Introduction

Whether you are registered as a limited company or as an individual or partnership – you need to know how to register for VAT, when you need to register and what documentation you need to complete the registration process. Before diving into the step-by-step guide, let me tell you a quick one line answer as to how to register for VAT UK.

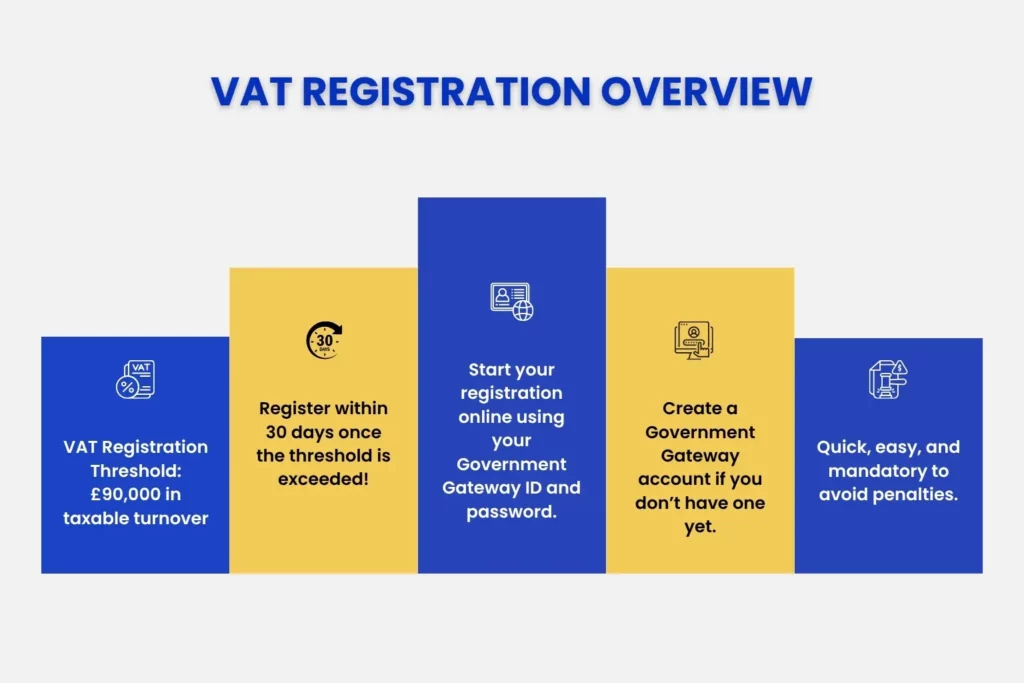

If your business’s annual taxable turnover exceeds the £90,000 mark threshold, you can start registering for VAT online- using your government gateway ID and password. If you don’t have one, no worries; you can create it when you sign in for the first time.Remember, the registration process must be completed within 30 days of reaching the threshold.

To know more about the VAT Registration threshold, read our blog, and let’s dive into the VAT registration process – the main purpose of this blog.

Who Needs To Register For VAT?

As mentioned above, any UK business that exceeds a taxable turnover of £90,000 (2025-2026) must register for VAT with HMRC. This is known as compulsory registration, and businesses must comply with it, to avoid penalties and issues with non-compliance.

On the other hand, you can also voluntarily register for VAT even when you are below the threshold. This is known as voluntary registration and should be executed, only after careful consideration and VAT reviews, to ensure it proves advantageous to you.

Let’s understand with an example:

Meet James, who runs a small tech consultancy business. He has been running the business for 3 years and his annual taxable turnover had mounted to around £75,000 each year, until last month when it exceeded the £90,000 mark.

Now James has to compulsory register for VAT with HMRC. He must do this within 30 days of surpassing the threshold to avoid penalties. Once registered successfully, James can then charge VAT on his services, submit VAT returns, and reclaim it using MTD (Making Tax Digital)- compatible software.

In contrast, meet Sarah who runs a small boutique shop. Her business has been operating for the last 2 years, and until recently, she has seen a surge in sales. Even with the growing demand for her products, her taxable turnover is around £25,000, which is way below the £90,000 threshold. Hence she is not bound to register for VAT.

However, she can voluntarily register for VAT, if it proves beneficial for her:

- If the majority of her customers are VAT registered businesses, her voluntary registration will open doors for her to freely and compliantly charge VAT on sales, and reclaim it.

- If Sarah is sure that her turnover will soon exceed the threshold – maybe because of her expansion from 1 store to a total of 5 outlets across the UK, her early voluntary registration will allow her to reclaim VAT on purchases made during expansion.

- It gives her a more professional image, enhancing her credibility in the market; likewise contributing to growth in sales in the coming days.

Running businesses must keep this in mind when registering for VAT with HMRC- whether it’s compulsory registration or voluntary registration for benefits.

What Documents Do You Need To Register For VAT?

As mentioned in the introduction, regardless of whether you are a limited company or an individual, or partnership – registering for VAT is compulsory if you exceed the threshold. In this section, we will discuss the documentation aspect for each type of company structure. You need to have these documents in-hand before you begin your VAT registration process (GOV.UK).

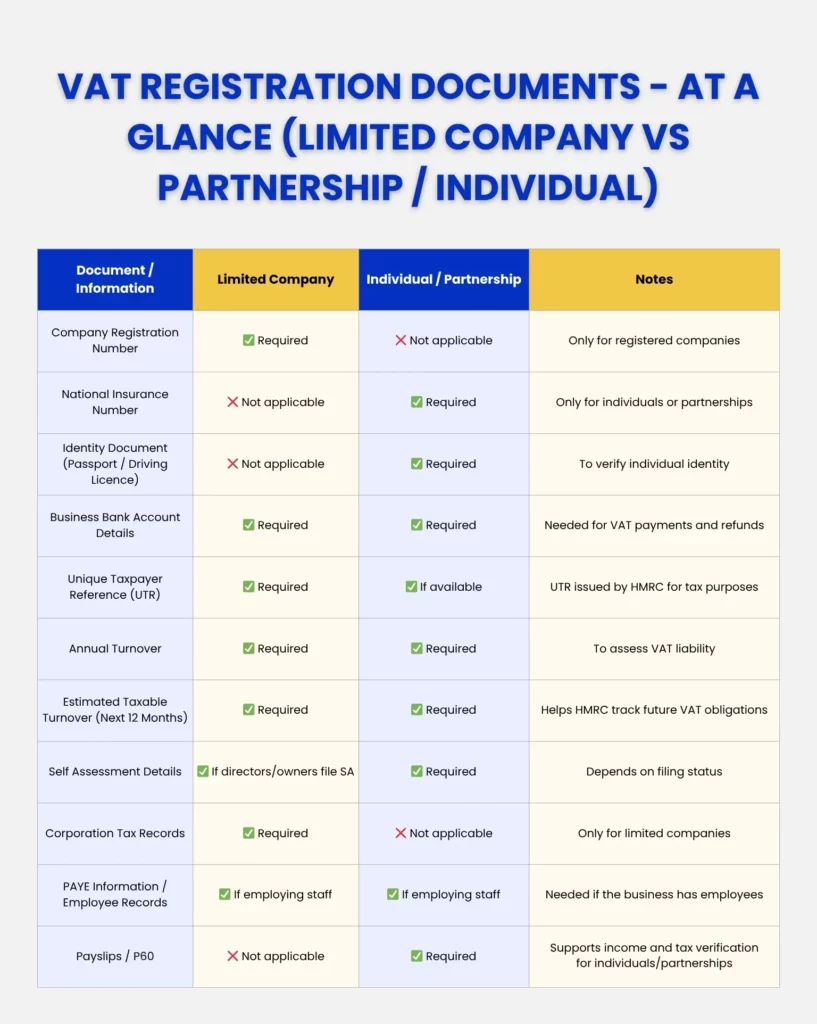

- Limited Company:

You’ll need:- your company registration number

- your business’s bank account details

- your Unique Taxpayer Reference (UTR)

- details of your annual turnover

- estimate of your taxable turnover for the next 12 months

You will also need information about:- your Self Assessment

- your Corporation Tax (learn how to plan your corporation tax for stability & save money)

- Pay As You Earn (PAYE)

- As an Individual or as a Partnership:

You’ll need:- your National Insurance number

- an identity document, like your passport or driving licence

- your bank account details

- your UTR, if you have one

- details of your annual turnover

- an estimate of your taxable turnover for the next 12 months

You will also need information about:- your Self Assessment return

- payslips

- P60

Let’s proceed to the next section which shows how to register for VAT in the UK.

Step-By-Step Guide To Register For VAT Online

James and Sarah, after knowing when they need to register for VAT, now need to learn how to register for VAT Online. VAT can also be registered offline i.e. by post (VAT1), but this method takes time when compared to online – which is the quickest and most convenient method.

There are, however, a few exceptions when you cannot register online and must use the paper VAT1 route. For example, if James were forming a VAT group with other businesses or Sarah needed separate VAT numbers for different shop divisions, they’d have to apply by post. The same applies to some overseas partnerships and certain public bodies. Paper applications take longer and HMRC will ask why the online service wasn’t used, so call the HMRC VAT helpline to request a VAT1 only when necessary.

Let’s proceed to the step-by-step guide to register for VAT Online:

- Create or log in to your Government Gateway Account using your government gateway ID and password

- Provide your business details, turnover and the type of goods/services you sell.

- Choose the best suited VAT scheme (Flat Rate Scheme, Annual Accounting Scheme) depending on your needs.

- Double check all the information, then submit your application.

- HMRC will review your application & issue VAT number if everything is in order.

How Long Does VAT Registration Take?

The process usually takes 2 to 4 weeks and sometimes might extend up to 6- 8 weeks, if HMRC wants to double check the legitimacy of registration, or is particularly busy at that time.

James, whose consultancy recently crossed the £90,000 threshold, might receive his VAT number within 2nd week of registration. Whereas, Sarah- who is registering voluntarily, may experience longer delays. Either way – the timeline differs from 2 to 4 weeks for normal circumstances, and may go beyond 6 to 8 weeks if further details need to be confirmed from HMRC end.

What Happens After You Register?

After you are done with the registration process, HMRC will issue a VAT number which you can then include:

- Within your invoices to show customers that you’re VAT-registered,

- Start charging VAT on the sale of your goods/services,

- Submit VAT Returns (quarterly or annually) depending on the scheme.

- Include the same within your website (If you’re unsure how to find your VAT registration number, check out our guide on how to find a company’s VAT registration number)

Common Mistakes To Avoid During VAT Registration

When you are in the process of registering for VAT, look out for these common mistakes most SMEs/partnership or individual firms make:

- Not keeping the records and documents in-hand. This could delay the registration process.

- Not double checking the details before submission. This could cause discrepancies & typo errors.

- Failing to choose the right VAT scheme based on your needs.

- Not contacting HMRC or getting in touch with a local accountant – who can help with smooth registration, and error-solving during the registration process.

- Missing the 30-day deadline once the threshold is exceeded. James, who surpassed the £90,000 threshold in March 2025, needs to register for VAT by 30th April 2025. Failing to do so could result in late registration penalties and hefty interest charges.

- Not updating your VAT registration details. Though this error occurs post VAT-registration, it is still one of the most common mistakes firms make. Ex: not updating the changes in your business structure or address.

VAT Registration Alternatives And Special Cases

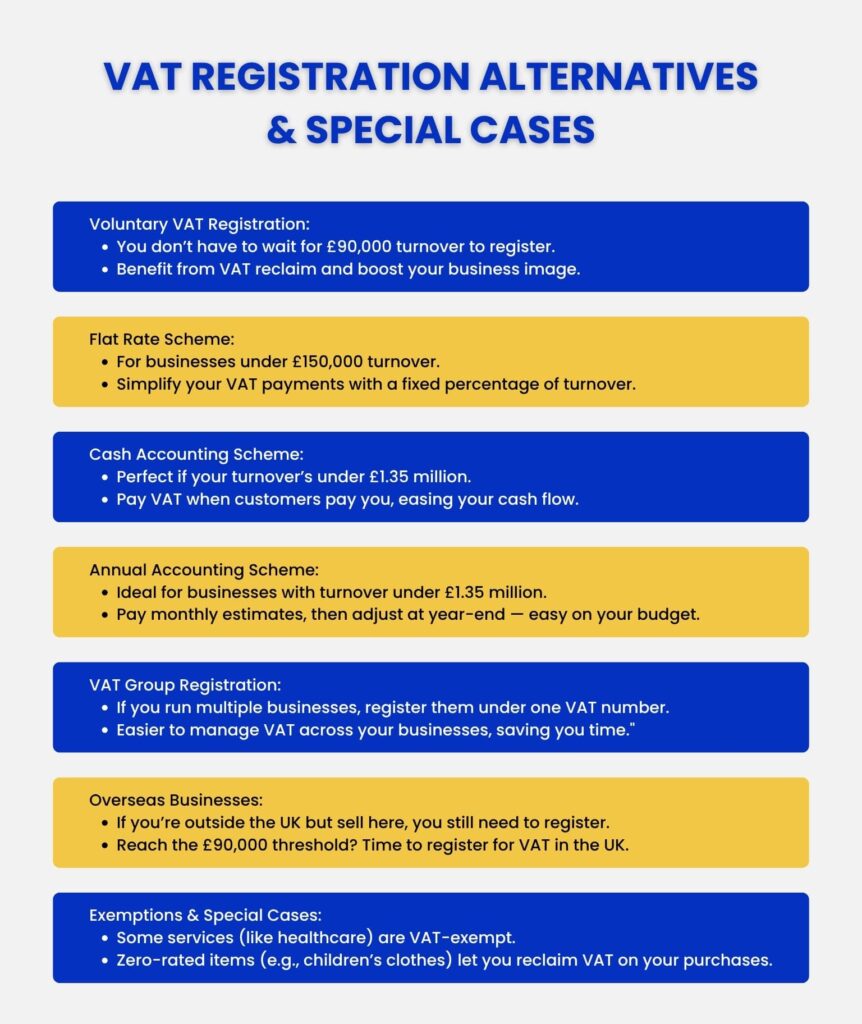

While the standard VAT registration process is pretty straightforward, i.e. exceeding the annual taxable turnover of £90,000 calls for compulsory VAT registration, there are certain alternatives and special cases that businesses may encounter.

#1.Voluntary VAT Registration

As discussed earlier, Sarah, after taking into consideration her goals and current circumstances can opt for voluntary registration – enhancing her credibility to future prospects, at the same time making VAT reclaim easier & more efficient. Voluntary VAT registration is an alternative case that needs to be thoroughly investigated to find its advantageous benefits.

#2. Flat Rate Scheme

Businesses with a turnover of £150,000 or less – may find flat rate schemes appealing. In such cases, businesses are allowed to pay a fixed percentage of their turnover as VAT. Example: If James’ business falls under this turnover limit, he can opt for flat rate scheme, where instead of calculating VAT on every sales & purchases, he would only pay a set percentage of his total turnover. This ultimately helps him save time & cost.

Ex: £100,000 Turnover

| Method | Sales VAT | Purchase VAT | VAT Payable | VAT Return Frequency | Pros | Cons |

| Flat Rate Scheme | £20,000 (20%) | – | £12,000 (12% of £100,000 turnover) | Quarterly/ Annually | Simple, no need to track each sale | Pays more VAT |

| Standard VAT Calculation | £20,000 (20%) | £16,000 (20% on £80,000 purchases) | £4,000 (£20,000 Sales VAT – £16,000 Purchase VAT) | Quarterly | Saves on VAT | Requires tracking of sales & purchases |

#3. Cash Accounting Scheme

This scheme is applicable for businesses with a turnover of £1.35 million or less. Under this scheme, businesses pay VAT only when they receive payment from customers, and reclaim, once the suppliers have paid. If James’ annual taxable turnover increases to £1 million, he can then pay VAT to HMRC only when his customers pay him, not when the sales are made. A significant benefit of this scheme is that it helps manage cash flow Annual Accounting Schemeduring slower periods.

#4. Annual Accounting Scheme

Under this scheme, businesses need to have a turnover of £1.35 million or less. You might notice the similarity in taxable turnover to the Cash Accounting Scheme. So, what’s the difference? The Annual Accounting Scheme is based on estimated payments.

Ex: James estimated turnover is £200,000. If the VAT rate is 20%, then estimated VAT would be £40,000. He has to pay £4,444 per month for 9 months as estimated VAT payments.

After filing his VAT return at the end of the year, any difference between the estimated payments and actual turnover is adjusted. James will then either need to pay or receive a refund at the year end, depending on the actual turnover.

#5. VAT Group Registration

This alternative allows two or more companies having a common control to register as a single entity for VAT purpose. Why? Because dealing with multiple VAT returns of your own companies can prove to be a hassle, that makes management accounting almost impossible.

If James were to expand his consultancy business, and create two more companies under his control, choosing VAT group registration would allow him to manage all his VAT for all his multiple companies under a single VAT number. This would allow him to estimate his cash flow and create dedicated management accounts, which will eventually help him make informed-practical decisions.

#6. Overseas Businesses

Here, overseas businesses are those that are based outside the UK, but trade with UK Business and customers. When their turnover by selling products/services to UK customers/businesses exceeds the £90,000 threshold, they need to register for VAT in the UK, even if they don’t have a physical presence in the country.

If Sarah were to partner with a French Company to get imported goods, the partner in France when exceeding the £90,000 threshold would require to register for VAT in the UK as well.

#7. Exemption and Special Cases

The VAT system takes into consideration VAT exempt goods/services that cannot charge VAT to customers on sale, neither reclaiming VAT on them is possible. Examples of such products and services are – financial services, health and medical services, charitable services etc.

If James were to offer financial advice as a part of his business, this service would be VAT exempt, i.e he couldn’t charge VAT nor reclaim it.

Now, let’s talk about special cases. If Sarah’s boutique sells children’s clothing (which is zero rate), she cannot charge VAT from her customers, but can reclaim it from HMRC on stocks & equipment. These Special VAT schemes are aimed to provide relief and in the end simplify the VAT process. Examples include – tourist refund scheme, the margin scheme, and of course the zero rating scheme (explained with the example of Sarah).

Wrapping Up

You’ve learned how to register for VAT UK, who can register, VAT registration alternatives and special cases, and also what type of documents you require to complete the registration process. The task might seem daunting to many, but with the right guidance, you can file VAT returns and claim – all accurately.

Taking a step ahead in helping you is Julian Hobbs & Co., who, on your behalf, will correspond with HMRC, ensuring all your VAT registration and compliance processes are handled seamlessly. From choosing the right VAT scheme,based on your need, to MTD-compliant digital record keeping for a minimum of 6 years, our expert accountants take care of every aspect – helping you propel your business, at the same time, avoiding common mistakes & pitfalls that consume many.

People Also Ask:

How much does it cost to register for VAT in the UK?

VAT registration itself is free; however if you choose to seek professional help that offers all-inclusive accounting& tax services, the fee will then depend on what type your business is and the level of support you need. Contact Julian Hobbs & Co. to learn how we can help you, or choose from our package and book a meeting.

Can I register for VAT voluntarily below the threshold?

Yes you can register for Voluntary VAT, even when you are below the threshold. But, do perform a thorough VAT review to determine if it would be beneficial for your business.

How long does it take to register for VAT?

VAT registration typically takes 2 to 4 weeks for normal circumstances, and beyond 6 to 8 weeks when HMRC is particularly busy or they require time to verify your legitimacy.

How do I cancel VAT registration if I no longer qualify?

Contact HMRC to de-register for VAT if your business no longer exceeds the VAT threshold or meet other eligibility criterias.

What happens if I miss the VAT registration deadline?

If you miss the VAT registration deadline, you could face penalties, and interest on VAT owed. Do ensure to register for VAT as soon as your business exceeds the VAT threshold, and within the 30-day time limit.

Do I need an accountant to register for VAT?

While you can register for VAT on your own, having an accountant by your side will ensure accuracy and help you select the right VAT scheme. Contact Julian Hobbs & Co. – a top accountant in St Albans Hertfordshire to help with VAT registration and VAT scheme selection.

Why choose Julian Hobbs & Co for VAT registration support?

We offer expert support with VAT registration and ongoing VAT management, helping you stay compliant and optimise your tax processes.