Maggie concentrated on her daily expenses. She always believed that her savings were the most secure aspect of her money because they were steadily accruing interest in the background. However, that sense of security shattered in April 2025.

She received a simple white envelope from HMRC, alerting her to the possibility that part of her hard-earned interest would now be subject to tax. She was shocked to know why she received the letter so suddenly.

After reading further, Maggie realised she was not alone. Since many regular savers had crossed the Personal Savings Allowance for the first time due to rising interest rates, HMRC was closely monitoring the situation under new regulations for the 2025–2026 tax year. Suddenly, there was a tax clock running on what had seemed like “safe money.” This blog explains what’s changed, who’s affected, and how to keep more of your interest tax-free.

Understanding the HMRC Savings Account Tax Warning

A] What Is the HMRC Savings Account Tax Warning?

It’s an alert from HMRC that the interest you’ve earned on your savings may exceed the tax-free limit. In the UK, everyone is allowed to earn a certain amount of savings interest annually without paying tax. If you exceed this limit and fail to report your interest earnings, HMRC may issue a tax penalty warning.

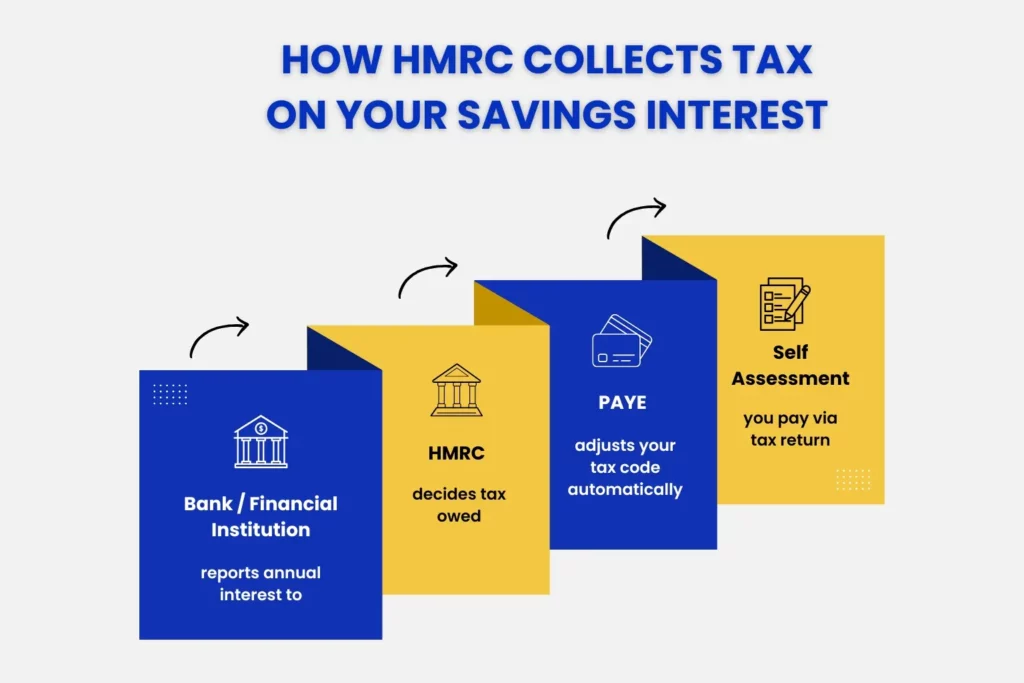

Your bank informs HMRC of the amount of interest you’ve earned, and if it’s too high, they’ll send you this warning so you know tax is due. In simple terms, it’s HMRC’s method of alerting you that you might have to pay tax on your savings for the first time.

B] Why Does HMRC Issue This Warning?

With interest rates rising, many savers are unknowingly crossing the Personal Savings Allowance (PSA) threshold. This warning is meant to ensure that savers are aware of their tax obligations and the potential for penalties if they don’t act promptly. For you to pay the correct tax, banks and financial institutions report the amount of interest earned directly to HMRC.

This has become more frequent, allowing even those with small savings to surpass the limit without realising it.

C] What Does Receiving This Warning Mean for You?

When HMRC realises your savings interest has exceeded the tax-free limit, it will issue a warning that the additional sum must be subjected to taxation. This could happen in two ways:

- If you’re employed or get a pension: HMRC may change your tax code to deduct the amount from your paycheck or pension automatically.

- If you’re self-employed or not in PAYE: you may need to file a Self Assessment tax return and pay the amount directly.

D] What You Should Do If You Receive a Warning?

- Check the details: Analyse your interest income while comparing it with your Personal Savings Allowance, which is £0 for additional-rate taxpayers, £500 for higher-rate taxpayers, and £ 1,000 for basic-rate taxpayers. If you believe you are entitled to a tax refund, ensure you meet the HMRC tax refund deadline to avoid losing your refund.

- Make sure it’s correct: Mistakes can happen, so check with your respective bank or financial institution. Take a proper statement as proof for HMRC’s reference.

- Follow HMRC’s instructions: If they ask you to file a tax return, make sure it’s before the deadline, and if they modify your tax code, make sure it matches what you owe.

- Plan for next year: Consider transferring funds to tax-free accounts, such as ISAs, to prevent exceeding the limit once more.

Received an HMRC Savings Tax Letter? What It Means and What to Do

These “nudge letters” are sent when HMRC believes you owe tax on your savings interest, based on information from banks & building societies. Note, these letters are not to accuse you of wrongdoings, rather to prompt you to review.

Your first step would be to check the figures. Keep in note that the total savings interest should not exceed the PSAs. Then match your bank reporting with that of HMRC’s records. If the figures don’t match, the letter may be the outcome of it.

Another reason to receive such letters might be that you stopped filing Self Assessment but still earned savings interest.

Actions to Be Carried Out are:

- If HMRC’s figures( within the letter) are correct, your tax code may be adjusted, and any tax due will be collected via PAYE or self assessment.

- If the figures are incorrect – you should then contact HMRC with supporting bank statements

- Note: Ignoring an HMRC savings tax letter is not advisable. Even if no tax is owed, failing to respond can lead to penalties, interest charges, or compliance checks.

Basics of Savings Interest Taxation in the UK

A] What Interest Is Taxable and What Isn’t?

| Taxable interest includes money you earn from: | Not taxable (you don’t pay savings tax on these): |

| Savings accounts with banks or building societies. | Interest earned inside an ISA (cash ISA, stocks & shares ISA, Lifetime ISA). |

| Fixed-rate bonds and regular savings accounts. | Premium Bond prizes. |

| Current accounts that pay interest. | Lottery or prize draw winnings. |

| Peer-to-peer lending. | Certain government-backed savings schemes, like some NS&I products. |

| Some company bonds or gilts. |

C] What Happens if You Don’t Pay the Tax Owed?

If you ignore HMRC’s warning and fail to pay the savings interest tax:

- Your debt will increase since HMRC has the right to charge interest on the outstanding tax.

- You can be subject to fines, which get worse the longer you put it off.

- Your tax code might be changed, and HMRC might automatically deduct the amount from your paycheck or pension.

- Although it is uncommon for minor amounts, serious occurrences can result in legal action.

Paying on time prevents additional fees and anxiety; HMRC’s notice provides an opportunity to resolve the issue before it gets out of hand.

B] Penalties for Failing to Pay Tax on Savings Interest

If you receive a tax penalty warning from HMRC for your savings interest, it’s important to act quickly. If you don’t, you then will be charged additional interests and penalties:

- Up to 30 days late: A penalty of 5% on the tax owed.

- After 30 days: Another 5% penalty for every additional 6-month period.

- Missing a Self-Assessment Deadline: you could be fined up to £100. The fine increases if the delay continues.

- Deliberate Avoidance: If HMRC believes you are attempting to avoid paying tax on purpose, the penalty could increase to 100% of the tax payable.

- Repeat Offenses: If you’ve been warned before and fail to pay the tax again, HMRC may increase the penalty for repeated non-compliance.

If you think you’ve overpaid tax due to incorrect interest reporting or tax code, you can claim a refund. Check our HMRC Tax Refund Guide for a step-by-step process.

Personal Savings Allowance 2025/26

A] What Is the PSA, and Who Qualifies?

The Personal Savings Allowance (PSA) is the amount of savings interest you can earn each tax year without paying tax.

How much you get depends on your income tax band:

- Basic-rate taxpayers (20%) – £1,000 allowance.

- Higher-rate taxpayers (40%) – £500 allowance.

- Additional-rate taxpayers (45%) – £0 allowance (no tax-free interest).

Since ISAs are already tax-free, the interest earned within them does not count towards the PSA. The PSA instead applies to interest from banks, building societies, and similar accounts, which covers the majority of individuals.

B] How PSA Interacts with Other Allowances?

There are other tax-free amounts that you can take advantage of for interest besides the Personal Savings Allowance:

- Starting Rate for Savings: In addition to your PSA, you may be eligible for up to £5,000 in tax-free savings interest if your other income (such as work or pensions) is less than £5,000.

- ISA Allowance: Interest earned from ISAs up to £20,000 annually is completely exempt from PSA calculations.

- Marriage Allowance: Although it doesn’t raise the PSA itself, transferring a portion of your personal allowance to your husband or partner will help lower your overall tax liability.

Recent and Upcoming Changes Impacting Savings Tax

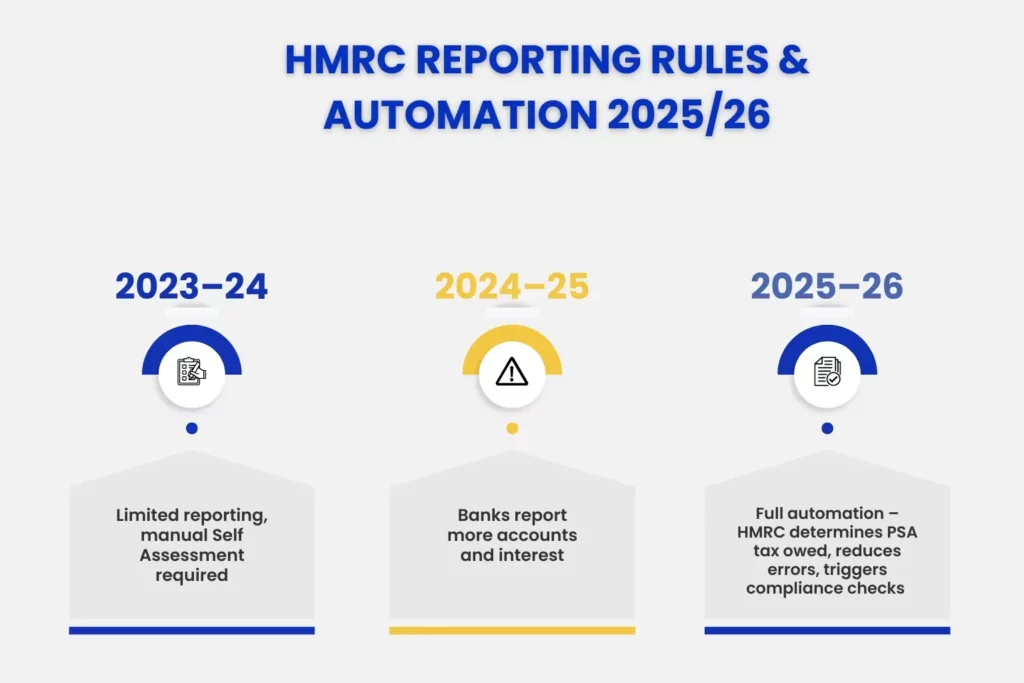

A] New HMRC Reporting Rules

Stricter reporting guidelines have been implemented by HMRC in an effort to increase savings income transparency. Banks, financial institutions, and online platforms are among the financial bodies that are now required to give comprehensive information about the interest and returns that are given to individuals. Taxpayers no longer have to manually declare saved income through their Self Assessment because this data is supplied straight to HMRC.

Since HMRC can automatically determine the tax owed under the Personal Savings Allowance, this will make things easier for the majority of savers. There is less opportunity for error or omission, as any differences between tax returns and bank reports are more likely to trigger compliance checks.

Example:

- Maggie’s savings account accrued £300 in interest during the course of the tax year.

- This interest is now reported to HMRC immediately by her bank.

- Under the Personal Savings Allowance (PSA), basic-rate taxpayers are exempt from paying taxes on savings interest up to £1,000.

What happens now:

Maggie’s £300 interest is automatically recognised by HMRC. No tax is owed because it falls inside the £1,000 PSA. On her self-assessment, she is not required to disclose it.

B] How Rising Interest Rates Affect Your Tax Position?

Many savers are getting far higher returns on their deposits, and interest rates are at their best points in years. Although this raises the likelihood of exceeding your Personal Savings Allowance (PSA), it is also excellent news for returns.

PSA thresholds:

- Basic rate taxpayers can earn up to £1,000 in savings interest tax-free.

- Higher rate taxpayers are limited to £500.

- Additional rate taxpayers receive no allowance.

Any savings interest that exceeds the given limits is subject to taxes. Now that banks and building societies are reporting interest to HMRC directly, you might see that tax is automatically collected through Self Assessment or PAYE adjustments.

C] Common Triggers for Receiving a Savings Tax Warning Letter

When HMRC’s records indicate that you may have underpaid savings tax, they send out “nudge” or warning letters. A few of the common triggers include:

- Exceeding the Personal Savings Allowance as a result of increased interest revenue.

- Discrepancies between the interest you recorded on your tax return and what your bank reported.

- Missing savings income when you continue to earn taxable interest even after you stop filing your self-assessment. In Maggie’s case the bank reported £1,800 in savings interest to HMRC after she ceased submitting Self Assessments. Considering that her allowance is £1,000, the additional £800 is taxable. HMRC changed her tax code to ensure that the correct tax is immediately collected.

- Multiple providers or accounts can result in some income being missed.

- You do not include offshore accounts or foreign savings in your UK tax filing.

A letter from HMRC indicates that they anticipate a response or explanation, but it does not always indicate that you owe taxes. Ignoring it can lead to penalties and compliance checks.

Your Responsibilities: Reporting to HMRC

Although banks and building societies now provide HMRC with direct access to savings income data, you are still ultimately responsible for appropriate tax filing.

- Verify your tax code: Errors can happen, but if savings interest is reported, HMRC may change it.

- Review annual bank statements: Make sure that the interest shown on the yearly bank statements corresponds to the information that HMRC has on file.

- Declare additional income: If you have overseas or offshore accounts or earn more than the Personal Savings Allowance, you may need to use Self Assessment.

- Respond promptly to HMRC letters: To avoid fines, reply to HMRC correspondence as soon as possible and explain or rectify any inconsistencies.

In summary, even though reporting is becoming automated, it’s crucial to maintain awareness and make sure your savings income is appropriately taxed.

How to Save Tax on Your Savings Legally?

A] Understanding Tax-Free Savings Options

Some savings income is exempt from taxes. There are several tax-free ways to increase your wealth without compromising your Personal Savings Allowance (PSA):

- ISAs (Individual Savings Accounts) – Interest earned in Cash ISAs and returns in Stocks & Shares ISAs are completely tax-free, regardless of your income level.

- Premium Bonds – Prizes are tax-free and do not count towards your PSA.

- Certain Government-backed accounts – Some savings schemes, such as Help to Save, also offer tax-free bonuses.

If you’re looking to keep your interest, dividends, and gains tax-free (all legally), check out our detailed & in-depth guide on tax free savings accounts.

Utilising these accounts will help you protect more of your savings from taxes, which is particularly helpful when interest rates are rising and taxable interest could exceed your PSA limit.

B] Strategies to Maximise Tax-Free Interest and Minimise Tax Liability

Planning your savings is more crucial than ever in light of rising interest rates. Here are a few useful tactics:

- Make full use of ISAs: ISAs are the best option for hiding savings because both interest and returns are tax-free.

- Share savings across partners: Each spouse or civil partner is entitled to their own Personal Savings Allowance (PSA). The tax-free benefit can be doubled when funds are shared.

- Optimise PSA and Starting Rate for Savings: In addition to the PSA, you can be eligible for the 0% beginning rate on up to £5,000 in savings income if your non-savings income is less than £17,570 (2025/26).

(Example: Maggie earns £16,000 from work and £2,000 from savings interest. Since her non-savings income is below £17,570, the £2,000 savings interest falls within the £5,000 starting rate band at 0% tax. She pays no tax on her savings.)

- Choose tax-free products: Returns from premium bonds and some government-backed accounts are tax-free and have no bearing on your PSA.

- Monitor interest growth: Verify frequently whether increasing rates are causing you to cross the threshold so you can change the location of your fund holdings.

When and Why You Should Consult a Professional?

Professional assistance can be quite helpful in some cases, even though many savers can handle their tax obligations on their own. Determining precisely what is taxed can easily get complicated if you have various accounts, funds abroad, or invest in a variety of items. To assist you in better organising your funds, a tax advisor in Hertfordshire can offer advice if you are approaching or beyond your Personal Funds Allowance. Expert tax planning services help you manage appropriately any warning letter you receive from HMRC and stay clear of needless fines. In addition to helping with compliance, advisers can help with longer-term planning by utilising pensions, ISAs, or other situation-specific tax-efficient solutions to reduce your overall tax liability.

Conclusion

Maggie’s story serves as a reminder that money saved isn’t always “tax-free.” More savers are going over the Personal Savings Allowance for the first time due to rising interest rates and new reporting requirements from HMRC. This increases the likelihood of receiving HMRC tax penalty warnings, and, sometimes tax refund deadline warning. The main lesson is straightforward: keep track of your overall savings income, comprehend the available allowances (such as the PSA and Starting Rate for Savings), and look into strategies to handle your money in a way that minimises taxes. More of your hard-earned interest can remain in your pocket if you plan.

Expert guidance can reassure people with complicated arrangements or increasing savings, and guarantee they are maximising their available allowances. You can safeguard your savings and maintain control over your tax situation by remaining knowledgeable and proactive.

People Also Ask:

Can HMRC check my bank accounts or transactions?

Yes. HMRC can request account information if they suspect undisclosed income and obtain savings interest details straight from banks.

What is an additional rate taxpayer in the UK?

An individual who makes more than £125,140 (2025–2026) is considered an additional rate taxpayer. They do not receive a PSA or Personal Allowance, and income over this is subject to 45% tax.

How is tax calculated if savings interest exceeds £10,000?

A self-assessment tax return must be filed if your savings interest exceeds £10,000. After deducting the interest from your other income (such as your pay or pension) and applying deductions like the Personal Savings Allowance and, if you qualify, the Starting Rate for Savings, tax is computed at your applicable income tax rate. Your marginal rate (20%, 40%, or 45%) is applied to any savings income that remains after these allowances.

How does the tax-free allowance work alongside PSA?

All of your income is covered by your personal allowance, which is £12,570. Following that, basic-rate taxpayers can earn £1,000 interest tax-free under the Personal Savings Allowance,£500 for higher-rate taxpayers, and none for additional-rate taxpayers. The Starting Rate for Savings (up to £5,000) may also be advantageous to you if your non-savings income is modest.

Why did I receive a savings tax letter from HMRC?

You may receive an HMRC savings tax letter- if information reported by your bank or building society shows that your savings interest may have exceeded your Personal Savings Allowance. Note, these letters are not to accuse you, rather to prompt you to review your position & confirm whether any tax is due. Remember, receiving a letter does not always mean you owe tax, but it should be checked carefully.

How do I avoid a savings tax penalty warning from HMRC?

To avoid a savings tax penalty warning from HMRC, make sure to:

– Report all your savings interest correctly, especially if it exceeds your Personal Savings Allowance (PSA).

– File your Self Assessment tax return on time if needed.

– Pay any tax owed before the deadline.

Will HMRC send such tax warning letters automatically?

Yes. HMRC automatically sends out “nudge” or warning letters when savings interest reported by your bank indicates that you might be in arrears. These are produced by regular data checks, even if you haven’t made a mistake on purpose.

Can I owe tax if I only have one savings account?

Yes. If your total income places you in a higher tax bracket or if the interest you earn puts you above your Personal Savings Allowance, you may still owe taxes on even a single account. HMRC checks this automatically using bank-reported data.

Are ISA Interests Taxed?

No, interest generated on ISAs (Cash ISAs, Stocks & Shares ISAs, Innovative Finance ISAs, and Lifetime ISAs) is not included in your Personal Savings Allowance and is entirely tax-free.

Does PSA Reduce When Your Income Exceeds £100,000?

No, the Personal Savings Allowance (PSA) is determined by your tax band rather than your overall income. But if your income is above £125,140 in 2025–2026, you are considered an additional-rate taxpayer, and PSA is not given to additional-rate taxpayers.

What happens if I miss the HMRC tax refund deadline?

If you miss the HMRC tax refund deadline (2024-25 tax year, is 5 April 2029) , you could lose the chance to reclaim any overpaid tax. HMRC won’t accept refund claims after the deadline, and you could miss out on getting your refund back.