Introduction

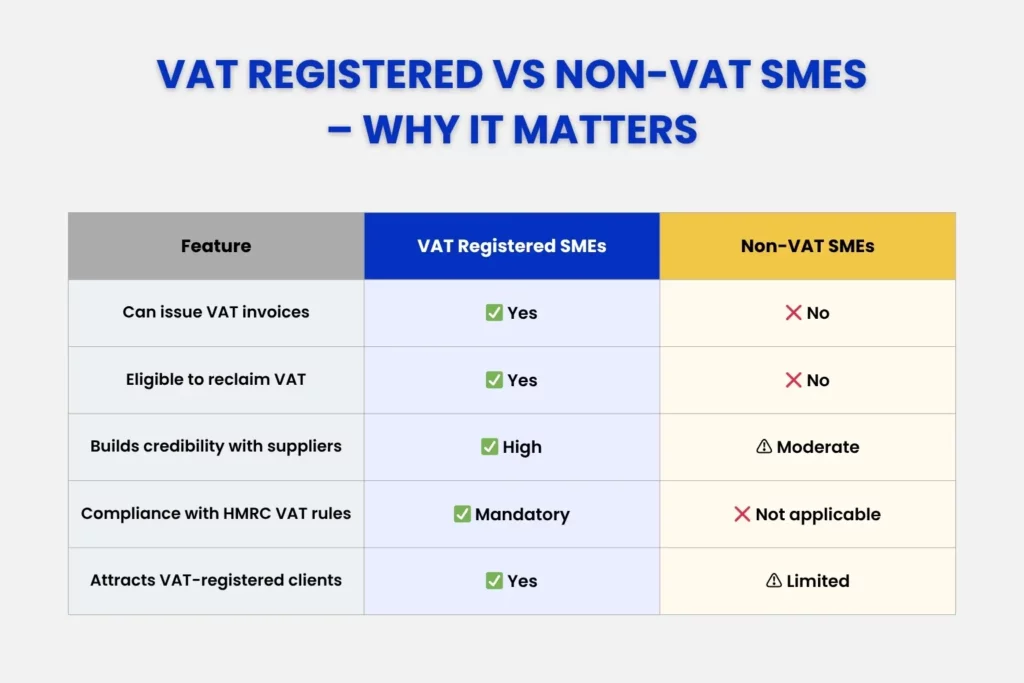

In the UK, SMEs are often divided into two categories- those that are VAT-registered and those that aren’t. If you are a business, looking for suppliers, you would most likely look for VAT registered companies. Why? Because this builds up trust. This puts your mind at peace, knowing that it’s no scam or fraud.

In this blog, we will look into how to find a company’s VAT registration number, common mistakes SMEs (small and medium-sized businesses) make when verifying the numbers, and how to interpret HMRC Vat number checker results. Sit back and read through, because this is the ultimate 101 guide, assisting you with information and queries you may have with the finding of the VAT number, and its verification.

What Is A VAT Registration Number And Why Do I Need It?

A VAT registration number (often called a VAT Number/ VAT ID/ VAT registration reference) is a unique identifier assigned by HMRC to businesses that are registered for VAT. Such businesses can file VAT returns and retrospectively reclaim VAT. They can issue invoices which can be accepted by businesses, accountants and customers. It is prefixed by “GB” followed by nine digit numbers.

You need a VAT registration number to:

- Reclaim input VAT

- Check the legitimacy of the suppliers when partnering with them

- Add it within the header/footer of your issued invoices and website

- Establish credibility, and trust in business dealings.

It is an important label, if not more than a label that helps HMRC track your VAT journey to ensure your compliance.

Where Can I Quickly Find A Company’s VAT Number?

You can find a company’s VAT number by going to their website and navigating to the header or footer section. You can also find it under the about us section/page, or legal/compliance page. Another way is to look into the invoice’s header or footer part. Legitimate VAT invoices in the UK always include the supplier’s VAT number. The customer’s number appears only if they’re also VAT-registered.

You can also utlise HMRC online VAT number checker to find a company’s VAT number. But this step is more of a minute task, since it requires you to navigate to the HMRC site and go to the right page. We will be discussing it forward, but for now- let’s look at other quick ways:

| Source | What to Check | Tips / Notes |

| Official Correspondence or Contracts | Check letters, agreements, quotes, or order confirmations. | Formal documents usually carry full business identity information. |

| Accounting Software / Records | In your bookkeeping or accounting software (e.g. FreeAgent) the supplier’s VAT number may already be recorded. | FreeAgent automatically attaches VAT numbers on invoices you send. |

| Ask the Company Directly | If all else fails, request the VAT number from the supplier’s finance/accounting team. | Legitimate entities will provide it promptly, and sometimes they’ll even send a copy of their VAT certificate. |

If you are looking to find VAT numbers for European Countries (EU) and North Ireland – navigate to VIES website for cross-border VAT number validation. VIES is nothing but a search engine like Google, owned by the European Commission – retrieving the result from national VAT databases.

How Can I Verify VAT Number UK?

- To verify VAT number UK, use HMRC online VAT number checker tool. This confirms whether a VAT number is valid or invalid, and when available- displays the registered name and address associated with it.

- You can also call the HMRC VAT helpline number (0300 200 3700) to confirm a VAT number.

- Another verification method is using third party checkers and commercial databases. Though these may exist, they’re less reliable and may not be up to date. Always use such third party tools with caution, since even light ignorance or complete reliance can lead to invoicing errors, compliance issues and disputes with suppliers and customers.

How To Check VAT Registration Number With HMRC

This method of verification is 100% safe, secure and trusted. When you use HMRC to check VAT registration number, you are bound to binary results – Valid or Invalid, or in some cases – multiple matches.This helps in confirming the legitimacy of a business, which in turn helps with precise bookkeeping and tax return processes. You also get access to registered business details, such as business name and address linked to the number.

Here are the steps to check VAT registration number with HMRC and ensure peace of mind.

- Go to the official VAT number checker page (Gov.uk ).

- Enter the VAT registration number you have (e.g. “GB123456789”).

- Submit the query.

- The system will return whether the number is valid or invalid, and show the registered business name and address (or partial match).

The tool also allows UK VAT-registered businesses to generate proof of verification. Simply tick the box that says “Select if you want proof of your check” and enter your own VAT number. You’ll get a document showing exactly when you completed the check, which you can keep for your records. Let us understand with an example of James: A small office supplier company in Hertford.

When James is about to place a big order with a new supplier, and if that new supplier had provided James with the VAT number. He can now use the checker to make sure everything is legitimate. When the system confirms the given number is valid, James can now tick the box to receive proof of verification. He can save these documents for future references, and can present them to HMRC if they ever audits his VAT returns.

This gives him the confidence to rightfully claim his input VAT claims, signifying they are correct and compliant.

How Do I Interpret HMRC VAT Number Checker Results?

When you use the HMRC VAT number checker tool, you are bound to get the results as – Valid/Invalid/Multiple matches or special cases.

- Valid VAT Number:

The search confirms that the inputted VAT number is active and registered. It also shows the registered company name and address associated with that number. You can then proceed to a business partnership with that supplier- without having to worry about fraud or non-compliance.

- Invalid VAT number:

The search confirms that the given VAT number is not registered. or in some cases- had been de-registered. The result will be displayed as “number not found” or “invalid”. In this case you should contact the supplier and request for the valid number. You should also ask for the revised version of the invoice with the correct VAT ID, if at all you want to reclaim the VAT.

- Multiple Matches/Special Cases

Sometimes the name or address may differ or only partially match (e.g., due to recent address changes). You may also get results showing that the VAT number is deregistered. Other times for cross-border cases, the number might appear invalid if it doesn’t match the required format for that jurisdiction.

Here, James will notice that the VAT number from an EU supplier appears invalid. Instead of 11 digits preceded by FR, the number which James gets has only 10 digits FR1234567890. Thus HMRC will flag it as invalid, and James should once again request for the correct VAT number before proceeding.

What Should I Do If HMRC Shows “Invalid”?

If the HMRC checker returns an Invalid result, you should then:

- Start with contacting the supplier immediately. Ash him/her for the right VAT number or clarify on any recent changes made.

- Ask for VAT registration certificate. This proof of registration includes – business name, business address, VAT registration number (VRN), date of VAT registration, HMRC contact details, and VAT accounting scheme if applicable.

- Suspend VAT reclaims on purchases from that supplier until resolved to avoid HMRC disallowance.

- Keep the screenshots and records of your HMRC verification attempt as evidence

- Then contact an experienced bookkeeping and VAT accountant to solve the discrepancies and guide you to rightfully claiming your VAT returns.

What Common Mistakes Do SMEs Make When Verifying VAT Numbers?

- Firstly, trusting third party websites and sources rather than the official HMRC tool and its result – is one of the most common mistakes SMEs make which proves to be a most fatal one amongst others.

- Other times, typo or formatting errors like missing GB prefix, or using UK in place of ‘GB’, or having the number exceed the 9 digit for UK.

- Another common mistake is assuming a number is valid forever. This is not true. A business can deregister and cease its operation. So, if in the past the supplier’s VAT number had worked for you, that doesn’t mean it will do so now. Always verify the number before closing any transaction.

- Not keeping proof of verification attempt is another mistake SMEs make when verifying VAT numbers.

- Lastly, failing to re-verify international EU suppliers via the VIES tool. If James wants to partner with an EU company, he needs to ensure the VAT number provided is correctly computed in the precise format of that jurisdiction.

Is There A Checklist Or Tool To Make This Easier?

Julian Hobbs & Co. has created the following checklist to make things easier for you.

✔ The invoice from the supplier must contain the VAT number

✔ Cross-check with HMRC by using HMRC Online VAT number checker tool.

✔ Before proceeding with any transactions, always confirm the business name, address match (exact), and VAT number to see if it is still active.

✔ Ahead of any monetary exchanges or even partnership – request a copy of the VAT registration Certificate

✔ Keep proof and records of verification by saving screenshots when they occur.

✔ Reverify the details periodically (Often quarterly)

You can also use accounting systems or specialist VAT software to automatically flag invalid or unverified VAT numbers during invoice processing.

How Can A Local Accountant Help With VAT Verification And Bookkeeping?

SMEs across Hertfordshire, Welwyn Garden City and across the UK require customised tailored expertise that takes into account the KPIs of the company, its goals, vision and current compliance status. Local accountants excel at this by providing industry expertise with local accounting solutions.

A local accountant can offer several benefits:

- Set up system and workflow for automatic computation and VAT check

- Support with VAT return filings

- Customised audit support to ensure Compliance with HMRC and Companies House.

- Corporate Tax planning and subsequent optimisation of taxes for lower tax liability

- Ease communication with HMRC on your behalf

- End-to-End assistance with any audit or compliance issue.

Why Choose Julian Hobbs & Co.

Our chartered accountants pre-check your compliance status ahead of your onboarding. From VAT and taxation services to outsourcing FDs and team, we bring global expertise to your business. Our VAT experts will audit your clients and suppliers to ensure every VAT registration number is valid, up to date, and HMRC-compliant. We will also integrate automated VAT verification tools within your bookkeeping system, maintain digital proof of checks for audits, and provide tailored advice on complex VAT scenarios such as CIS, cross-border trade, and partial exemptions. Our goal is to provide jargon-free advice and simplified numbers that work for you- one which you can comprehend in order to make informed decisions.

Conclusion

This blog guides you to the simple steps with which you can find a company’s VAT registration number, validate it with HMRC checker tool, and use a checklist to stay compliant. Doing this prevents costly errors, rejected VAT claims and potential HMRC scrutiny. Your business deserves peace and growth- which can only be possible when your foundation is strong.

Before partnering with any supplier, find out if the provided VAT number is registered and active. You can avoid a whole lot of trouble while closing transactions by following the simple steps outlined in the blog. If at all at later stages, when your business grows and presents complicated issues – can you consider outsourcing your bookkeeping and VAT to Julian Hobbs & Co.

Find out if your company requires VAT and bookkeeping services at this moment- by booking a call with us today. Get your numbers sorted, base strong and relation built on transparency and trust.

People Also Ask:

Where can I find a UK company’s VAT registration number?

On invoices, the company’s website (footer or legal pages), official correspondence, or demand it directly from the supplier.

What if HMRC shows the VAT number as invalid?

Contact the supplier, request proof of registration, suspend VAT claims on that transaction until resolved, and document your verification efforts.

How long should SMEs keep verification proof?

SMEs should keep the records and screenshots for at least 6 years (the same retention duration as your statutory accounts).

Is a VAT number the same as a company registration number?

No. VAT number is not the same as Company Registration Number (CIN). Your VAT number is provided by HMRC, whereas the CIN is issued by Companies House at incorporation stage.

What should I do if a supplier refuses to provide a VAT number?

Treat that as a red flag. Do not accept their invoice, and reconsider doing business elsewhere.

Why should I choose Julian Hobbs & Co for VAT verification and bookkeeping?

Because we specialise in VAT compliance for SMEs, integrate verification into your bookkeeping, offer local support, and help you build defensible VAT practices reducing your risk with HMRC.