Late payment in construction industry projects is more than just a headache; it may cause relationships to suffer, projects to fail, and your company’s cash flow to be blocked. Waiting weeks or even months to be paid puts strain on your ability to pay employees, cover expenditures, and take on new projects, regardless of whether you are a supplier, subcontractor, or contractor. In our industry, where complicated contracts, lengthy project timeframes, and numerous stakeholders combine to create the ideal environment for cash flow issues, payment delays are regrettably all too prevalent.

No need to worry, there’s good news. You can maintain your business’s efficient operation and safeguard it from late payers by being aware of your legal rights, strengthening your payment procedures, and implementing preventive measures. In this blog, we’ll understand strategies to protect your revenue, cut down on late payments, and keep a healthy cash flow so you can concentrate on creating projects rather than paying bills.

Understanding the Causes of Late Payment in Construction Industry

One of the biggest problems in the construction industry is late payment, especially for suppliers, subcontractors, and contractors. Project schedules and cash flow are disrupted by unpaid invoices, which continue to be a significant source of financial strain in the UK. Effectively addressing the problem begins with an understanding of the reasons behind these delays.

Common Causes of Late Payment in the Construction Industry:

- Complex payment chains: Funds move more slowly via several levels of contractors and subcontractors.

- Extended payment terms: Contracts frequently provide 60–90 day payment windows.

- Project disputes: Disagreements over scope, quality, or completion dates can halt payments.

- Administrative errors: Processing is delayed by incomplete paperwork, inaccurate invoicing, or slow approval procedures.

- Client cash flow issues: Financial struggles on the client’s side push your invoice to the back of the queue.

- Lack of clear payment schedules: Uncertainty and justifications for delays are produced by unclear or inadequately stated payment terms.

- Retention clauses: Large amounts may remain unpaid if a portion of the payment is unpaid until the project is finished.

Businesses can reduce many of these risks by implementing bookkeeping services that ensure accurate invoicing and tracking.

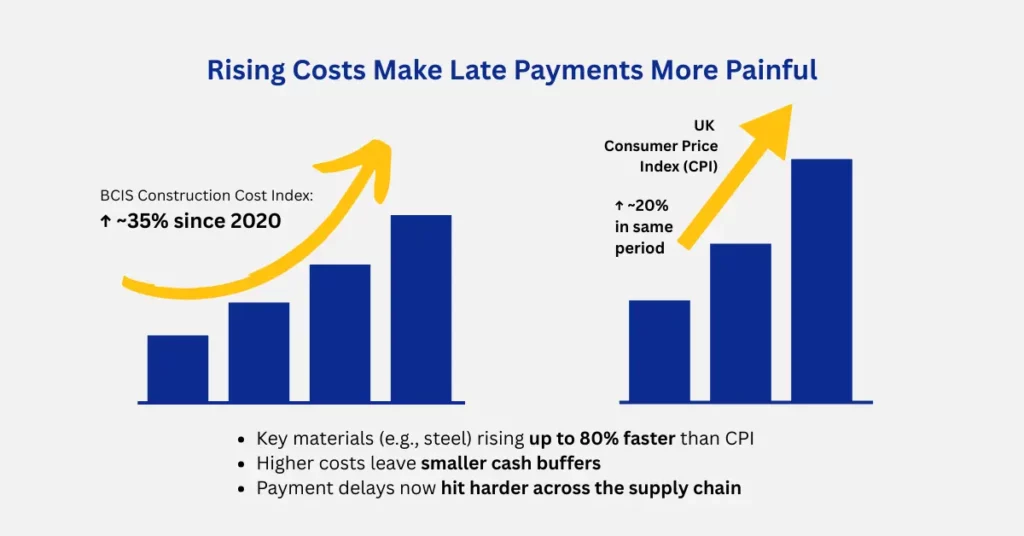

The Domino Effect: How Payment Delays Hurt the Entire Supply Chain

One late payment in the construction industry can have an impact on the entire supply chain, not just one company. Subcontractors, suppliers, and service providers are all impacted when a principal contractor misses paying invoices. In order to pay salaries, buy supplies, and maintain project timeliness, every link in the chain depends on prompt payments.

Smaller companies at the bottom of the chain are frequently the most severely impacted when cash flow decreases at the top. The inability of subcontractors to compensate their teams may cause labor availability to be delayed. Costly project halts could result from suppliers tightening credit terms or delaying supplies. In extreme situations, persistent delays may drag smaller businesses into debt or even bankruptcy.

Legal Rights and Protections for Contractors & Subcontractors

Understanding your legal rights in the UK construction industry might mean the difference between months of chasing funds and a speedy resolution. The purpose of the Contractor Subcontractor Payment Act and other pertinent laws is to guarantee that people who supply labor, supplies, and services are paid promptly and equitably.

Payment terms must be specified explicitly in the contract under this framework, and non-payment or delays may be challenged in court. For instance, if payment is not received, contractors and subcontractors are entitled to cease work, issue a formal payment notice, or impose statutory interest on past-due amounts.

Proven Strategies to Reduce Late Payment in the Construction Industry

- Mandatory payment schedules – Contracts should outline specific due dates and amounts.

- Adjudication rights – A fast-track dispute resolution process for payment disagreements.

- Interest and compensation – The right to charge interest and late payment fees to avoid delays.

- Suspension rights – The ability to halt work if payment deadlines aren’t met.

Contractors and subcontractors can safeguard their cash flow, lower the possibility of unpaid work, and preserve financial stability, even in cases when clients are slow to pay, by being aware of and using these rights.

How to Recover Unpaid Invoices Without Damaging Client Relationships?

Managing past-due payments is one of the most challenging aspects of operating a construction company. You want to keep your valued customer relationships for future business, but you also need to secure your cash flow. In the field of debt recovery construction, a professional yet forceful approach is essential.

As soon as the deadline has passed, begin by sending a kind reminder. Sometimes an internal administrative delay or a simple oversight causes late payments. Send a more formal payment request if you don’t hear back, making sure to include the sum owed, the date of the original invoice, and any interest costs that may be imposed by your contract or the Late Payment of Commercial Debts Act.

Consider providing a short-term payment plan if the problem continues so that the client can fulfill their responsibilities without putting a burden on their own finances. In many cases, this can maintain goodwill while guaranteeing payment.

Partnering with Experts to Keep Your Construction Cash Flow Healthy

In a sector with narrow profit margins and frequent payment delays, having the proper expert assistance might mean the difference between financial security and hardship. Seeking professional assistance early on can avoid concerns from spiraling into major debt or construction insolvency, as many organisations suffer cash flow issues in the construction industry.

You may improve your payment terms, strengthen your credit control processes, and settle disputes before they cause operational disruptions with the assistance of expert consultants/ accountants and legal counsel.

Julian Hobbs is one such professional, specialising in construction finance. We have spent years assisting subcontractors and contractors in resolving intricate payment disputes. We offer customised solutions to bridge short-term construction cash flow problems and promote long-term financial stability.

In addition to resolving short-term cash flow issues, collaborating with professionals fosters long-term resilience. Contractual protections, sound procedures, and careful financial preparation can help you lower the chance of payment delays so you can concentrate on what you do best: complete excellent projects on schedule and within budget.

People Also Ask:

What is insolvency in construction?

In the construction industry, insolvency occurs when a contractor or subcontractor is unable to make their payments on time or owes more than they own, frequently as a result of serious cash flow issues. It may result in official processes like administration or liquidation, which could interrupt projects and have an impact on the entire supply chain.

What are the main causes of late payment in the construction industry?

Complex payment chains, long contract periods, project disagreements, administrative mistakes, client cash flow problems, unclear payment schedules, and retention provisions that withhold a portion of the payment until the project is finished are all common causes of late payments.

How can I prevent construction cash flow issues resulting from unpaid invoices?

You can lower risk by using staged or milestone billing, issuing accurate invoices on time, following up on past-due payments promptly, establishing clear payment terms, and verifying a client’s creditworthiness before beginning work. Keeping a cash reserve and consulting a professional as soon as possible can also help avoid unpaid invoices becoming a major cash flow issue.

What is the Contractor Subcontractor Payment Act, and how does it protect me?

It’s a law that helps ensure timely payment to subcontractors and contractors. It lays down precise due dates for payments and enables you to levy interest, halt services, or promptly file a lawsuit if a client defaults.

Can I charge interest on delayed payment in construction projects in the UK?

Until your contract specifies otherwise, you may charge statutory interest on past-due invoices under the Late Payment of Commercial Debts Act (currently 8% plus the Bank of England base rate).

How does late payment lead to construction insolvency?

Late payments cause cash flow problems, making it difficult to pay suppliers, purchase supplies, and cover payroll. If left unchecked, this strain can eventually drive a construction company into debt and ultimately result in insolvency.

What are the best steps for debt recovery in construction industry cases?

A courteous reminder should be sent, followed by a formal request for payment, a payment plan should be offered if necessary, and, if no payment is received, adjudication or legal action should be taken. The procedure can be accelerated and client connections preserved by hiring a professional in debt recovery in construction industry instances.