues are no longer generally available, existing index-linked certificates remain tax-free. This is a type of tax-free savings product, often less-known, but a prominent player in the tax-free savings realm, usually held for longer periods to maximise benefits.

You get guaranteed capital safety and gains in a tax-free manner.

#4 Individual Savings Accounts (ISAs)

ISAs are often seen as synonymous with tax-free savings accounts, and a popular solution to preserving your hard-earned income and its interest.

With what we’ve understood till now, I hope this assumption has shattered. Nevertheless, the Individual Savings accounts will continue to be a popular choice for all the good reasons.

In addition to making every penny of interest tax-free – no capital gains, no income tax, nothing; it also provides various ISA forms that allow us to use £20,000 over a single or multiple ISAs. The following are four main types of ISA you can hold:

- Cash ISA: It’s the simplest type of savings account, where you deposit money and earn interest- all tax-free. This type of ISA is ideal for short-term savings, emergency funds, or even saving for a wedding, thanks to its simple access & convenience.

- Stocks & Shares ISA: This type of ISA lets you invest in stocks, shares, and other securities, giving you tax-free gains & dividends. If you’re looking to fulfil long-term goals, like saving for retirement and wealth building, then consider investing in this.

- Lifetime ISA (LISA): Such ISAs are most suited to individuals aged 18 to 39 years. So, if you’re saving for your first home or retirement and intend to withdraw after age 60, this ISA is for you. Remember, any withdrawal before the age of 60, aside from buying your first home, can result in 25% penalty.

- Innovative Finance ISA: While investing in this type of peer-to-peer lending, remember to always consult an experienced advisor beforehand. Why? Because it has great potential for higher returns, at the same time for higher risks.

- Junior ISA: If you’re looking to invest for your child under 18 years, then a Junior ISA is for you. Its annual contribution limit is £9,000 for the 2025/26 tax year, and all growth is tax-free.

Tax-Free Savings Account vs. Regular Savings Accounts: What’s the Difference?

Choosing between tax-free and regular savings accounts isn’t always straightforward. Sometimes a regular account pays better interest than a lower-rate ISA, even after tax. Other times, the tax benefits of a tax-free savings account are worth more.

Let’s understand the difference between the two in simple terms, without using much jargon.

| Feature | Tax-Free Savings Account | Regular Savings Account |

| Tax Treatment | Interests/dividends & growth are all tax-free. | Taxable once you exceed the PSA (£1,000 basic rate / £500 higher rate / £0 additional rate) |

| Examples | Different types of ISAs, premium bonds, other NS&I products, and CTF (Children’s Trust Fund) | High street savings accounts, fixed-rate bonds, and online savings accounts |

| Annual limits | – £20,000 per tax year across all ISAs – £4,000 for Lifetime ISAs – £50,000 for Premium Bonds | No limit whatsoever |

| Typical interest rates | – Cash ISA has 4.4% (easy access), around 4% (fixed-rate) – Premium Bonds around 3.60% – Stocks & Shares ISAs are subject to market performance | Usually 5% to 7.5%, often higher than ISAs |

| Flexibility | – Cash ISA offer flexible withdrawal. – Lifetime ISAs – Withdrawal after 60 years, or when buying a first home | Most flexible. You can withdraw whenever you like. |

| Minimum to Open | – You can open ISAs from £0 – Premium Bonds – £25 minimum | £1 – £1,000 depending on account type |

| Government Backing | – Premium Bonds – Backed by HM Treasury – ISAs – Backed by FSCS | Also FSCS protected |

| Best for | – ISA is ideal for those whose savings are up to £20,000 who want tax-free growth – Premium Bonds are ideal for higher/additional-rate taxpayers with over £20,000 in savings – NS&I Products are best for sophisticated savers- wanting CGT-free gains | People under PSA limits who want maximum interest rates |

Your choice between the two – should be based on your needs, goals, financial situation, and how you want to grow your savings.

How to Maximise Your Tax Free Savings in the UK

Before diving into the tax-free savings maximisation strategy, we first need to understand different accounts in the market, their government support and how they work together. Then, you have to calculate how much interest you’re currently earning and what your personal allowance is. If it’s well under, you can continue with your regular savings account that offers you a higher rate.

Else, you can move into a tax-free savings account to fulfil your long-term goals, while ensuring your interests, dividends and investment growth are tax free. With the help of an expert, you can adapt multiple savings accounts that work well together.

Here’s how you can maximise your savings, tax-free:

- Use your allowances first if your savings are modest

- Use Premium Bonds for large, flexible cash holdings. You can invest up to £50,000 and get tax-free prizes. If you’re a higher/additional-rate taxpayer with significant cash savings, this option might be for you.

- Utilise ISAs for long-term growth and higher interest exposure. Remember to use your ISA allowance (currently £20,000 in 2025/26) across one or more ISA types by midnight on 5th April. Otherwise, any unused allowance will be lost as the new tax year begins.

- Don’t forget about Junior ISAs. A JISA lets you save or invest up to £9,000 per year, per child, with no tax on interest, dividends, or growth. The money stays locked until the child turns 18 years old. This ultimately converts into adult ISA at 18, letting you keep all those tax benefits intact.

- Also, choose your ISA type wisely. Go for a cash ISA for short-term goals and safety, and a stocks & shares ISA for long-term goals.

- Combine your allowance wisely. You can maximise your yearly allowances by distributing your funds among many tax-free accounts.

- Lastly, keep an eye on interest rates. The ISA vs regular savings calculation changes asthe rate moves. What made sense last year might not work now. Hence, review your accounts annually.

Using these simple yet effective strategies will help you maximise your savings while remaining tax-free.

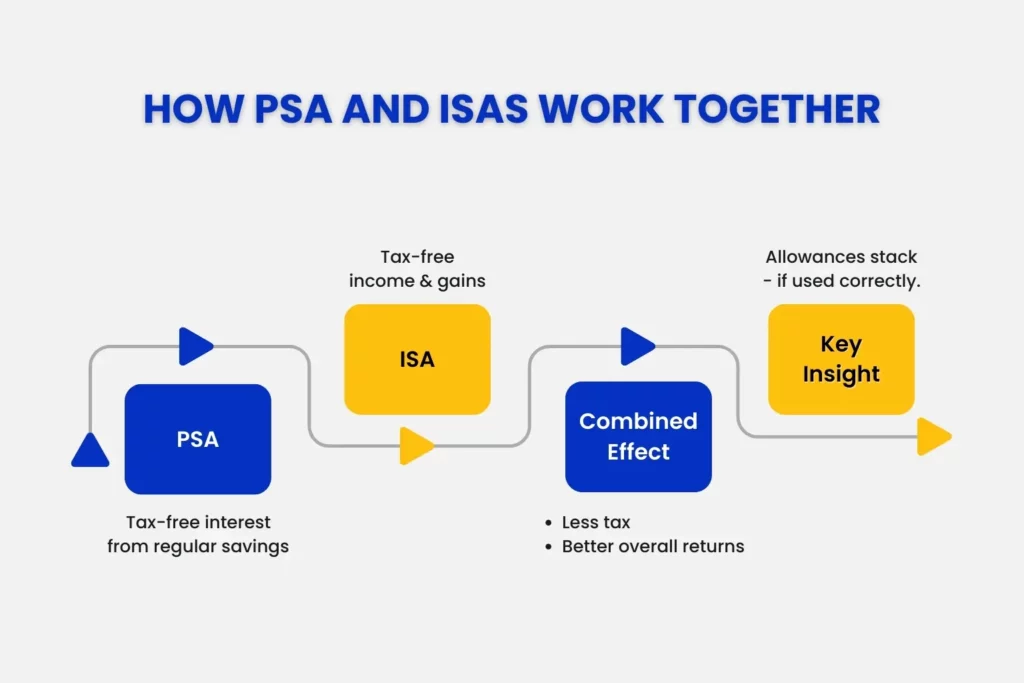

Personal Savings Allowance and Its Role in Tax Free Savings

The Personal Savings Allowance, or PSA for short, is an automatically applied allowance that lets UK taxpayers earn a specific amount of interest from regular savings without paying taxes. As of 2025/26, the amount varies, depending on your income tax band.

- Basic-rate taxpayers (20%) – £1,000 tax-free interest

- Higher-rate taxpayers (40%) – £500 tax-free interest

- Additional-rate taxpayers (45%) – £0 tax-free interest

These allowances fall outside ISAs into regular savings account interests, which are provided by banks and building societies. So, what it’s role in tax-free savings?

The PSA can be used alongside different tax-free savings accounts, like ISAs. In addition to earning £1,000 tax-free interest in a regular savings account, you can also get the tax benefits of an ISA, meaning the two allowances stack.

Let’s say you have a total of £25,000 to save, and you’re a basic rate taxpayer. You can put £20,000 in an ISA and the rest, £5,000, in a regular savings account.

The result?

- No tax is paid on savings from an ISA, since it’s within the £20,000 limit.

- Within the regular savings account, the first £1,000 of interest is tax-free, and excess interest gets taxed based on your income.

- Ultimately, you’ll be paying less tax on interest by combining PSA and ISA allowances.

Common Mistakes to Avoid with Tax Free Savings Account

- Assuming ISAs are always the best option. You need to look into different tax free savings accounts as well as regular accounts to see which complements you.

- Forgetting about Junior ISA rules. Money in a JISA is locked until 18 and is inaccessible to parents in the short term. Think of it as a long-term commitment towards your children’s future.

- Ignoring tax-free allowances entirely

- Withdrawing and redepositing money into a new ISA instead of a transfer. Doing this will be counted as a new subscription, and could accidentally cause you to breach your £20,000 limit for the tax year.

- Not being updated on recent tax changes within the savings realm. If you want to know what HMRC warns UK savers in 2025/26, check out our detailed guide: “HMRC Savings Account Tax Warning Explained: What UK Savers Need to Know in 2025/26“.

- Buying Premium Bonds beyond the £50,000 limit. At that point, you won’t be qualified for the prizes.

- Keeping everything in cash. Even if you’ve been saving for decades, the inflation quietly erodes your cash savings. Consider diversifying your savings within regular accounts and tax-free savings accounts.

These mistakes are very common, so much so that even experienced savers make such avoidable blunders. Remember to consult an adviser to help you choose the right fit, regardless of the account type.

Conclusion

Tax free savings accounts, such as ISAs, Premium Bonds, CTFs, and NS&I Products are the best way to protect your interest, dividends and investment growth from taxes. These accounts are very different from your regular savings account – offering tax-free benefits – majority of which are government-approved.

Indulging in them is not only appreciated but also publicised to help you retain your hard-earned savings. Whether your goal requires short-term or long-term commitment, analysing these options can prove to be beneficial when paired with expert advice.

Consult Julian Hobbs & Co’s expert advisors and find the right fit for you, one that can seamlessly integrate with your basic-must allowances. Remember, these accounts are not limited to ISAs; there are other approved tax-free savings accounts that you can use to maximise your savings, without having to pay capital or income tax on gains. Firms and SMEs across Hertfordshire & Watford trust Julian for this, why not you? Contact us today to learn how our services can be customised to protect your interests- and help you save for the long term.

People Also Ask:

Do you pay tax on savings if you earn under £17,570

No. Your income is low enough to qualify for the starting rate for savings, which allows up to £5,000 of savings interest to be tax-free.

What are the limits for a tax free savings account?

For the tax year 2025/26, ISAs have a limit of £20,000; Junior ISAs have a limit of £9,000; Lifetime ISAs have a limit of £4,000, but this is included within the overall £20,000 ISA limit; and Premium Bonds have a limit of £50,000.

Do you get taxed on savings in an ISA?

No. All the interests, dividends and capital gains inside an ISA are tax-free till now. Tax rules might change, and continuous review is required to stay compliant.

How long does it take to open a tax free savings account?

Depending on whether you apply online or by mail, opening a tax-free savings account in the UK (Cash ISA or NS&I savings account) can take anywhere from a few minutes to ten days. While the majority of online applications are processed fast, some, like HSBC Expat, may require seven to ten days to process checks.

Are children’s savings accounts tax free?

Junior ISAs are tax-free, up to the annual limit. Other children’s savings accounts, such as a regular child’s bank account, get taxed on interest.

Should I open a regular savings account or an ISA?

An ISA is a better option if you want to earn interest tax-free. You can save up to £20,000 annually without having to pay interest tax. Similar interest may be available in a standard savings account, but unless you are within your personal savings allowance, you will be required to pay tax on the earnings.

How to open an ISA?

To open an ISA, select a provider (bank, building society, or online), select the type of ISA (Stocks & Shares ISA, Cash ISA, etc.), and fill out the application. Personal information such as your name, address, and National Insurance number will be required. After being accepted, you can begin making contributions for the 2025–2026 tax year up to £20,000.

Why choose Julian Hobbs & Co. as an advisor when opening a tax-free savings account?

Julian Hobbs & Co. offers expert, personalised advice to help you make the most of tax-free savings. We simplify the process of opening such accounts and guide you to the best options for maximising your savings.