A Quick Brief

You might be wondering – why is an accountant diving into legal concepts? It is the work of legal firms. You are absolutely right!. There are dedicated business legal service providers who will help you deal with unpaid invoices legal actions and other kinds of disputes. Our aim here is to provide awareness to SMEs and UK taxpayers in knowing how the law can support them.

It might be awkward to chase receipts in the beginning from the debtor (business owners or individuals), but with time, your patience and overall respect and belief start to wear thin. What was a series of occasional-awkward encounters, now turns into daily/weekly tasks. Getting back to them via mail, phone calls, and other mediums quickly turns into a frustrating and time-consuming quest.

Hence, in this guide, we’ll help you know what actions you can take to recover the debt, and when it’s time to get expert help. Let’s dive in.

Step 1: Understand Your Rights and Responsibilities as an SME

As an SME, for whom profitability is highly dependent on cash flow; any disruption to it can force owners to make tough decisions- leading to rocky business relationships and operability. This is why you need to know your legal rights & responsibilities beforehand, so you can effectively handle late payments.

a. Know Your Payment Terms & Rights:

Any agreement signed between you and your partner, should clearly include the payment terms. It could be ‘N30’, ‘N60’, or any other specific date you both agreed upon.. Additionally, it has to outline any interest being charged if the payment is overdue. The Late Payment of Commercial Debts (Interest) Act 1998 gives you the right to charge interest of around 4% on overdue invoices.

Moreover, according to gov of uk, if you’ve been chasing debt, you are entitled to claim compensation amount of:

| Compensation you can Charge | For Debt of up to |

| £40 | Up to £999.99 |

| £70 | £1,000 to £9,999.99 |

| £100 | £10,000 or more |

b. Establish Communication Early On:

As I said, write emails with attached invoices or call your partner/client to remind them of pending payments. Clear communication is a must. You can’t expect your partner to read your mind or understand your problems-this goes both ways. If you’re unable to clear the invoices due to any hitch, please let your partner know. Likewise, if you can no longer wait for the same old pattern of late payments, let your client know this.

c. Know what Alternative Dispute Resolution (ADR) Is:

Unpaid invoices legal actions does not necessitate only the court as a medium to solve issues and disputes. You can use various ADR methods like – arbitration or mediation to resolve payment disputes.

These methods are some of the most cost-effective ways to resolve problems- allowing both the parties to maintain as well as influence control over the outcomes. For instance, if there is a dispute where the client feels that the cost on the invoice is too high than agreed upon. In such cases, you can opt for mediation, where a neutral third-party mediator will preside over the process-facilitating a conversation between you and your client.Both sides will be able to present their views and work towards a mutually agreeable solution.

This approach is flexible and often leads to a more acceptable outcome – usually agreed upon by both parties.

Step 2: Send a Letter Before Action to Recover Unpaid Invoices

When the emails and phone calls aren’t enough, a Letter Before Action (LBA) is the next logical step. This is a formal letter you send to the debtor as a warning that legal actions will be taken if the debt is not settled within a set timeframe (usually 14 days).

While drafting this letter(LBA), you need to ensure the following details are definitely included:

- Your invoice number and the amount owed

- Detailed description of the reason for the dispute and the dispute amount.

- It should also specify the final deadline for the payment

- Ultimately, the consequences of non-payments like pursuing legal actions or referring the matter to a collection agency.

Step 3: Charge Interest and Apply Fixed Late Payment Fees

As discussed earlier, for your chase to recover unpaid invoices, you are due compensation. It doesn’t matter if it’s stated in the agreement or not, you have the legal right to charge interest on overdue invoices. This ensures the paying party knows the consequences of late payments- thereby protecting your business from financial strains.

Now, the important thing to note here is that charging interest and applying fixed late fees are two very different things.

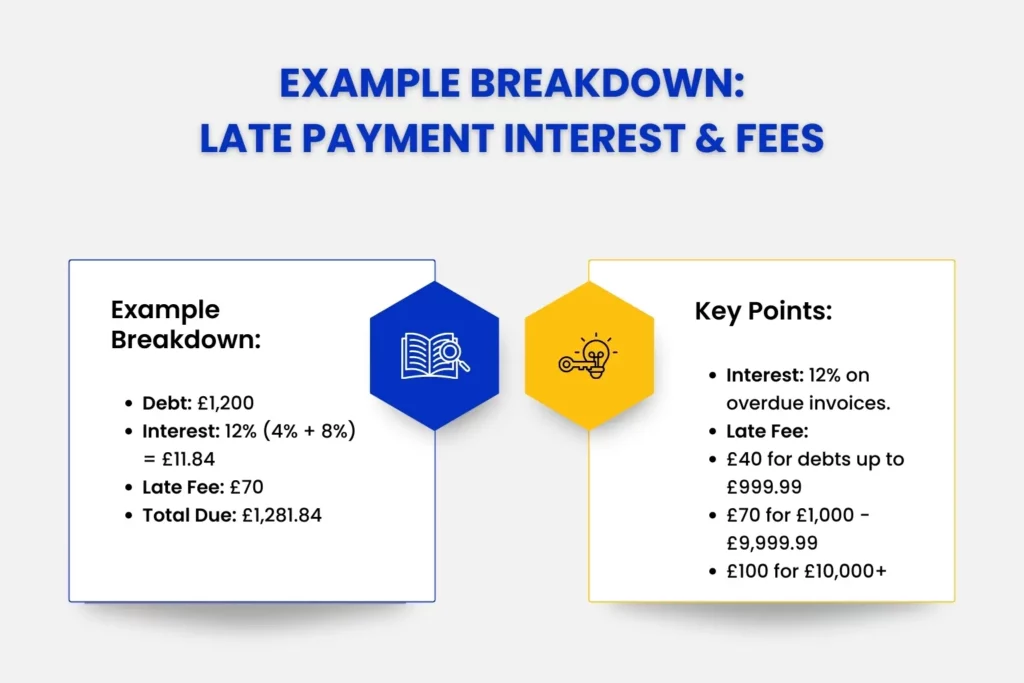

The Bank of England’s base rate is 4% (as per recent updates). This, when coupled with the 8% statutory interest – leads to a total of 12% interest rate which you can charge on overdue payments. Let’s understand with an example:

If your client owes you £1200 and has not made payment for 30 days beyond the due date, here’s how to calculate the interest:

- Due amount: £1200

- Interest: 4% + 8% = total interest is 12%

- Days overdue: 30

- Then – £1,200 x 12% x 30 ÷ 365 = £11.84 this is the interest owed for the overdue payments.

Additionally, you are also entitled to apply fixed late payment fees, as per the value of the debt. This you can find in Step 1. Nevertheless, here’s the breakdown once again.

- For Up to £999.99 debt – you can charge £40; likewise,

- For £1,000 to £9,999.99 debt – you can charge £70, and lastly

- For £10,000 or more debt – you can then charge £100

Let’s get back to our example:

The total interest owed, as per our calculation is £11.84 (for £1200 pending payment -30 days beyond the due date). Now, you can apply the above fixed late payment fees, as per the value of the debt:

- Since debt is £1200, you now can charge £70 fixed fee

- Hence, yotal Due is = £1,200 + £11.84 + £70 = £1,281.84

The client is now legally obliged to pay you a total of – £1,281.84, as permitted under the Late Payment of Commercial Debts (Interest) Act 1998.

Step 4: Take Your Case to Small Claims Court for Unpaid Invoices

At this stage when all your informal attempts to recover the due payment goes in vain, even with your constant reminders, follow-up mails, second reminders, discount offerings, and letter before action – the next logical step would be to take your case to these small claims courts.

They are designed to help SMEs and individuals fight for what they owe-in the most cost-effective manner. Here you don’t need a legal representative to fight your case, you can do it yourself.

However, to use this method, you need to know the eligibility for small claims court. The claim amount for such courts cannot exceed the £10,000 threshold. If it does, then it no longer qualifies for small claims court, rather to a more fast track or multi-track system- which is more complex and costly.

Let’s take the same example, where the client owes £1,281.84 (after interests + fixed rate charges). The process to file a claim would be:

- Filling a Claim Form (form N1) with your local county court first. Always ensure your form has all the details: the amount you are owed; name, address and other details of the debtor; a summary of the facts and the reason for non-payment.

- The court will then issue your claim and serve it to the debtor, asking them to respond within the timeframe provided, which is usually 14 to 28 days. The issued claim will either ask the debtor to

- Pay the full debt

- Dispute the claim, in which case they must file a defense.

- And ultimately outline that if they don’t respond, a default judgment in favor of the pressing party will be made.

- In case the debtor fails to dispute the claim or pay the amount owed, a hearing date will then be set. This is usually rare though, as majority of small claims cases- are settled way before reaching the court hearing.

As per Gov of UK, the fee for filing a claim are as below:

- For claim Up to £300 = fee will be £35

- For Claim of £300.01 to £500 amount = the fee will be £50

- For claim within £500.01 to £1,000 = the fee will be £70

- For £1,000.01 to £1,500 amount = the fee will be £80

- For claim amount between £1,500.01 to £3,000 = the fee will be £115

- For £3,000.01 to £5,000 = the fee will be £205, and lastly

- For £5,000.01 to £10,000 claim = the incurred fee will be £455

This might not seem like a cost-effective way, but if you win your case, the debtor will then be obligated to pay these additional costs on top of the original debt. Remember solicitor’s fees cannot be recovered, unless allowed under specific circumstances.

Step 5: Recover Payment After a Court Judgment

Let’s assume, the debtor hasn’t yet paid the debt and the matter is taken to the court. Once the court grants the decision in your favor, you are now legally obligated to get the full sum, as well as the additional costs incurred in the claiming & filing process. Happy Ending right?

Not yet.

Obtaining a judgement doesn’t guarantee that the debtor will pay you right away. It is all too common for debtors to ignore or delay payments even after the court filing. This is why you need to pursue certain enforcement actions to ensure the default is settled soon. Let’s understand a few of them.

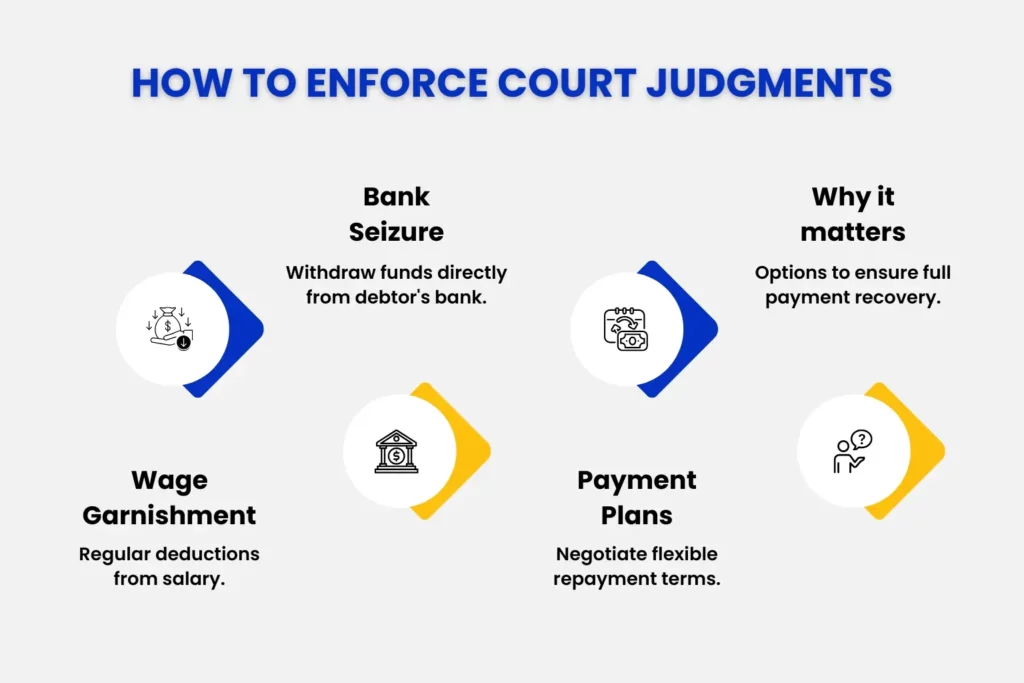

a. Wage Garnishment:

This option, also known as Attachment of Earnings Order, lets you take regular payments from the debtor’s salary or wages. When you apply for this option to the court, the court will then instruct the debtor’s employer to deduct a portion on a monthly basis, until the debt is paid off.

However, this option is not effective if the debtor is self-employed or unemployed.

b. Bank account seizure:

This enforcement action lets you take funds directly from the debtor’s bank account or from the third parties who owe money to the debtor. This TPDO when issued by the court has its pros and cons, and largely depends on knowing where the debtor holds their accounts or assets.

c. CCJs and Payment Plans:

This enforcement action lets you negotiate with the debtor to come to a payment plan – allowing the debtor to pay a monthly payment that fits his/her financial means/capacity. The court might issue a CCJ (County Court Judgment), which can stay on the debtor’s credit file for six years.

d. Insolvency (Winding Up or Bankruptcy Petition):

In extreme cases, if the debtor is a company, you can apply for a Winding-Up Petition. For individual debtors, you can apply for a Bankruptcy Petition. Note: these are often considered a last resort and may not always result in full debt recovery. However, they are necessary when other enforcement actions fail.

Step 6: When to Seek Professional Advice

If you are finding yourself unsure of the next step, or you find the trials and processes overwhelming, often draining you, then it’s time to seek professional advice and services. Be it from a legal firm, or an accountant to help you with insolvency or bankruptcy process – hiring a professional service provider can help you navigate the debt landscape with assurance that outcome may be towards your full satisfaction or enough to bring peace into your chaotic life.

From handling the disputes resolution, to selecting the best enforcement route for debt repayment – professional advice or having an expert by your side goes a long way in recovering due payments, by utilising the right tools and strategies where required. Julian Hobbs & Co. can help you with this.

With our Outsourced Finance Department and Cash Flow Services, SMEs and individuals can ensure timely invoicing and steady cash flow, ultimately avoiding the strains of overdue payments. Our chartered accountants can collaborate with your legal team or representative and act as your spokesperson for HMRC and other compliance bodies.

So if you are looking for a competent local accountant across Hertfordshire, Welwyn City and nearby regions; contacting Julian Hobbs & Co. for efficient financial management will be your first step towards hassle-free debt recovery and strong, stable finances.

People Also Ask:

Can I charge interest on unpaid invoices?

Yes, if it’s agreed in the contract or you rely on statutory provisions, you can charge 8% interest above the Bank of England base rate, which is 4%. .

When should I escalate unpaid invoices to legal action?

After you’ve sent out polite reminders a few times and finally had to send a formal letter saying you’re about to take the matter to court, and still no response; it’s time to take legal actions.

What If a Client Refuses To Pay Even After Court Ruled In My Favor?

If a client is still digging in their heels even after the judge has given a clear verdict – you’ve got a few more options left. You can try to seize their wages, freeze their bank account, or even get the county court bailiff to turn up at their doorstep to sort the debt out.

What if the client becomes insolvent?

If the debtor is declared bankrupt or their business is liquidated, you may not recover the full amount, but there are steps you can take to try and recover what’s owed.

Can I Get My Legal Costs Back For Unpaid Invoices In The UK?

In most cases, you can recover your legal costs if you win the case, though there are limits to how much you can claim.