A Quick Brief

MTD for Income Tax has been in talks for many years. Finally, from 6 April 2026, MTD for Income Tax Self Assessment becomes mandatory for UK sole traders and landlords. So, if you’re earning either from self-employment income or landlord income, or both, you will fall within the scope of MTD for Income Tax if your combined gross income exceeds £50,000 a year.

Sounds mechanical & jaron-enriched, right? Let me help you.

In this blog, you’ll learn exactly what MTD for Income Tax is, who it affects, how it works in practice, and how to prepare it properly – avoiding stress and penalties. Get ready to understand it in simple language – with only two months to go!

What Is MTD for Income Tax and Why HMRC Is Changing the System

Making Tax Digital for Income Tax is a government initiative to go digital and paperless. Its target audience for now is sole traders & landlords, who are required to –

- Keep digital records of their income & expenses

- Submit quarterly updates (every 3 months) to HMRC using compatible softwares

- And, finally, submitting the final declaration at the end of the tax year.

You’ll (meaning sole traders & Landlords) still need to file your Self Assessment tax return by 31st January, and if applicable, make payments on account (31st Jan & 31st July). However, your income and expenses will now be reported to HMRC every quarter in a fully digital manner, unless you’re digitally exempt.

Note, filing your tax return (annual declaration) is not the same as submitting quarterly updates. The former confirms your final tax liability to HMRC (what you owe), while the latter keeps HMRC updated on your income and expenses.

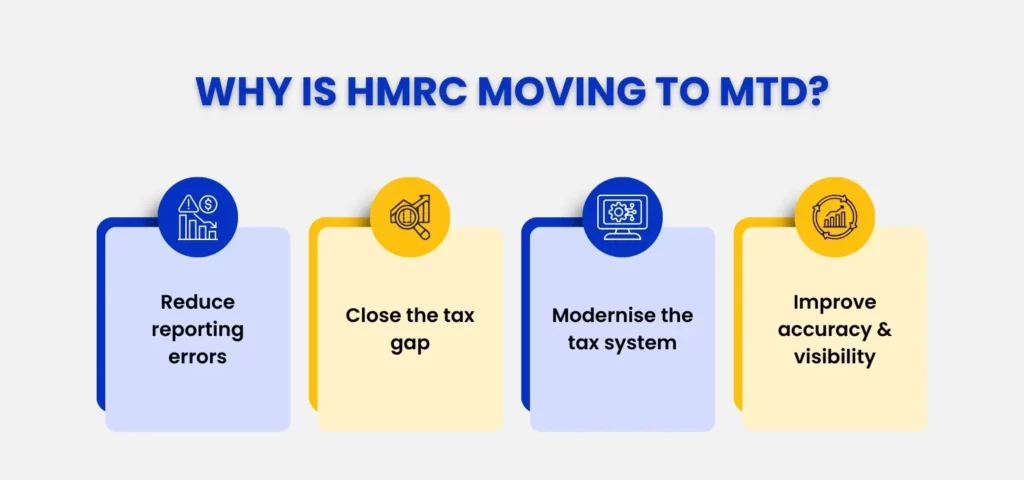

So, why is HMRC introducing this?

The ultimate objectives are to reduce errors, last-minute hustle & rush, and ensure precision. This would eventually close the tax gap caused by mistakes and misreporting.

The UK is on a mission to streamline financial reporting with utmost accuracy & precision. This modernisation comes with penalty relief for the April 2026 MTD income tax filing, where HMRC has offered a soft landing – meaning no penalty points for late submission for this year’s quarterly updates.

When Does MTD for Income Tax Start? Key Dates & Thresholds

MTD for Income Tax starts on April 6th, 2026.

All sole traders and landlords earning self-employed and/or property income, be it individually or jointly (i.e., earning from both self-employment & property income), are mandated to digitally record their income and expenses if they reach or exceed the £50,000 threshold.

Such individuals’ total qualifying income constitutes the gross income (before expenses) and determines the eligibility. Simply put, your total earnings from self-employment and/or from property in a tax year will determine whether you need to comply with MTD for ITSA.

Other Key Dates and Thresholds Are:

- From 6 April 2027 (Phase 2): the threshold will reduce to £30,000

- From 6 April 2028 (Phase 3): the threshold will reduce to £20,000.

Keep in note, these calculations are only to decide your qualification for MTD, and NOT your tax bill.

Think of it as a VAT registration threshold that analyses your historic data to determine your eligibility. Likewise, for April 2026- MTD compliance, HMRC will assess your 2024-25 Self Assessment tax return to verify your eligibility for MTD for Income Tax.

HMRC MTD for Income Tax Changes Explained Simply

HMRC’s MTD for Income Tax changes are effective from 6 April 2026, based on qualifying income from self-employment and property. This means other income streams such as employment (PAYE), your share of partnership profits, dividends, State Pension, and private pensions do not count towards the £50,000 qualifying income threshold.

Even if you lose one of your income streams, you may still fall within MTD. Why? Because HMRC allows ceased self-employment or property income to be calculated towards eligibility. Only when all qualifying incomes have ceased will HM Revenue & Customs remove the compliance requirement.

Here’s a simple comparison of the current system and what will change under MTD.

| Current Self Assessment | Under MTD for Income Tax |

| Keep all records, be it in paper, spreadsheet or software format | Must keep digital records |

| Submit one annual return | Submit 4 quarterly updates + final declaration |

| File via HMRC portal | File via MTD-compatible software |

| Tax paid by 31 January | Tax still paid annually (plus payments on account if applicable) |

Remember, these quarterly updates are reporting guidelines. You do not have to pay tax each quarter.

How Does MTD for Income Tax Work in Practice?

Follow the steps below to stay compliant and see how a typical tax year operates under MTD:

Step 1: Keep Digital Records

You must record:

- Income

- Business expenses

- Property income and costs

- VAT adjustments (if registered)

This must be done using compatible software.

Step 2: Submit Quarterly Updates

You submit four updates covering:

- Q1: 6 April – 5 July

- Q2: 6 July – 5 October

- Q3:6 October – 5 January

- Q4: 6 January – 5 April

Ensure your updates are summarising income and expenses for that quarter, and remember these updates do not go towards your tax bill calculation.

Step 3: Make Year-End Adjustments

After the tax year ends:

- Account for adjustments

- Claim allowances

- Make accounting corrections

Step 4: Submit Final Declaration

This replaces the traditional Self Assessment submission.

Step 5: Pay Tax

Tax deadlines remain:

- 31 January (balancing payment)

- 31 July (if payments on account apply)

Who Needs to Comply? Self-Employed & Landlords Explained

| Category | Who Needs to Comply? | Notes / Details |

| Sole Traders | You must comply if you are self employed, your gross business income exceeds the threshold, and you file Self Assessment | Applies whether you run one trade, multiple trades, or have a PAYE job alongside your business. PAYE income does not count towards qualifying income, but having a job does not exempt you if business income exceeds the threshold. |

| Landlords | Residential landlords, furnished holiday lets, joint property owners (based on individual share of income) | If your share of gross rental income exceeds the threshold, you fall within scope. |

MTD-Compatible Software: What You’ll Need (and What You Don’t)

This tax year, if you’ve received an HMRC letter about Making Tax Digital for Income Tax, it means you are in scope for mandatory, digital quarterly reporting, starting April 2026. To do this, you’d require MTD compatible software like Xero, QuickBooks, FreeAgent & more.

There are options available to continue using spreadsheets, provided you submit data through MTD-compliant bridging software. To know more, read our in-depth guide on MTD Compatible Software (How to Choose the Right Solution for MTD for Income Tax)

As for what you don’t need:

- You don’t need to hire staff or a full-time, in-house accountant. You can simply stay compliant in the most cost-efficient way by outsourcing to Julian Hobbs & Co.

- Your software migration, or even the first step of choice and integration, doesn’t have to be a source of stress. Simply reach out to an accounting firm/chartered accountant with experience and expertise within MTD.

Remember not to wait until March 2026 for software selection and implementation. HMRC will not provide you with accounting software – individuals must arrange this themselves. Hence, early adoption will reduce disruptions and give you time to double-check your entries and details.

Common MTD for Income Tax Pitfalls (And How to Avoid Penalties)

- Missing Quarterly Deadlines: Each late submission from April 2027 will incur 1 point (as per the point-based penalty system). After 4 points, you’ll receive a £200 penalty. Each further missed deadline will then trigger another £200.

- Confusing Reporting with Payment: Newly eligible sole traders and property owners may confuse quarterly updates with tax payments. Remember, these quarterly submissions are for reporting purposes only – they do not require quarterly tax payments.

- Ignoring Ceased Income Rules: Some taxpayers may assume that stopping one income source, be it from self-employment or by selling rental property – automatically removes them from MTD. This is not necessarily true. If you still have any continuing qualifying income, you may remain within scope.

Only when all qualifying income (from self-employment and/or property) has ceased and you fail to notify HMRC will this result in continued unnecessary reporting obligations and potential penalties. - Assuming Exemptions without Approval: Any exemptions from MTD for Income Tax must be applied for and formally approved by HMRC. Assuming you are exempt without approval may result in continued reporting obligations, penalty points, and financial penalties. Refer to HMRC’s Guidance page to find out if you can get an exemption from MTD for ITSA.

- Setting up Software Too Late: Late setup will increase the risk of errors and missed submissions.

Do Limited Companies Need to Worry About MTD for Income Tax?

No. MTD for Income Tax applies to individuals- not limited companies.

Such companies should continue filing corporation tax returns. In future, they may face MTD for Corporation tax, but as of now, it’s not yet planned or implemented. For now, if the limited companies are VAT-registered, they must comply with MTD for VAT.

How to Prepare for MTD for Income Tax Before April 2026

12 Months Before:

- Review your 2024-25 gross income

- Confirm whether you exceed £50,000

- Speak to your accountant

6 Months Before:

- Choose compatible software

- Start keeping digital records

- Test quarterly reporting internally

3 Months Before:

- Ensure bank feeds are active

- Categorise expenses correctly

- Understand submission deadlines

First MTD Year

- Submit quarterly updates on time

- Review profit trends

- Monitor payments on account

Preparation removes stress. Delay increases risk.

How Julian Hobbs Helps You Stay Compliant With MTD for Income Tax

Whether you want to check your eligibility for MTD for Income Tax or require help choosing or transitioning to MTD-compliant software, Julian Hobbs & Co. can help you stay compliant with irresistible confidence.

Our professional support can help you with:

- Assessing qualifying income

- Setting up compliant digital systems

- Managing quarterly submissions

- Avoiding penalty points

- Providing ongoing visibility over your tax position

For many sole traders and landlords, the real value lies not just in meeting HMRC’s requirements, but in understanding what the numbers mean throughout the year. Julian Hobbs provides customised support in a jargon-free manner, with planning focused on improving cash flow, reducing tax risks, and supporting the best decision.

People Also Ask:

What is MTD for Income Tax in simple terms?

It is a system requiring certain sole traders and landlords – whose qualifying income is at or above £50,000 to keep digital records and send quarterly income summaries to HMRC using approved software.

Who must comply with MTD for Income Tax?

Individuals with gross qualifying self-employment and/or property income at/above the £50,000 threshold are mandated to comply with MTD for Income Tax from April 6, 2026.

Is MTD mandatory for landlords?

Yes, if your gross qualifyingrental income exceeds the £50,000 threshold.

Do quarterly updates mean paying tax quarterly?

No. They are reporting updates only. Tax payment deadlines remain largely unchanged (still calculated at the end of the year, with payment deadlines in January (and July for payments on account)).

What happens if I don’t sign up?

If you have reached or exceeded the £50K threshold for MTD for Income Tax, signing up now becomes a requirement. Failing to do so could result in penalty points and financial penalties.

Can my accountant submit MTD reports for me?

Yes. It’s actually a sound-efficient practice to let accountants manage digital submissions on your behalf.

Is MTD for Income Tax delayed again?

No. As per the current legislation – April 2026 is the confirmed start date for the first phase.