Running a business means more than checking the bank balance or glancing at a sales report. You need to know what’s really going on behind the scenes.

That’s where monthly management accounts come in. They are regularly published and easy-to-read summaries that show how your business is performing right now. They help you understand your numbers.

If you’ve ever felt unsure how much profit you’re making, or why cash feels tight even when sales feel good, monthly management accounts give you all the answers.

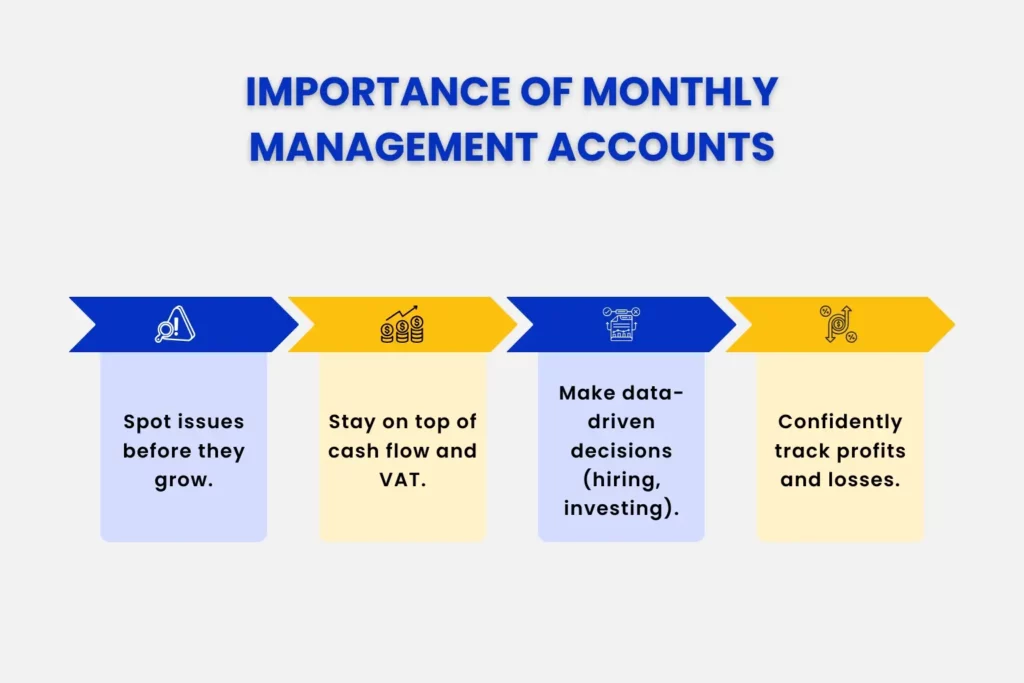

Why Monthly Management Accounts Matter

Many small business owners only see their figures once a year when it’s time to file accounts. By then, it’s too late to make changes; the year end has already happened.

Monthly management accounts stop that problem. They put you ahead of any developing problems, allowing time to fix any issues before key deadlines like the year end. With the help of management accounts, you can track trends and spot issues before they become headache. For example, if expenses start creeping up or sales drop, you can make adjustments right away.

They also help businesses stay compliant with VAT regulations. For instance, monthly management accounts help keep track of VAT threshold, registration requirements, and rolling VATable sales, ensuring you know in advance if you need to register and avoid penalties.

They also help you plan around key decisions such as affording a new hire, or investing in equipment. You can base those choices on facts, not gut feelings.

For business owners, this kind of insight builds confidence. You can stop guessing and start making decisions based on what’s really happening.

Who Uses Monthly Management Accounts?

There is a common misconception that management accounts are only for big companies with finance teams. Nothing could be further from the truth.

Plenty of small business owners use them every month. They help the business owners stay in control of their numbers and keep their businesses on track.

Accountants also use them to give better advice. Instead of talking about what happened last year, accountants can focus on what’s happening in real time. Investors and lenders often ask for management accounts too. It helps them see that a business is well run and financially healthy.

Even sole traders and freelancers can benefit. A simple monthly summary helps you see which clients or services bring in the most profit and which ones might not be worth the effort.

No matter the size of your business, if you want to understand your finances better, monthly management accounts are worth the effort.

What to Include in Monthly Management Accounts

A good set of management accounts needs be clear and insightful. They should strike a balance between too much detail but still being easy to digest and follow.

Here’s what’s usually included in a set of management accounts:

- Profit and Loss Summary showing your income, costs, and profit. This tells you if the business is making money and where it’s going.

- Balance Sheets listing what your business owns and owes. It’s like a health check for your finances.

- Cash Flow Report tracking how cash moves in and out. Even profitable businesses can struggle if cash flow is tight, so it is a crucial report. (Know more of what cash flow forecast is – by reading our detailed blog on it). Now, let’s get back to the point.

- Key Ratios or KPIs. These are simple numbers that show how well you’re performing, such as gross profit margin or debtor days.

- Commentary or Notes: A few short explanations about what changed and why. Numbers alone don’t tell the full story, so this is a very important addition to the overall report.

The trick is to not throw everything into the document you can think of. It’s about including the right information. For example, a retailer might focus on stock levels and gross margins, while a consultancy company might track billable hours and project profitability.

When set up properly, management accounts give you just enough detail to make informed decisions without overwhelming you.

Monthly Management Accounts Example (Illustration)

Let’s take a small example. Imagine a local café called Bean & Bite.

Every month, they review their management accounts. One month, they notice that coffee sales are steady, but food sales have dipped. Their ingredient costs have crept up too.

Because they see this early, they dig into the details and quickly realise that a supplier quietly raised prices without telling them, and one popular lunch option isn’t selling as well as before.

The business owners act fast on this information. They switch suppliers, simplify the menu, and run a short promotion to bring in more lunchtime customers. As a result, two months later, profits are back up, and cash flow is smooth again.

Without those monthly figures, they might not have spotted these issues until year-end, at which point fixing it would have been harder and more expensive.

That’s the point of management accounts. They help you understand what’s happening now so you can act now. Regular reporting doesn’t just show you what’s wrong; it also shows what’s working well in your business too.

How to Prepare Monthly Management Accounts

Creating management accounts doesn’t have to be complicated. Here’s how to get started.

- Gather your bookkeeping data. Make sure all sales, expenses, and bank transactions are recorded correctly.

- Reconcile your bank accounts. Check everything matches so your reports are accurate.

- Create your reports. Use accounting software to generate a profit and loss, balance sheet, and cash flow report. You can use external software to help prepare the management accounts document itself. External software can present information visually and graphically helping you to understand the document more.

- Add your insights. Include notes about why numbers changed and how things are tracking against your forecasts.

- Review the results. Look at trends and decide what needs attention before the next month rolls around.

If you use software like Xero or QuickBooks, you can automate much of this. Set up templates once and update them monthly.

An accountant can help fine-tune your reports, highlight what’s important, and interpret what the numbers really mean. That saves time and avoids confusion.

Think of it as an ongoing conversation with your business. Each month you check in, see how things are going, and plan your next move.

Conclusion & Why Choose Julian Hobbs & Co for Management Accounts

Numbers can be intimidating, but they don’t always have to be. When you understand them, they become a powerful tool for running your business.

Monthly management accounts give you insight, confidence, and control. They let you see what’s working, what’s not, and what needs to change.

At Julian Hobbs & Co, we work with small businesses across the UK who want to understand their numbers better. We set up management reports that make sense, review them with you, and explain everything in plain English.

You’ll know exactly where your business stands and what to do next. No jargon. No unnecessary reports; just clear information that helps you grow.

People Also Ask:

Are monthly management accounts legally required?

No, they’re not. But they’re one of the best ways to keep control of your business. They help you be proactive instead of reactive.

What is the difference between monthly management accounts and annual accounts?

Annual accounts are for compliance and tax. They’re backward-looking. Management accounts are for decision-making and they show you what’s happening right now.

What are the key components of monthly management accounts?

A Profit and loss, a balance sheet, a cash flow, and short commentary are essentials. Together they show a full picture of performance and financial health.

Who should prepare monthly management accounts?

Many small businesses work with their accountant or bookkeeper. You can do them yourself if your records are accurate, but an accountant adds context and saves you time.

When is the best time to prepare monthly management accounts?

Ideally within two to three weeks after month-end. That keeps your information fresh and helps you take action quickly.

Can I prepare monthly management accounts myself?

It’s possible as cloud accounting tools make it easier than ever to prepare management accounts. But they will take you time to prepare, and you’ll be missing out on the experience that a seasoned accountant can bring when analysing the numbers and recommending the best path forward.