Introduction

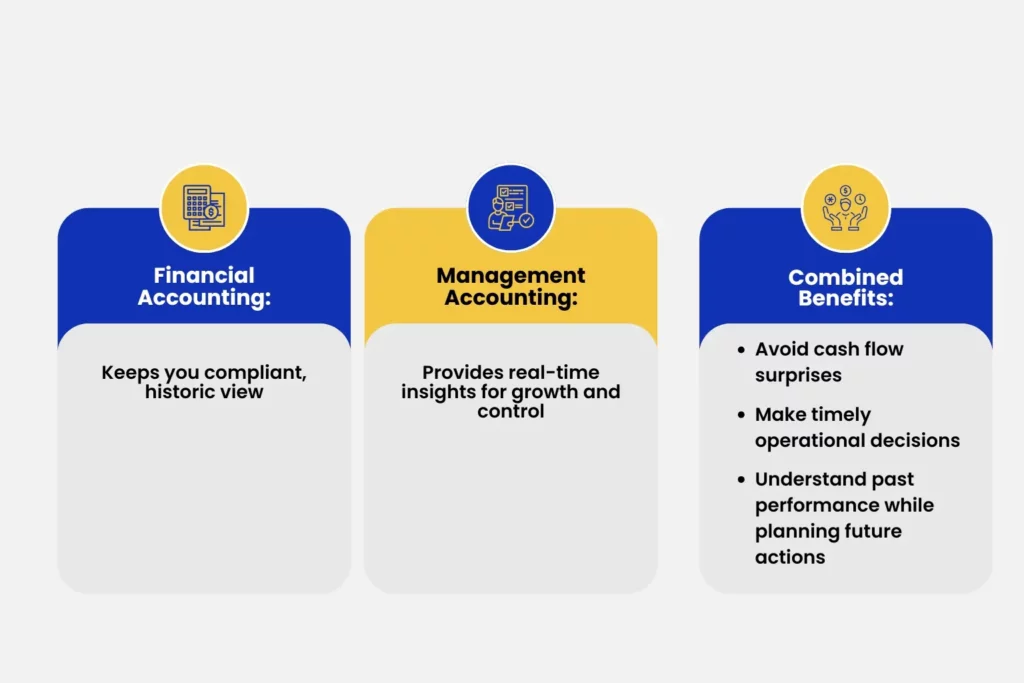

I often meet founders who say, “We’ve got our year-end accounts, but we still don’t know if we can afford to hire in a few months.” This is where understanding financial accounting vs management accounting really matters. While financial accounts look backwards to keep you compliant, management accounts look forward, giving you the insight to make confident decisions.

In this guide, I’ll explain both in plain English, highlight the key differences, and show why most small businesses in Welwyn Garden City and across Hertfordshire benefit from having both.

What is Financial Accounting

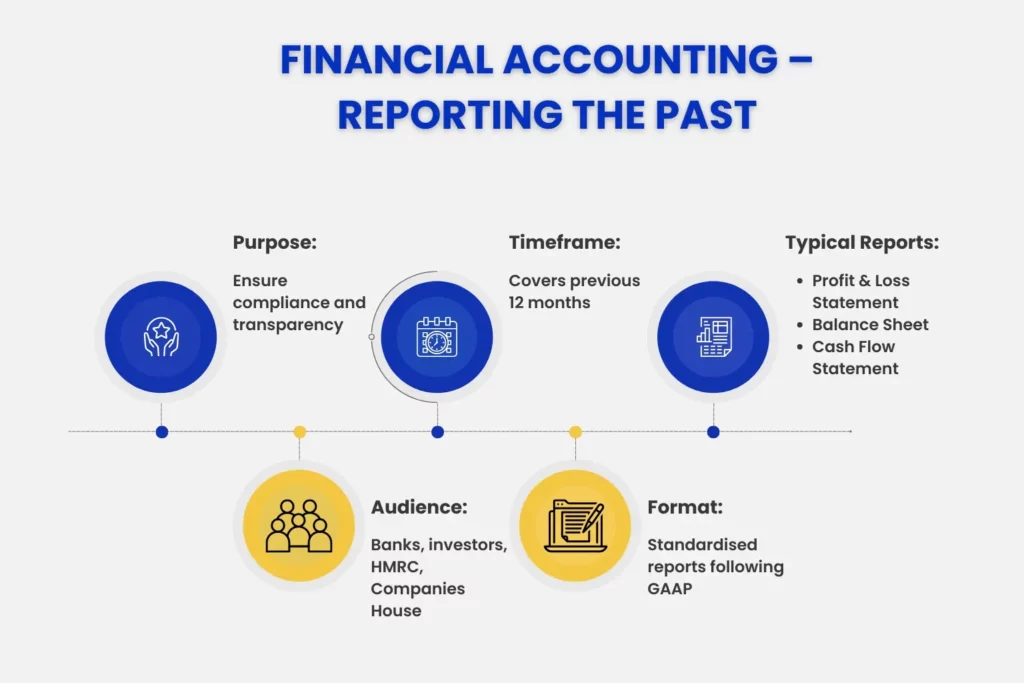

Financial accounting is about reporting the past. It’s the set of accounts you file each year with Companies House and HMRC. They show what happened in your business over the last 12 months.

The purpose is compliance and transparency. Investors, banks, and regulators use these accounts to see if your business is healthy and meeting its obligations. They follow strict rules and formats. They have to comply with UK Generally Accepted Accounting Principles (“GAAP”).

Financial accounts are essential. But they’re historic. By the time you get them, the numbers are already old news.

What is Management Accounting

Management accounting is for you, not the regulators. These are reports prepared monthly or quarterly to help you run the business. They include profit and loss, cash flow, balance sheet, and key metrics.

The purpose is control and decision-making. You see how things are going now, not a year ago. You spot problems early and plan with confidence.

Unlike financial accounts, management accounts are flexible. Instead of having a rigid and fixed format, you choose the detail, the KPIs, and the style that works for your team. You can opt for a more visual presentation using charts and graphs, or dashboard presentation to highlight your KPIs or a more traditional accounts type presentation.

How Internal and External Accounting Differ

Financial accounting is designed primarily for external readers. It provides an annual summary of the company’s performance, prepared in a standard format, and used by regulators, banks, and investors. Its main focus is compliance with legal and reporting requirements.

Management accounting, by contrast, is produced for internal use. Reports are usually prepared monthly and tailored to the needs of the business. Their purpose is to support planning, decision-making, and day-to-day control rather than to satisfy external stakeholders.

Both types of accounting are essential. Financial accounting ensures that statutory obligations are met, while management accounting gives business owners the insight they need to manage operations effectively and plan for the future.

When SMEs Need Both

SMEs sometimes think they can skip management accounts because they already file year-end accounts. But that’s risky.

Financial accounts will keep you legal and compliant but Management accounts will tell you what’s happening in your business today. If you only rely on financial accounts, you won’t see cash issues until it’s too late. As an analogy, Financial Accounts are the horse, whereas Management Accounts are the stable door to stop the horse bolting!

One Hertfordshire founder I worked with had spotless year-end accounts. But they nearly ran out of cash before payroll one month because they weren’t tracking cash weekly or even monthly. Once we set up management accounts, they got cash visibility before these issues become a panic. They could see issues months ahead, not weeks

Implementing Management Accounting (Monthly Process & Tools)

Here’s how to get started:

- Set a rhythm. Monthly is ideal for most SMEs

- Choose a tool. A spreadsheet is fine to start, but software like Xero makes it easier. You can even extend out to more detailed dedicated management accounts apps like Fathom or Futurli.

- Pick your KPIs, for example sales, margins, cash flow, debtor days. Don’t forget non-financial KPIs, including the number of website enquiries received in the month.

- Review your management accounts document carefully. Be sure to take away all the learning you can.

- Act on the learnings. Use the numbers to decide on hires, spending, or chasing invoices.

It doesn’t need to be complex. The key is consistency.

Common Mistakes & How to Avoid Them

- Relying only on annual accounts (financial accounts). Remember – these report history only!

- Preparing management reports with too much detail.

- Preparing management accounts but never properly reviewing them. As we note above, be sure to take away all the learning points you can from each set of accounts.

- Not linking reports to real business decisions.

Keep it simple. Keep it regular. Make sure the numbers drive action.

Conclusion & Next Steps

Financial accounting and management accounting are two sides of the same coin. Financial accounts keep you compliant. Management accounts keep you growing. SMEs in Welwyn Garden City and across Hertfordshire need both to thrive.

If you want support setting up clear, practical management accounts alongside your annual accounts, our accountants in Hertfordshire can help. We make the numbers easy to use so you can focus on running your business.

People Also Ask:

What is the main difference between management accounting and financial accounting?

Financial accounting looks back at the past year and is used for compliance. Management accounting looks forward and is used for planning and control inside the business.

How often should SMEs prepare management accounts?

Monthly is best. It gives you a steady rhythm to review performance, spot issues, and adjust plans. Quarterly can work, but monthly is much more useful.

What is the main purpose of financial accounting for SMEs?

To meet legal requirements and provide transparency to external stakeholders like HMRC, Companies House, banks, and investors. For official guidance on business accounting records, visit HMRC: Company and accounting records.

Who in my business should use management accounts?

Owners, directors, and managers. Anyone making decisions about spending, hiring, or growth should be using these reports. If you don’t have an internal finance expert, an Outsourced Finance Director can help interpret the numbers and guide decisions.

What KPIs should SMEs track in management accounts?

Sales, gross margins, net profit, cash flow, debtor days, and creditor days. Be sure to include non-financial KPIs too such as number of website enquiries, or customer satisfaction rankings. Pick a handful that matter most to your business and track them consistently.

How can Julian Hobbs help SMEs with management accounting and annual accounts?

We prepare both. Annual accounts keep you compliant. Monthly management accounts keep you in control. We work with Hertfordshire businesses to make sure the numbers are clear, accurate, and more importantly than anything else, actually useful.