Introduction

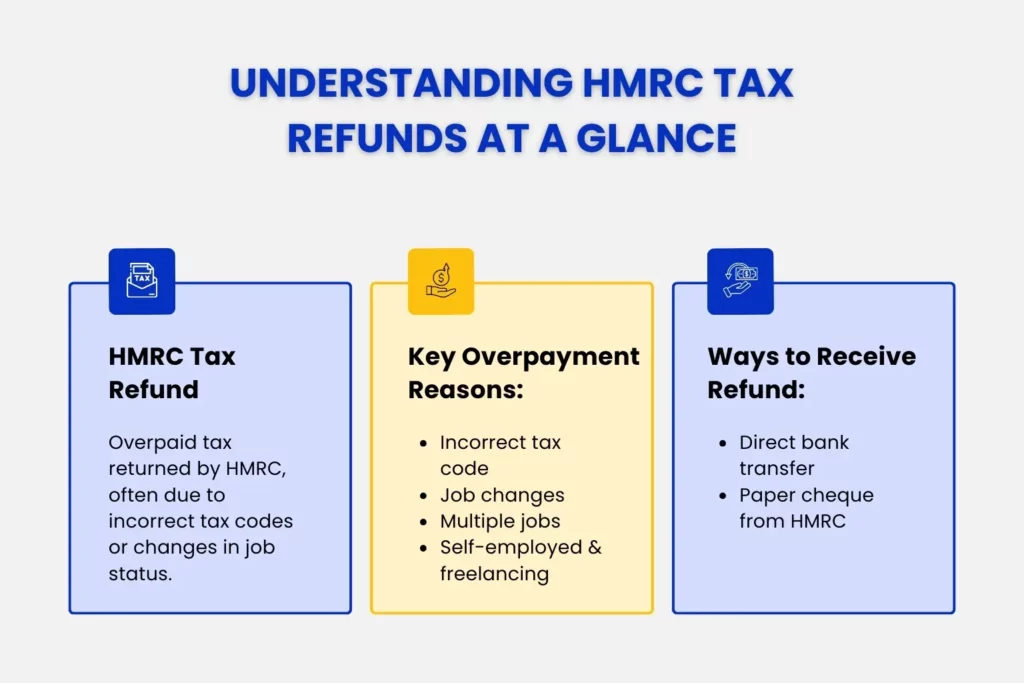

Every year, millions of UK households receive an HMRC tax refund, offering financial relief to those who have overpaid in taxes. The reasons could vary, such as an incorrect tax code, a job change, PAYE errors, etc. Nevertheless, folks are not fully aware of the scope of HMRC tax refunds.

While Self Assessment refunds often take the spotlight, it is not always the only reason for a tax rebate. There are various other reasons and scenarios for it, like PAYE refunds, VAT refunds, and even corporation tax refunds. People often confuse and correlate HMRC tax refund to self assessment & this is why many miss out on the possible reliefs and overpaid tax claims.

This guide aims to dispel all the confusion around tax refunds and let you in on the proper method to claim them, the timelines involved, and the common mistakes to avoid. You’ll be getting a crisp, simple, jargon-free understanding of the concepts, so in the future, you know exactly what to do.

What is an HMRC Tax Refund?

When we talk about HMRC tax refund, we are simply referring to the overpaid amount in taxes, which you shouldn’t have. Its the money being returned to you, nothing more complicated than that.

Overpayment can occur due to many reasons, no matter the entity structure you’re involved in. Whether you’re an employee, self-employed, or earning from different sources like savings or rental income, if you have overpaid, HMRC will return the money to you, many times automatically, and sometimes by having you fill out forms.

If you’re looking for information on how savings income affects your taxes, check out our blog- HMRC Savings Account Tax Warning: What UK Savers Need to Know in 2025/26.

Let’s dive into the major types of HMRC tax refunds, where people end up paying too much.

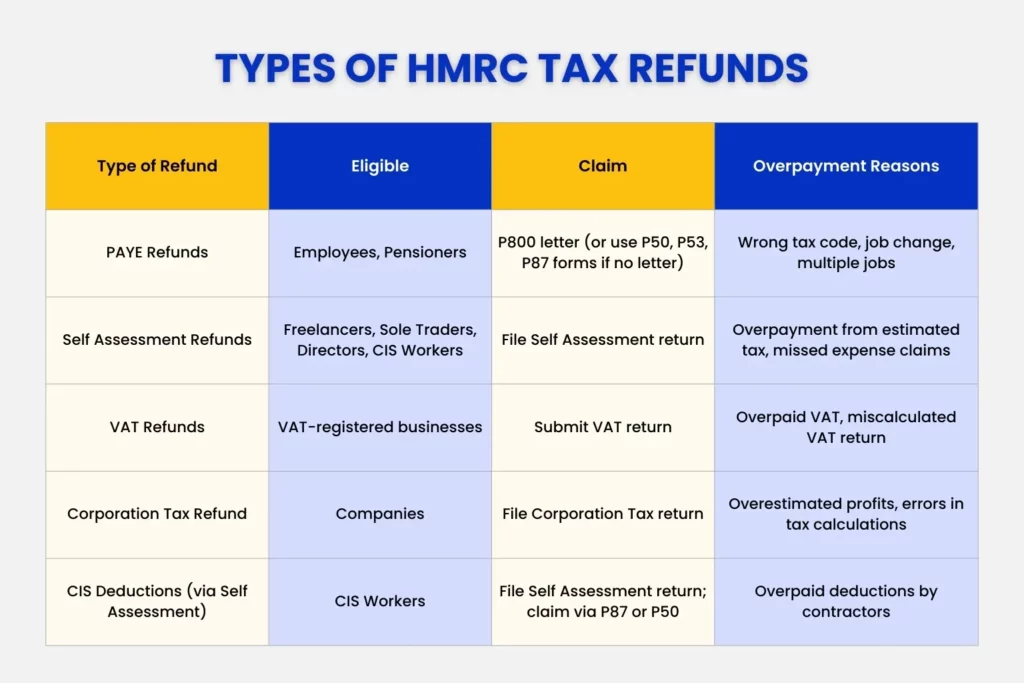

PAYE Tax Refunds (Employees & Pensioners)

Employees and pensioners often pay their taxes through the PAYE system. The employer would calculate how much you owe and send it straight to HMRC, even before you receive your payslips. Sometimes it happens so that you end up overpaying in taxes. Reasons include:

- Incorrect Tax Code: HMRC might assign you the wrong tax code sometimes, resulting in tax overpayment/underpayment. This happens when you’ve recently changed jobs, started receiving pensions, or had changes to the benefits. Let’s understand them.

- Job Changes: If you’ve switched jobs mid-year, oftentimes your new employer might not have your full tax history. They might put you on an emergency tax code, which means you’ll be paying too much initially.

Also, if you work for multiple employers, confusion may arise about your tax-free allowance split. The result? Tax overpayment.

You’ll then receive a P800 tax refund letter informing you of the next steps.

P800 Tax Calculation (A Key Component of PAYE Refunds)

If HMRC’s systems spot that you’ve overpaid through PAYE, they’ll automatically send a P800 tax calculation letter. The letter would clearly outline how much you’ve overpaid and the steps to claim a refund – i.e., logging into your HMRC Personal Tax Account, entering the necessary credentials, and choosing the mode.

You can request your refund to be paid directly into your bank account or sent by mail in certain cases.

When You Need to Claim Manually

If you haven’t received the refund letter yet, or believe you are owed a refund, you can claim it manually using the following forms.

- P50: Form P50 is for people who have stopped working and won’t be working again in the same tax year. Maybe because of retirement, a career break, or leaving the UK.

- P53: Form P53 works for people who haven’t received a P800 but believe they’re owed a refund based on their own calculations.

- P87: These are for individuals wanting to claim work-related tax reliefs like mileage, uniform costs, professional subscription costs, etc.

Self Assessment Tax Refunds

Self Assessment tax refunds apply to self-employed individuals, company directors, and contractors working under CIS (Construction Industry Scheme). It is a type of HMRC tax refund, catering to the Self Assessment system instead of PAYE.

- Sole Traders & Freelancers: They often overpay taxes when making payments on account, which is an advance payment towards next year’s tax bill on this year’s income. If the income drops or they fail to claim all eligible reliefs, they might end up overpaying taxes and will be due a HMRC Tax refund.

- Directors: As a company director, you may end up in a tricky situation if you receive both salary and dividends. Your salary gets taxed through PAYE, while dividends are subject to different tax rules. If not properly accounted for, mix-ups can happen, resulting in overpayment.

- Landlords: If you own a rental property and fail to claim all legitimate expenses like repairs, maintenance, insurance, and more, you end up paying too much in tax. Hence, you might qualify for a tax refund.

- Construction Workers: Workers under CIS get their tax deducted by the company/contractor before payment. If these deductions are more than what you actually owe, then you can claim a refund through Self Assessment.

If you’re interested in the latest news about the construction industry, check out our guide on Construction Cost Inflation in the UK: Why It’s Rising and How to Protect Your Margins.

Other Refund Situations

Apart from PAYE and Self Assessment, you may also be eligible for other HMRC tax refunds, such as:

- VAT Refunds: This applies only when your business is VAT registered and has overpaid in taxes. HMRC may allow you to claim a VAT refund.

- Corporation Tax Refund: This occurs when a company has overpaid due to changes in profits, loss relief claims, or errors in the original calculation.

How Do You Know if You’re Due an HMRC Tax Refund?

Most people don’t check on their tax situations until something feels truly off. Here’s how to check if you’re making mistakes and are due a refund:

- Your tax code looks wrong.

Match your payslip with what HMRC says online. Look out for BR, D0, or D1codes, as well as emergency codes like WI, M1, or X. If any of these codes have lasted for months, then you are definitely overpaying taxes.

- You’ve switched jobs this year.

Chances are, you might be paying the wrong tax. Your new employer may be giving you a full allowance (meaning you’ll owe money later), or assuming you’ve already used it all (meaning you overpay now). Either way, the year-end calculation rarely balances perfectly.

- You’re working multiple jobs.

Sometimes, you might receive the £12,570 allowance for both your jobs, when you should only be receiving it for one and splitting it equally between them.

- You’ve retired or stopped working mid-year.

The tax system, in most cases, assumes you are still working and earning, and may continue to tax you, leading to overpayment. To ensure this wouldn’t happen, you need to fill out a P50 form, notifying HMRC, so they can fix their mistakes.

- You receive a pension and still work part-time.

HMRC might owe you a refund if the personal allowance is fully applied only to the part-time job. This means you haven’t used up your full allowance, which can lead to overpayment of tax on your pension income.

- You’ve claimed benefits that should affect your tax code, but haven’t.

In simple terms, this means you’re either overpaying or underpaying tax. Benefits like marriage allowance and so on should be correctly accounted for by HMRC so as to adjust the code correctly. If not, you end up paying too much tax, or too little, and later be asked to pay back with penalties & fines.

- You’re self-employed, and your income dropped from what you’d estimated

Generally, you pay tax in advance when making payments on account, based on last year’s earnings. But what if you earn less this year? Those advance payments quickly become overpayments.

How to Claim Tax Refund from HMRC

Follow this step-by-step guide to get your money back (when you’re actually owed one).

- Start by checking your payslips, income records, and tax statements to ensure you’re due a refund. Then use HMRC’s tax checker tool to review any outstanding dues.

- Gather all your documents and paperwork. You’ll need P60s, P45s, P87s, or your Self Assessment records.

- For PAYE refunds: If you’ve received a P800, follow the instructions within the letter and claim online or wait for a cheque. If you haven’t received the P800 tax calculation letter, use forms like P50, P53, or P87. Complete them and submit them to HMRC.

- For Self Assessment refunds: If you’re self-employed, a director, or a landlord, file your returns as usual. HMRC will automatically calculate any refund due based on your submitted returns. If due, the money will be transferred into your bank account. Complex returns can take up to eight weeks to process.

- Keep track of your claim using HMRC’s online service. Log in to your personal tax account and go to ‘Check your income tax’ or ‘Track your refund’ to follow up.

How Long Does HMRC Take to Process Your Tax Refund?

- Online claims through PAYE: 5 working days once HMRC processes your request.

- Cheque Claims (PAYE): Up to 6 weeks from when you submit your claim.

- Self Assessment Refunds: 2 weeks for basic returns, and up to 8 weeks for complex returns, where HMRC needs to investigate.

Note: These timescales are based on the premise that everything is running well. Don’t fully rely on them.

Common Mistakes and Pitfalls to Avoid When Claiming a Tax Refund

- Incorrect Information:

Human errors like a typo mistake, selecting the wrong tax year, or inputting incorrect details can get your refund delayed for months, or even get it rejected.

- Missed Deadlines:

Missing the deadline is the worst mistake. You have four years from the end of the tax year when you overpaid to claim your money back. Otherwise, you might lose your refund.

- Claiming ineligible expenses:

When you claim expenses you’re not entitled to, it will backfire. Make sure you claim all the allowable expenses because HMRC checks them. Any ineligible claim can lead to an investigation or rejection.

- Falling for Scams:

You might end up not just losing your money, but also all your sensitive data. Remember, HMRC will never contact you by mail, text, or phone call to inform you about a refund.

What Happens if You Miss the Deadline for Claiming Tax Refund?

HMRC gives you four years to claim the refund, beginning with the end of the tax year in which the overpayment happened. If you missed the deadline, you can still claim it through Extra-Statutory Concession B41. But here’s the twist, this is very rare and applicable only when the overpayment happened due to an HMRC error. If not, you will lose the chance and never get your refund back.

So, be vigile and always stay ahead of your deadlines. Here’s an example tax year to give you a gist.

For tax year 2024/25, when the year ends on 5th April, 2025 – You can claim the refund by 5th April 2029.

How to Spot and Avoid HMRC Tax Refund Scams

With the self-assessment tax return season soon approaching, HMRC warns of scams- targeting taxpayers expecting a refund. Scammers love free money, and they’ll do anything, even HMRC impersonation, to get you trapped. Even with all the sophisticated scamming practices, the fundamentals remain the same. You need to be aware of these to quickly identify a potential scam and report it to HMRC.

Things HMRC will never do:

- HMRC will never send an unsolicited email, text, or phone call telling you about a refund. If you do receive such communication, immediately take a screenshot and note the sender’s details. Then send it to HMRC at phishing@hmrc.gov.uk, while simultaneously deleting & marking it spam.

- Claim that you’re due a refund & ask for info. Even if the mail/message or call looks legitimate with all the logo, mail address and dominating tone, it’s still spam. Don’t fall for it. HMRC will never request your personal information through any channel, claiming to help you or threatening that you might miss a refund. Real refunds are always processed directly through your HMRC account.

There are subtle yet distinct ways by which you can identify a scam. Mails with links – asking you to click on them urgently, or address “hmrc-gov.uk” instead of “hmrc.gov.uk”. Looks almost legitimate, right? Remember, always log in to the official website & then ask for assistance.

- Asking for your bank details, or maybe even pin & password? HMRC will never do this, whether by email, phone or text. It’s spam – don’t fall for it. They already have your details.

How to Avoid Scams:

- Do not click on any links, disclose information or download any kind of attachments.

- Even when the message has a snippet of the original website, do not click on it. Instead, go to your safe browser, type ‘www.gov.uk’ and then click on the official website.

- Change the passwords for your Government Gateway account and other necessary accounts if you think they have been compromised. This practice is also helpful even without any immediate threat, as it safeguards your information.

- Keep track of your files, documents, claims and communication with HMRC. This will help you not only stay organised, but also spot any suspicious activity ahead of time.

- When in doubt, always type ‘www.gov.uk’ into your browser and visit the official HMRC website. Only then, contact the relevant authorities by using the number and address listed there.

Conclusion

HMRC tax refunds aren’t just limited to Self Assessment refunds. It is an umbrella term, comprising PAYE refunds and other types of refunds. In fact, PAYE refunds contribute to the majority of the refund claims.

You owe a refund if there is an error in your tax code or on HMRC’s side, maybe due to recent changes within your job landscape or changes to benefits. Either way, you can claim an HMRC tax refund by logging in to your HMRC account and reviewing your tax details. If you identify you’ve overpaid in tax, then you can request a refund directly through your PTA account or by contacting HMRC directly. Remember to stay vigilant throughout the process and avoid potential scams/threats.

You can reach out to Julian Hobbs & Co. to help you with HMRC tax refunds. Our chartered accountants will help you identify eligible benefits, file returns, and, in some cases, assist you with the end-to-end refund reclaim process, while fully complying with GDPR ethics and standards. We are known across Hertfordshire, Watford and our neighbouring regions for our tax planning & accounting services. If you’re looking for an accountant who provides jargon-free solutions that ultimately expand as you grow, then contact Julian Hobbs. You can also look into our affordable packages to pick which suits you best.

People Also Ask:

Do HMRC automatically refund overpaid taxes?

Yes, HMRC does automatically refund the overpaid taxes, especially through PAYE (P800 letter). But there are instances where it might not be possible. In such cases, you have to manually claim your refund and fill out forms.

Can I claim a tax refund if I worked abroad?

Yes, if you’ve been taxed in the UK while working abroad, you may be entitled to a refund.

How do I know if I’ve overpaid tax on savings income?

Check your bank statement and total up the interest you received. You get a tax-free allowance: £1,000 if you’re a basic-rate taxpayer, £500 for higher-rate, and nothing for additional-rate. If your bank took tax off, but your interest was below the limit (threshold), then you’ve paid too much. Also, look at the P800 letter, and confirm your interests and tax on it. If it doesn’t match, then you’ve overpaid taxes.

What should I do if I missed the deadline for claiming a tax refund?

If you missed the 4-year timescale, there are still options available to let you avail. First, you can demonstrate to HMRC why you’ve missed. Provide a reasonable excuse like serious illness or other exceptional circumstances you underwent. You can also try claiming through Extra-Statutory Concession B4, but it is only applicable when tax overpayment is the result of an HMRC error.

Can I claim a tax refund if I received a redundancy payment?

Yes, you can claim a refund if you were overtaxed on your redundancy payment.

What happens if I claim a tax refund and later realise I made a mistake?

You can contact HMRC to correct the mistakes. If it’s within 12 months timeframe, you can then amend your return online. After that, you’ll have to write to them. Honest mistakes won’t usually attract penalties, but if it’s proven that the delay was caused by carelessness or deliberate error, then you will be fined interest and penalties.

How long does it take for HMRC to process a tax refund?

HMRC tax refunds typically take about 5 working days for online claims, such as P800. For Self Assessment, it’s usually 1-2 weeks, but in more complex cases, it can take up to 4 weeks or longer for verification. Paper claims, however, take much longer – often 6-12 weeks. PAYE refunds generally take 2-3 weeks.