Cash flow management software + ERP/Accounting systems + AI efficiency= Guaranteed Growth

Introduction

The best option for defining success and sustainability of a business – is not necessarily its bottom line. Cash flow for SMEs is often viewed as a reactive process, attributed to luck and hope. Let us understand this with an example. Imagine you are running a profitable retail business. You are getting good business and making profit, but you are unable to pay your suppliers, staff, and vendors.

Do you still believe your business is viable, and is going to sustain in years to come? The answer is no.

Just like how you plan your product, its launch date, marketing campaign, and most importantly its target market; you need to plan ahead for the cash flow as well. Money coming-in and going-out should be strategically planned to align with your operational and unexpected needs. You need to ensure your outstanding payments are cleared at the same time you clear your APs – both for functionality and good business relations.

In this blog, we will understand why nearly one in three UK businesses (around 73%) fail within the first few years, and how it is related to cash flow. We will also be discussing 6 best cash flow management software you can use in 2026 for guaranteed financial stability.

Why UK SMEs Struggle with Cash Flow

In addition to being reactive, focusing solely on debt collection, and lacking cash flow planning and forecasting tools, there are other factors as well that contribute to the struggle.

- Late Payments from Clients: Every business has one or two clients who pay late. Even with constant reminders and follow-up, they take their sweet time. This results in a lack of working capital which in-turn creates a cascading effect where businesses struggle to meet their own obligations while waiting for customer payments.

- High Operational Costs: With rising economic uncertainties and inflation, operating costs can quickly add up. Utility, labour and raw material expenses, when paired with seasonal fluctuations can quickly drain available cash. This can leave businesses fighting to stay operational.

- Overreliance on a Small Customer Base: SMEs usually have a small customer base, and if one or two of them are experiencing their own financial struggles, it can have a direct-and negative-impact on your business.

- Knowledge Gap: Many owners still lack an understanding of what cash flow truly is. They relate it to getting payments from clients and paying their bills. This is a debt obligation mindset, which makes them more prone to financial strain and unexpected errors, in turn – hindering their business’s growth.

To summarise, SMEs struggle with cash flow due to both internal and external factors. From clients not paying on time, to some extending payments for several months, and their own lack of understanding of cash flow’s true meaning and potential- these all contribute to their struggles and, ultimately, to business closure in the early years.

Understanding the Cash Flow Management Process for SMEs

Let’s understand the cash flow management process – with respect to Sole Proprietors vs. Limited Companies.

Sole Proprietors:

For sole proprietors, cash flow management is both simpler as well as riskier. You must design a plan and process that addresses both your personal and corporate expenses.

Take Sarah, for example -who runs a graphic design business as a sole proprietor. One month, a major client, due to some issue, had delayed payment. This meant Sarah didn’t have enough cash that month to cover both personal and business expenses. She was unable to pay her rent, or buy new software for her business.

Since her business and personal finances are tightly connected, Sarah had to dip into her personal savings to keep her business afloat and avoid missing bills.

Here’s her cash flow management process:

| Step | Action | Key Focus | Example |

| 1. Get a Handle on Your Cash Flow | Ensure to keep track of all the money coming in and going out. | Cash In vs Cash Out | Sarah tracks £1,000 in client payments and £600 in personal/business expenses (e.g., rent, software). |

| 2. Figure Out What’s Coming Next | Think about what you expect to earn and spend in the near future – especially if there might be any delays. | DSO (Days Sales Outstanding), Forecasting | Sarah looks ahead to next month and thinks she’ll have £2,500 coming in but then she realises one of those payments is probably going to be late, and she adjusts her forecast down to £1,500. |

| 3. Manage AR & AP | Make a note on who owes you money (AR management) and what you owe others (AP Management). | AR (Accounts Receivable), AP (Accounts Payable) | Sarah sends a reminder to the client who’s a month overdue on his payment. She also keeps track of her software bill so she doesn’t get stung with any fees. |

| 4. Review Your Spending | Review and cut unnecessary business expenses. | Cost Control, Expense Management | Sarah realises she’s still paying £50 a month for a software subscription she no longer uses, so she cancels it – which will save her a pretty penny in lean months. |

| 5. Keep Some Cash Back for When You Need It | If you save a bit each month, you’ll be ready for times when cash is tight. | Cash Reserve, Financial Cushion | Sarah has a plan to always put £500 aside each month to cover slow payments or unexpected expenses. |

| 6. Use Accounting Software to Simplify Your Life | Automation streamlines the invoicing process, and keeps track of your cash in real time. | Automation, Invoicing, Real-Time Tracking | Sarah uses software to automate sending out her invoices and track which ones are still outstanding. This makes her life a lot easier and stops the cash flow problems. |

Limited Companies (Ltd):

Since Limited Companies are marked by separate personal and business finances, the management process is more formal and complex – demanding a structured approach to handling business expenses, taxes, and payment schedules.

Let’s understand with an example of John, who runs a small tech firm under limited business structure. Unlike sole proprietorship, where personal finances were used to cover business expenses – this model keeps both, as separate entities, thereby affecting suppliers payments and salaries when client does not pay. This often leads to operational disputes.

Here’s the cash flow management process for John’s Ltd company:

| Step | Action | Key Focus | Example |

| 1. Track your Cash Flow | Monitor all incoming payments and outgoing expenses for the company | Cash In, Cash Out | John tracks the incoming payment from client of £10,000 and £7,000 (outgoing) in operational costs (e.g., employee salaries, rent, software subscriptions). |

| 2. Forecast Income & Expenses | Forecast the company’s income and expenses, keeping into accounting possible delays and taxes. | DSO (Days Sales Outstanding), Forecasting | John assumes that next month will record payment of £12,000. He also predicts a delay of £3,000. Hence, he adjusts his forecast down to £9,000 |

| 3. Manage AR & AP | Keep track of Accounts Receivable (AR) and Accounts Payable (AP). | AR (Accounts Receivable), AP (Accounts Payable) | John sends reminders to clients with overdue invoices. This is done so supplier payment is not compromised. |

| 4. Review Your Spending | Review and cut unnecessary business costs | Cost Control, Expense Management | John upon reviewing his income and expenses realises that £300 is being unnecessarily used for software license. Hence, he cancels it to free up cash |

| 5. Build a Cash Reserve | Every month/quarter to set aside a portion of profit for emergencies. | Cash Reserve, Financial Cushion | In this way John saves up to £1,000 and uses it to cover unexpected costs/expenses |

| 6. Use Accounting Software | Streamline your invoicing and cash flow tracking | Automation, Invoicing, Real-Time Tracking | John, upon using the accounting software automates his manual tasks, thereby ensuring better cash flow management. |

Both processes might look the same, but Limited Companies face a higher level of complexity due to legal obligations, tax liabilities, employee payroll, and the need to maintain a separate legal entity.

The 6 Best Cash Flow Management Software for UK SMEs

Since we have understood the importance of cash flow management, processes behind it and challenges SMEs face, let’s now dive into the best software/tools you can use to automate your manual tasks.

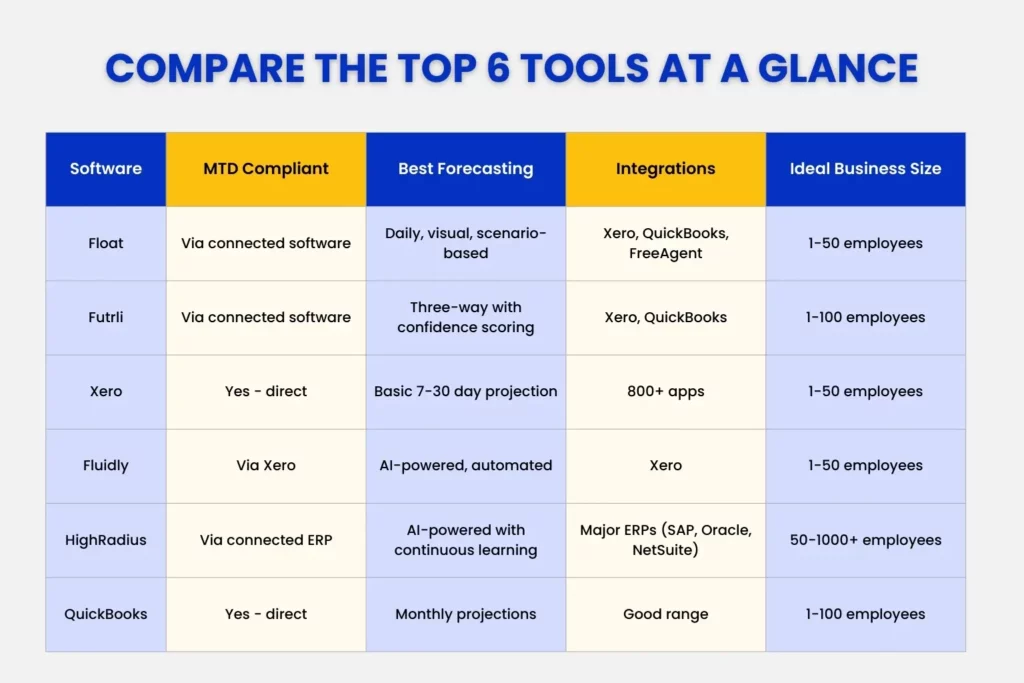

Here are top six cash flow management software UK SMEs use to streamline and execute their financial plans, with respect to cash flow. These tools seamlessly integrate with your business system and provide real-time insights, also predicting on what will happen next/in the near future.

#1 Float

Float is amongst the trusted forecasting tools, providing seamless integration with top accounting softwares like Xero, QuickBooks and FreeAgent.

Designed to help businesses and decision makers take prompt actions, this tool provides monthly and weekly forecast features, and also helps in planning for ‘what if’ situations. Questions such as ‘can we afford a new hire’, ‘when will we run out of cash?’, or ‘what happens if we lose a customer’ – are all answered with speed, backed by loads of data and facts.

You can think of running your business without a finance team in the startup phase. The tool provides visual representation to help owners with no accounting background understand what comes next and what they need to do.

Ideal for small and medium-sized businesses, Float provides a plethora of benefits. However, it is accompanied by a set of cons, such as: limited accounting software integration to only 3 tools, not being much of a help for seasonal businesses and those having irregular cash patterns.

You can go for Float if you want straightforward, visual cash flow forecasting without complexity.

#2 Futrli (Sage)

If you are looking for a jargon-free software that will help you make sense of the numbers – all while integrating seamlessly with Sage and other accounting software, then Futrli is for you.

Built to synchronise with your client’s endless ledgers, this tool offers daily cash flow projection and confidence scoring features – telling you how certain a forecast is, and ultimately helping you make the right decision at the right time.

From predicting how money will move in and out of the business, to estimating income and expenses over a period, and your assets and liabilities snapshot – the tool offers three-way forecasting to help you understand your business’s overall performance. In addition, it also helps you create your own dashboard and send automated alerts on when your cash is low and whether the thresholds are met.

If you are a business looking for financial features that extend beyond cash flow, then Futrli by Sage is for you. There are however certain disadvantages like – simple, traditional dashboard and extra costing for add-ons that can outthrow your decisions. This is why you need to consider your goals against your resources and then select the optimal tool.

#3 Xero

Xero is accredited as one of the top accounting software/tools – offering a modern interface and over 800+ app integrations. You can use its cash flow management feature to closely predict your cash position and spot shortfalls before they cause problems.

From automating connections to different bank accounts to providing a short-term cash flow dashboard, Xero offers a comprehensive financial ecosystem in accordance with the growing need for MTD compliance submissions.

Be it on laptop or your phone, you can download the app and use it on the go. You can also collaborate with other accountants – dynamically revising the strategies that work for you. The tool does not require your manual intervention in either invoice tracking nor in software updates.

However, it does have certain disadvantages to it.

Being an accounting software by origin, its cash flow forecasting is basic when compared to dedicated forecasting tools. In addition, the pricing can change as your business grows. For you to have advanced cash management features, you need to integrate it with third-party apps, which also come with their own costs.

So, if you’re a small business and you require comprehensive accounting and basic cash flow features – then Xero is for you.

#4 Fluidly

Inspired by 3D modeling tech, Fluidly provides out of the box cash visibility and forecasting features. The tool combines AI features with cash flow management – automating predictions and credit controls.

If you are looking for daily cash flow reports and forecasting, liquidity management, personalised payment reminders automation, real-time synchronisation with Xero, and CFO-level services- then this tool is for you.

It is amongst the first tools to use AI to analyse historic transaction patterns, ensuring accurate forecasting over time. SMEs wanting to stay ahead in this tech-driven era and streamline their processes with machine learning capability can use Fluidly to predict, take immediate actions and streamline their cash flow processes like bank feed automation, and more – all within one tool.

The tool does present certain cons like – incorrect predictions (by AI),limited manual adjustment capabilities and syncing delays. Hence if you’re a business operating with regular transaction patterns, Fluidly can prove to be an ideal choice.

#5 HighRadius

While your traditional ERP system can help you track cash flow in a gist, HighRadius on the other hand – provides advanced cash flow planning, forecasting and management features, far exceeding the basic systems. Powered by AI, and over 180+ AI agents to foresee end-to-end cash flow management- this tool is often used for treasury and AR management for its accuracy.

It also supports integration to major ERPs like SAP, Oracle, NetSuite, and Dynamics 365, making it an enterprise-grade tool usually adapted by larger businesses. So, if you are looking for software that can help with multi-currency data consolidation and making sense of the numbers – then High Radius is for you.

Apart from helping you free-up cash for re-investing, predicting when customers will pay you, scenario planning and handling changing variables, the tool comes with a set of disadvantages like – being costly, requiring 3 to 5 months implementation time, and not being suited for SMEs, which takes up the majority of UK business sector.

#6 QuickBooks Online

This is a cloud-based accounting software by Intuit, built for small and mid-sized businesses. With it, you don’t have to worry about invoice and expense tracking, cash flow forecasting for the next 90 days, payment reminders, and profit/loss projections.

Get your purchases, investments highlighted without editing your actual records. Stay compliant with HMRC as well, with its robust MTD system. Any doubts? Don’t worry! Go through the tutorial resources and support- anytime, anywhere.

Now, to its disadvantages -the software can become costly very quickly. Additionally, its cash flow forecasting is less sophisticated than other specialist tools. Hence, if you want to streamline your accounting operations, QuickBooks Online can be your go-to choice.

How to Choose the Right Cash Flow Software for Your SME

- Begin with assessing your current situation such as whether you are aware of your current cash flow? Can you forecast for the next month with confidence? Is it suited for your business – both from an operational and cost perspective? And what pain points can it resolve?

- Then match the tool to your business stage. For an SME or sole proprietor, it wouldn’t be viable to use software suited for established/50+ employee companies. Choose the solution that is best-suited for your business and that can grow as you grow.

- If you are already using accounting softwares like Xero, QuickBooks or Sage, you need to ensure the specialist tool/app can seamlessly integrate with your existing solutions. Or, choose the accounting software with cash flow features and add-on benefits- ideal for you.

- Factor in the subscription cost, implementation and training time, and setup costs. Budget realistically against the time- so your operations are not hindered, ensuring all forecasts are accurate and backed by historic data and facts.

- Evaluate your cash flow pattern. If your business has a predictable pattern of cash coming in and going out, then simpler tools will be ideal. Else, you can use sophisticated tools like Float, HighRadius for uncertain cash pattern businesses.

- And lastly, make sure to use the trial option diligently to see whether the system is operating accurately.

The Julian Hobbs Advantage – Outsourcing Cash Flow Management

Julian Hobbs & Co. can help you with cash flow planning, forecasting and budgeting services. If you are looking for an expert who can catch up your accounts, help you in selecting the right software/tool, and also help with the setup and compliance processes – then Julian Hobbs is for you.

We help businesses across Hertfordshire and nearby regions outsource their cash flow services to us – offering compounding benefits. Not only do we help you make sense of the numbers, but also provide you with a cost-effective outsourced finance team that can take up your accounting tasks – while you handle your clients and relations.

Contact us today to get a custom quote that works for you-no jargon, just plain English and numbers that make sense.

People Also Ask:

Which cash flow software is best for micro-businesses?

Xero, QuickBooks and FreeAgent are the best choices if you want to manage your micro-businesses’ cash flow.

How long does it take to implement a cash flow tool?

For simple tools that are best suited for SMEs, it takes 3 to 4 hours. However, its accurate implementation i.e. connecting bank feeds, categorising historical data precisely, and setting up forecasting rules – can all take 3 to 7 days.

Can these tools handle VAT & MTD requirements in the UK?

Yes – all the six mentioned softwares can handle VAT and MTD requirements.

Do I need an accountant to use cash flow software?

Not strictly. Businesses with predictable cash patterns can learn to use the software in its implementation phase. However, if you want to grow your business exponentially, then hiring an accountant can greatly benefit.

Is my data secure when connected to the software?

Reputable software providers use bank-level security measures to protect your data, including 256-bit SSL encryption, automatic backups, GDPR compliance, and ISO certifications, ensuring your information remains safe and secure.

How does Julian Hobbs integrate with my chosen software?

We handle the migration from spreadsheets or legacy systems, configure the software correctly, train your team, and provide ongoing support. This partnership model means you get both technology and expertise, without the need to hire full-time finance staff.