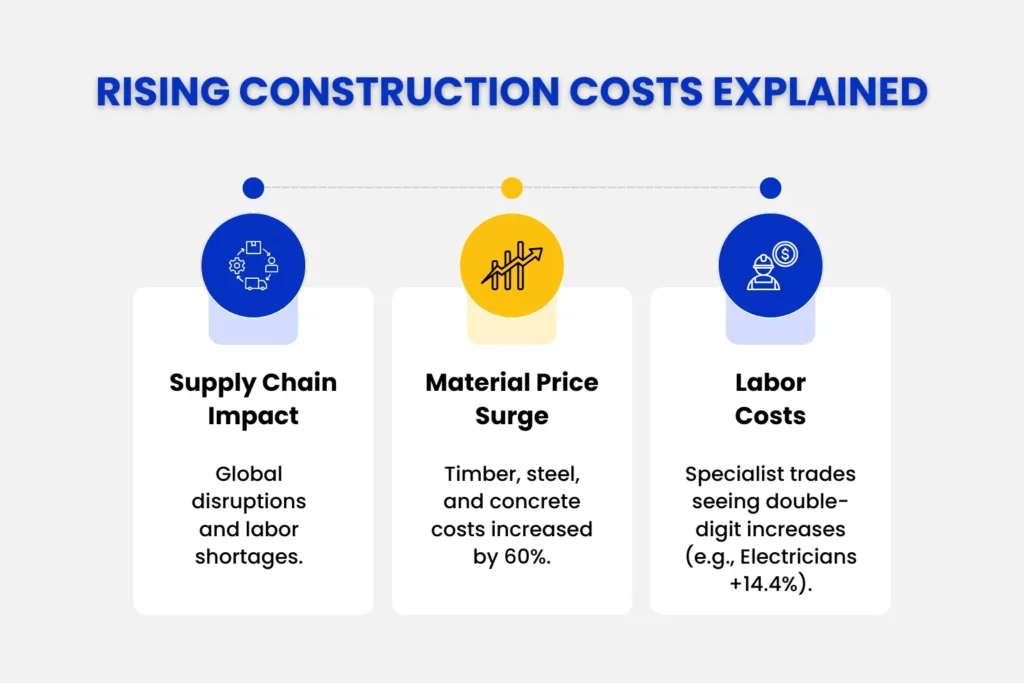

Construction cost inflation has been affecting project budgets and profitability for many suppliers, developers, and contractors in the UK construction sector. In recent years, the cost of materials such as steel, wood, and concrete has increased significantly. At the same time, labor shortages, rising energy prices, and disruptions in the global supply chain have all contributed to rising costs. Regulatory changes and fluctuating market demand add to these constraints, making cost management more difficult. To make wise judgments, reduce risks, and protect your margins in a cutthroat market, you must comprehend the underlying causes of inflation in building costs.

In spite of the difficulties, this blog looks at the reasons behind the rising costs and provides practical solutions to sustain profitability.

What Has Been Happening?

Global Shocks and Supply Chain Issues Since 2021:

Inflation in construction supply chains has skyrocketed since 2021. Global economic shocks, ongoing labor shortages, and brittle supply chains are the perfect storm of reasons. Inflation of commodities, increased labor expenses, and supplier failures have resulted in a triple squeeze for the business. Risks are expected to increase further into 2026, and margins are currently in danger.

Building Materials Price Increases:

Important building materials have experienced unheard-of inflation. The cost of concrete, steel, insulation, and timber has increased dramatically, some by more than 60% since 2020. Deep supply-demand imbalances and logistical challenges are reflected in this oscillation, which is not just a trend.

Labour Cost Inflation and Wage Trends:

Labour has followed the same pattern. Specialist trades are demanding and securing double-digit uplifts. For example:

- Electricians: +14.4% in one year

- Scaffolders: +9.3% in one year

As wage pressures persist, the combined effect with materials inflation is reshaping cost structures across the sector.

The Financial Impact of Construction Cost Inflation

Cash Flow Volatility and Fixed-Price Contract Risks:

One characteristic that now distinguishes project delivery is cash flow unpredictability. Contracts with fixed prices that were signed even six months ago have the potential to rapidly turn a loss. Without price variation clauses, contractors are left with little contractual remedy when costs rise by double digits, which immediately reduces margins and jeopardizes the viability of the project.

Some businesses are responding to this by implementing re-pricing clauses, such as quarterly material cost reviews. Others are allowing prices to fluctuate under market realities by linking supplier pricing lists to publicly available indexes like BCIS or BEIS.

Supplier Insolvency:

Cost inflation is having a significant impact on suppliers. Construction accounted for one in nine business insolvencies in the UK in 2023, indicating that insolvency rates are at all-time highs. More than £700 million was owed to suppliers and subcontractors after ISG collapsed in 2024; many of these parties might not make it through the financial shock.

BCIS Construction Inflation Trends and Forecasts:

According to the BCIS, tender prices will increase by about 15% by 2030, while building expenses will increase by an additional 14%. Through this, it’s confirmed that the inflation issue is structural rather than cyclical.

Why Cost Inflation Is Now a Structural Challenge?

Increasing construction prices are becoming more than a temporary issue. There will always be a shortage of trained workers, unstable energy prices, weak supply chains, and shifts in international trade. Profit pressure will continue to grow unless businesses modernise their contracting, risk management, and material procurement processes.

Strategies to Mitigate the Cost Inflation Challenge

In today’s high-cost market, construction companies should take the following easy steps to reduce risk and safeguard profits:

- Add price adjustment clauses to contracts: To allow prices to fluctuate with the market, tie material costs to established market indicators or schedule frequent repricing dates.

- Buy from domestic suppliers where possible: Local sourcing can prevent significant fluctuations in import pricing, minimise delays, and save transportation expenses.

- Track the supplier’s financial record: To identify issues early, review credit scores, late payment histories, or spot problems each month using management accounts and budgeting tools.

- Track key cost control metrics: Take measurements of your project’s gross margins, the average cost overrun on materials, and the number of contracts with cost protection regulations.

- Projects can remain economically viable even as costs continue to rise by taking these steps to more evenly distribute risk among suppliers, contractors, and clients.

Quick Wins Checklist (Under Six Months)

- Review all supplier contracts for fixed-price exposure.

- Add clauses for cost re-evaluation tied to BCIS or similar indices.

- Start monthly supplier and customer health screenings via credit data tools or trade insurance partners.

- Model the impact of 10% and 20% material price shifts on active projects with your project management team.

Conclusion – Preparing for a High-Cost Construction Future

In the construction business, rising expenses are becoming the rule rather than the exception. Pressures from labor, materials, and the supply chain will keep reducing margins for the next few years, making tax planning complex. The speed and efficiency with which businesses adjust, through better cost tracking, stronger supplier relationships, and more intelligent contracts, will determine their level of success. Failure to make adjustments will put projects in danger of losing money before they are even completed.

Julian Hobbs & Co. specialises in guiding construction companies through this difficult market. From contract reviews and price protection to supplier stability evaluations and cost trend predictions, we give you the knowledge and resources you need to maintain project profitability and company sustainability in a high-cost environment.

People Also Ask:

What Is Construction Cost Inflation and Why Is It Happening?

Inflation in construction costs is the continuous increase in the cost of labor, materials, and other inputs required to complete building projects. A number of local and global causes are contributing to it, including altered global trade patterns, increasing energy prices, shortages of skilled labor, and supply networks that were disrupted following the pandemic. Because of all these factors, building a project now is frequently far more expensive than it was a few years ago, and costs are only going to continue to rise.

How Much Have Electrician Wages Increased in the UK?

Electrician wages in the UK have seen notable increases in recent years:

– 7% pay rise from 2024, followed by a 5% increase in 2025, under the Joint Industry Board deal.

– Looking ahead, a new three-year agreement sets out further hikes: approximately 3.95% in 2026, 4.6% in 2027, and around 4.85% in 2028

What Is BCIS and How Can It Protect Contracts?

A UK service called BCIS (Building Cost Information Service) monitors and disseminates information on construction costs, such as labor rates, material prices, and trends in tender pricing. Contracts can have their prices modified to reflect actual market fluctuations by being linked to BCIS cost indices. This makes projects more equitable and lowers the chance of losses by shielding clients and contractors from unforeseen cost increases.

What Are the Building Cost Forecasts to 2030?

– Building (general construction costs): Expected to rise by 14% between mid-2025 and mid-2030

– Tender prices (what clients pay): Forecast to increase by 15% over the same five-year period.

– Materials cost index: Despite recent moderation, it’s projected to grow by 13% over the forecast time frame.

– Civil engineering (infrastructure) project costs: Also set to climb by 16% up to Q1 2030

– Civil engineering tender prices: Exposed to sharper increases—expected to soar by 24% over five years